Form 10-K - Union Pacific

Form 10-K - Union Pacific

Form 10-K - Union Pacific

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

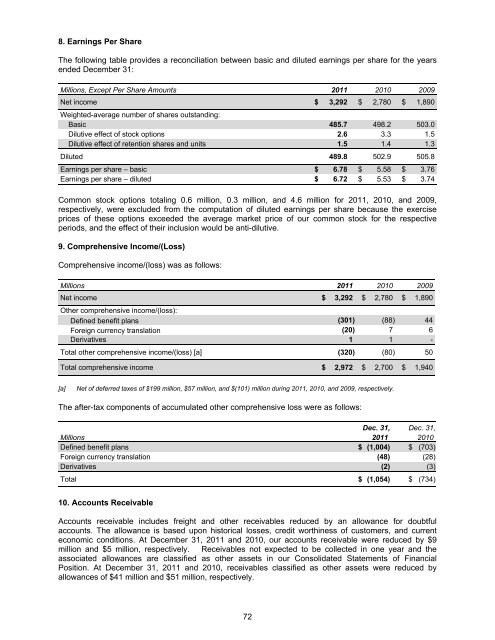

8. Earnings Per Share<br />

The following table provides a reconciliation between basic and diluted earnings per share for the years<br />

ended December 31:<br />

Millions, Except Per Share Amounts 2011 20<strong>10</strong> 2009<br />

Net income $ 3,292 $ 2,780 $ 1,890<br />

Weighted-average number of shares outstanding:<br />

Basic 485.7 498.2 503.0<br />

Dilutive effect of stock options 2.6 3.3 1.5<br />

Dilutive effect of retention shares and units 1.5 1.4 1.3<br />

Diluted 489.8 502.9 505.8<br />

Earnings per share – basic $ 6.78 $ 5.58 $ 3.76<br />

Earnings per share – diluted $ 6.72 $ 5.53 $ 3.74<br />

Common stock options totaling 0.6 million, 0.3 million, and 4.6 million for 2011, 20<strong>10</strong>, and 2009,<br />

respectively, were excluded from the computation of diluted earnings per share because the exercise<br />

prices of these options exceeded the average market price of our common stock for the respective<br />

periods, and the effect of their inclusion would be anti-dilutive.<br />

9. Comprehensive Income/(Loss)<br />

Comprehensive income/(loss) was as follows:<br />

Millions 2011 20<strong>10</strong> 2009<br />

Net income $ 3,292 $ 2,780 $ 1,890<br />

Other comprehensive income/(loss):<br />

Defined benefit plans (301) (88) 44<br />

Foreign currency translation (20) 7 6<br />

Derivatives 1 1 -<br />

Total other comprehensive income/(loss) [a] (320) (80) 50<br />

Total comprehensive income $ 2,972 $ 2,700 $ 1,940<br />

[a]<br />

Net of deferred taxes of $199 million, $57 million, and $(<strong>10</strong>1) million during 2011, 20<strong>10</strong>, and 2009, respectively.<br />

The after-tax components of accumulated other comprehensive loss were as follows:<br />

Dec. 31, Dec. 31,<br />

Millions 2011 20<strong>10</strong><br />

Defined benefit plans $ (1,004) $ (703)<br />

Foreign currency translation (48) (28)<br />

Derivatives (2) (3)<br />

Total $ (1,054) $ (734)<br />

<strong>10</strong>. Accounts Receivable<br />

Accounts receivable includes freight and other receivables reduced by an allowance for doubtful<br />

accounts. The allowance is based upon historical losses, credit worthiness of customers, and current<br />

economic conditions. At December 31, 2011 and 20<strong>10</strong>, our accounts receivable were reduced by $9<br />

million and $5 million, respectively. Receivables not expected to be collected in one year and the<br />

associated allowances are classified as other assets in our Consolidated Statements of Financial<br />

Position. At December 31, 2011 and 20<strong>10</strong>, receivables classified as other assets were reduced by<br />

allowances of $41 million and $51 million, respectively.<br />

72