Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 9 5<br />

<strong>Campus</strong> <strong>Living</strong> Finance Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

It is effective for accounting periods beginning on or after<br />

1 January 2011 and must be applied retrospectively.<br />

The amendment clarifies and simplifies the definition of<br />

a related party. When the amendments are applied, the<br />

consolidated group will need to disclose any transactions<br />

between its subsidiaries and its associates. However, there<br />

will be no impact on any of the amounts recognised in the<br />

financial statements.<br />

It does not expect that any adjustments will be necessary as a<br />

result of applying the revised rules.<br />

Certain new accounting standards and interpretations have<br />

been published that are not mandatory for the 30 June 2010<br />

reporting period other than those mentioned above. The<br />

Fund has assessed the new standards and interpretations as<br />

unlikely to have a material impact.<br />

CLFT<br />

AASB 2010-3 Amendments to Australian Accounting<br />

Standards arising from the <strong>Annual</strong> Improvements Project and<br />

AASB 2010-4 Further Amendments to Australian Accounting<br />

Standards arising from the <strong>Annual</strong> Improvements Project<br />

(effective from 1 July 2010/1 January 2011). In June 2010,<br />

the AASB made a number of amendments to Australian<br />

Accounting Standards as a result of the IASB’s annual<br />

improvements project. The group will apply the amendments<br />

from 1 July 2010.<br />

p) Parent entity information<br />

The financial information for the parent entity disclosed<br />

in note 21 has been prepared on the same basis as the<br />

consolidated financial statements except as set below:<br />

Investment in subsidiaries<br />

Investments in subsidiaries are accounted for at cost in the<br />

financial information provided for the parent entity.<br />

2. Financial risk management<br />

CLFT’s activities expose it to a variety of financial risks, which include credit risk, cash flow interest rate risk and liquidity risk.<br />

The overall risk management program focuses on the unpredictability of financial markets and seeks to minimise potential<br />

adverse effects on the financial performance.<br />

a) Credit risk<br />

Credit risk arises from cash and cash equivalents, deposits with major banks and financial institutions and loans to related<br />

parties and entities within the CLV Fund. Only banks and financial institutions with high credit ratings are used to deposit funds.<br />

Credit granted to related parties is monitored regularly and the loan agreements contain unsecured recourse against the<br />

borrower for default of the loans.<br />

b) Cash flow interest rate risk<br />

The borrowings of CLFT (refer note 11) are variable and the entity does not utilise interest rate swaps to mitigate fluctuations<br />

in interest rates. The funds drawn from external borrowings are lent to entities within the fund at the variable rate plus an<br />

appropriate margin to cover interest and finance charges incurred.<br />

As at 30 June 2010 CLFT had a $28.3m facility from the ANZ Bank to provide financing for development projects and<br />

acquisitions to other entities within the staple when required.<br />

The loan incurs interest at the variable rate of BBSY for 30 days plus 0.42% margin and the undrawn facility attracts a<br />

commitment fee of 0.25%. The facility was repaid and the bank guarantees and letters of credit were cash backed in July 2010.<br />

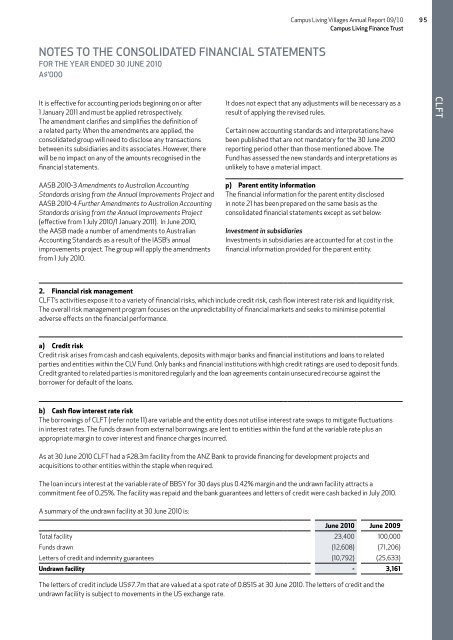

A summary of the undrawn facility at 30 June 2010 is:<br />

June 2010 June 2009<br />

Total facility 23,400 100,000<br />

Funds drawn (12,608) (71,206)<br />

Letters of credit and indemnity guarantees (10,792) (25,633)<br />

Undrawn facility - 3,161<br />

The letters of credit include US$7.7m that are valued at a spot rate of 0.8515 at 30 June 2010. The letters of credit and the<br />

undrawn facility is subject to movements in the US exchange rate.