Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 9 9<br />

<strong>Campus</strong> <strong>Living</strong> Finance Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

A new loan was established between CLV Finance UK Limited and <strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> (Salford) UK Ltd and bears interest at<br />

a variable rate of 0.57% plus a margin of 4%. The principal amount of the loan is repayable on 1 November 2019. Amounts due in<br />

the next 12 months will be replaced by additional loans or instruments. An increase in interest rates of 0.25 basis points results<br />

in additional interest received of $0.41m per annum (2009: $0.46m) based on current balances.<br />

CLFT<br />

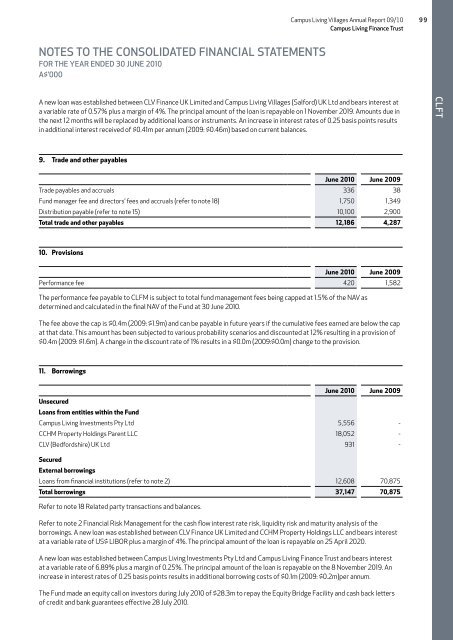

9. Trade and other payables<br />

June 2010 June 2009<br />

Trade payables and accruals 336 38<br />

Fund manager fee and directors’ fees and accruals (refer to note 18) 1,750 1,349<br />

Distribution payable (refer to note 15) 10,100 2,900<br />

Total trade and other payables 12,186 4,287<br />

10. Provisions<br />

June 2010 June 2009<br />

Performance fee 420 1,582<br />

The performance fee payable to CLFM is subject to total fund management fees being capped at 1.5% of the NAV as<br />

determined and calculated in the final NAV of the Fund at 30 June 2010.<br />

The fee above the cap is $0.4m (2009: $1.9m) and can be payable in future years if the cumulative fees earned are below the cap<br />

at that date. This amount has been subjected to various probability scenarios and discounted at 12% resulting in a provision of<br />

$0.4m (2009: $1.6m). A change in the discount rate of 1% results in a $0.0m (2009:$0.0m) change to the provision.<br />

11. Borrowings<br />

June 2010 June 2009<br />

Unsecured<br />

Loans from entities within the Fund<br />

<strong>Campus</strong> <strong>Living</strong> Investments Pty Ltd 5,556 -<br />

CCHM Property Holdings Parent LLC 18,052 -<br />

CLV (Bedfordshire) UK Ltd 931 -<br />

Secured<br />

External borrowings<br />

Loans from financial institutions (refer to note 2) 12,608 70,875<br />

Total borrowings 37,147 70,875<br />

Refer to note 18 Related party transactions and balances.<br />

Refer to note 2 Financial Risk Management for the cash flow interest rate risk, liquidity risk and maturity analysis of the<br />

borrowings. A new loan was established between CLV Finance UK Limited and CCHM Property Holdings LLC and bears interest<br />

at a variable rate of US$ LIBOR plus a margin of 4%. The principal amount of the loan is repayable on 25 April 2020.<br />

A new loan was established between <strong>Campus</strong> <strong>Living</strong> Investments Pty Ltd and <strong>Campus</strong> <strong>Living</strong> Finance Trust and bears interest<br />

at a variable rate of 6.89% plus a margin of 0.25%. The principal amount of the loan is repayable on the 8 November 2019. An<br />

increase in interest rates of 0.25 basis points results in additional borrowing costs of $0.1m (2009: $0.2m)per annum.<br />

The Fund made an equity call on investors during July 2010 of $28.3m to repay the Equity Bridge Facility and cash back letters<br />

of credit and bank guarantees effective 28 July 2010.