Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 1 3 1<br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

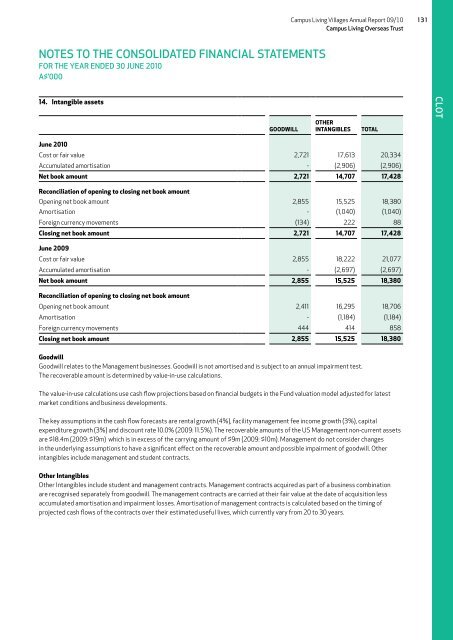

14. Intangible assets<br />

goodwill<br />

other<br />

INtangibles<br />

TOTAL<br />

CLOT<br />

June 2010<br />

Cost or fair value 2,721 17,613 20,334<br />

Accumulated amortisation - (2,906) (2,906)<br />

Net book amount 2,721 14,707 17,428<br />

Reconciliation of opening to closing net book amount<br />

Opening net book amount 2,855 15,525 18,380<br />

Amortisation - (1,040) (1,040)<br />

Foreign currency movements (134) 222 88<br />

Closing net book amount 2,721 14,707 17,428<br />

June 2009<br />

Cost or fair value 2,855 18,222 21,077<br />

Accumulated amortisation - (2,697) (2,697)<br />

Net book amount 2,855 15,525 18,380<br />

Reconciliation of opening to closing net book amount<br />

Opening net book amount 2,411 16,295 18,706<br />

Amortisation - (1,184) (1,184)<br />

Foreign currency movements 444 414 858<br />

Closing net book amount 2,855 15,525 18,380<br />

Goodwill<br />

Goodwill relates to the Management businesses. Goodwill is not amortised and is subject to an annual impairment test.<br />

The recoverable amount is determined by value-in-use calculations.<br />

The value-in-use calculations use cash flow projections based on financial budgets in the Fund valuation model adjusted for latest<br />

market conditions and business developments.<br />

The key assumptions in the cash flow forecasts are rental growth (4%), facility management fee income growth (3%), capital<br />

expenditure growth (3%) and discount rate 10.0% (2009: 11.5%). The recoverable amounts of the US Management non-current assets<br />

are $18.4m (2009: $19m) which is in excess of the carrying amount of $9m (2009: $10m). Management do not consider changes<br />

in the underlying assumptions to have a significant effect on the recoverable amount and possible impairment of goodwill. Other<br />

intangibles include management and student contracts.<br />

Other Intangibles<br />

Other Intangibles include student and management contracts. Management contracts acquired as part of a business combination<br />

are recognised separately from goodwill. The management contracts are carried at their fair value at the date of acquisition less<br />

accumulated amortisation and impairment losses. Amortisation of management contracts is calculated based on the timing of<br />

projected cash flows of the contracts over their estimated useful lives, which currently vary from 20 to 30 years.