Form 10-K - Union Pacific

Form 10-K - Union Pacific

Form 10-K - Union Pacific

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

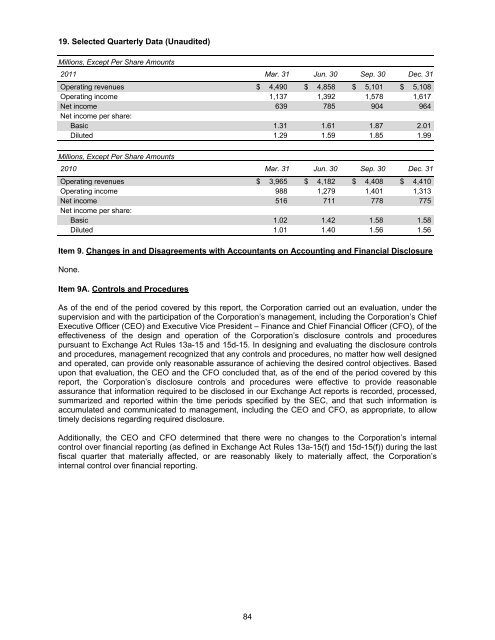

19. Selected Quarterly Data (Unaudited)<br />

Millions, Except Per Share Amounts<br />

2011 Mar. 31 Jun. 30 Sep. 30 Dec. 31<br />

Operating revenues $ 4,490 $ 4,858 $ 5,<strong>10</strong>1 $ 5,<strong>10</strong>8<br />

Operating income 1,137 1,392 1,578 1,617<br />

Net income 639 785 904 964<br />

Net income per share:<br />

Basic 1.31 1.61 1.87 2.01<br />

Diluted 1.29 1.59 1.85 1.99<br />

Millions, Except Per Share Amounts<br />

20<strong>10</strong> Mar. 31 Jun. 30 Sep. 30 Dec. 31<br />

Operating revenues $ 3,965 $ 4,182 $ 4,408 $ 4,4<strong>10</strong><br />

Operating income 988 1,279 1,401 1,313<br />

Net income 516 711 778 775<br />

Net income per share:<br />

Basic 1.02 1.42 1.58 1.58<br />

Diluted 1.01 1.40 1.56 1.56<br />

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure<br />

None.<br />

Item 9A. Controls and Procedures<br />

As of the end of the period covered by this report, the Corporation carried out an evaluation, under the<br />

supervision and with the participation of the Corporation’s management, including the Corporation’s Chief<br />

Executive Officer (CEO) and Executive Vice President – Finance and Chief Financial Officer (CFO), of the<br />

effectiveness of the design and operation of the Corporation’s disclosure controls and procedures<br />

pursuant to Exchange Act Rules 13a-15 and 15d-15. In designing and evaluating the disclosure controls<br />

and procedures, management recognized that any controls and procedures, no matter how well designed<br />

and operated, can provide only reasonable assurance of achieving the desired control objectives. Based<br />

upon that evaluation, the CEO and the CFO concluded that, as of the end of the period covered by this<br />

report, the Corporation’s disclosure controls and procedures were effective to provide reasonable<br />

assurance that information required to be disclosed in our Exchange Act reports is recorded, processed,<br />

summarized and reported within the time periods specified by the SEC, and that such information is<br />

accumulated and communicated to management, including the CEO and CFO, as appropriate, to allow<br />

timely decisions regarding required disclosure.<br />

Additionally, the CEO and CFO determined that there were no changes to the Corporation’s internal<br />

control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) during the last<br />

fiscal quarter that materially affected, or are reasonably likely to materially affect, the Corporation’s<br />

internal control over financial reporting.<br />

84