Form 10-K - Union Pacific

Form 10-K - Union Pacific

Form 10-K - Union Pacific

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Other Retirement Programs<br />

401(k)/Thrift Plan – We provide a defined contribution plan (401(k)/thrift plan) to eligible non-union<br />

employees for whom we make matching contributions. We match 50 cents for each dollar contributed by<br />

employees up to the first six percent of compensation contributed. Our plan contributions were $14 million<br />

in 2011, $13 million in 20<strong>10</strong> and $14 million in 2009.<br />

Railroad Retirement System – All Railroad employees are covered by the Railroad Retirement System<br />

(the System). Contributions made to the System are expensed as incurred and amounted to<br />

approximately $600 million in 2011, $566 million in 20<strong>10</strong>, and $562 million in 2009.<br />

Collective Bargaining Agreements – Under collective bargaining agreements, we participate in multiemployer<br />

benefit plans that provide certain postretirement health care and life insurance benefits for<br />

eligible union employees. Premiums paid under these plans are expensed as incurred and amounted to<br />

$66 million in 2011, $60 million in 20<strong>10</strong>, and $48 million in 2009.<br />

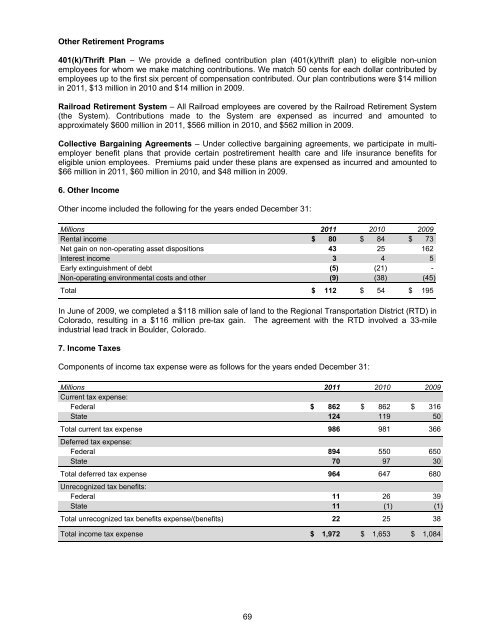

6. Other Income<br />

Other income included the following for the years ended December 31:<br />

Millions 2011 20<strong>10</strong> 2009<br />

Rental income $ 80 $ 84 $ 73<br />

Net gain on non-operating asset dispositions 43 25 162<br />

Interest income 3 4 5<br />

Early extinguishment of debt (5) (21) -<br />

Non-operating environmental costs and other (9) (38) (45)<br />

Total $ 112 $ 54 $ 195<br />

In June of 2009, we completed a $118 million sale of land to the Regional Transportation District (RTD) in<br />

Colorado, resulting in a $116 million pre-tax gain. The agreement with the RTD involved a 33-mile<br />

industrial lead track in Boulder, Colorado.<br />

7. Income Taxes<br />

Components of income tax expense were as follows for the years ended December 31:<br />

Millions 2011 20<strong>10</strong> 2009<br />

Current tax expense:<br />

Federal $ 862 $ 862 $ 316<br />

State 124 119 50<br />

Total current tax expense 986 981 366<br />

Deferred tax expense:<br />

Federal 894 550 650<br />

State 70 97 30<br />

Total deferred tax expense 964 647 680<br />

Unrecognized tax benefits:<br />

Federal 11 26 39<br />

State 11 (1) (1)<br />

Total unrecognized tax benefits expense/(benefits) 22 25 38<br />

Total income tax expense $ 1,972 $ 1,653 $ 1,084<br />

69