Form 10-K - Union Pacific

Form 10-K - Union Pacific

Form 10-K - Union Pacific

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

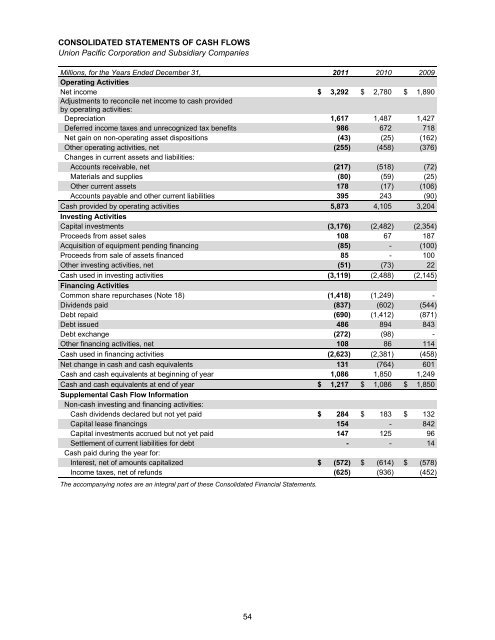

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

<strong>Union</strong> <strong>Pacific</strong> Corporation and Subsidiary Companies<br />

Millions, for the Years Ended December 31, 2011 20<strong>10</strong> 2009<br />

Operating Activities<br />

Net income $ 3,292 $ 2,780 $ 1,890<br />

Adjustments to reconcile net income to cash provided<br />

by operating activities:<br />

Depreciation 1,617 1,487 1,427<br />

Deferred income taxes and unrecognized tax benefits 986 672 718<br />

Net gain on non-operating asset dispositions (43) (25) (162)<br />

Other operating activities, net (255) (458) (376)<br />

Changes in current assets and liabilities:<br />

Accounts receivable, net (217) (518) (72)<br />

Materials and supplies (80) (59) (25)<br />

Other current assets 178 (17) (<strong>10</strong>6)<br />

Accounts payable and other current liabilities 395 243 (90)<br />

Cash provided by operating activities 5,873 4,<strong>10</strong>5 3,204<br />

Investing Activities<br />

Capital investments (3,176) (2,482) (2,354)<br />

Proceeds from asset sales <strong>10</strong>8 67 187<br />

Acquisition of equipment pending financing (85) - (<strong>10</strong>0)<br />

Proceeds from sale of assets financed 85 - <strong>10</strong>0<br />

Other investing activities, net (51) (73) 22<br />

Cash used in investing activities (3,119) (2,488) (2,145)<br />

Financing Activities<br />

Common share repurchases (Note 18) (1,418) (1,249) -<br />

Dividends paid (837) (602) (544)<br />

Debt repaid (690) (1,412) (871)<br />

Debt issued 486 894 843<br />

Debt exchange (272) (98) -<br />

Other financing activities, net <strong>10</strong>8 86 114<br />

Cash used in financing activities (2,623) (2,381) (458)<br />

Net change in cash and cash equivalents 131 (764) 601<br />

Cash and cash equivalents at beginning of year 1,086 1,850 1,249<br />

Cash and cash equivalents at end of year $ 1,217 $ 1,086 $ 1,850<br />

Supplemental Cash Flow Information<br />

Non-cash investing and financing activities:<br />

Cash dividends declared but not yet paid $ 284 $ 183 $ 132<br />

Capital lease financings 154 - 842<br />

Capital investments accrued but not yet paid 147 125 96<br />

Settlement of current liabilities for debt - - 14<br />

Cash paid during the year for:<br />

Interest, net of amounts capitalized $ (572) $ (614) $ (578)<br />

Income taxes, net of refunds (625) (936) (452)<br />

The accompanying notes are an integral part of these Consolidated Financial Statements.<br />

54