Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 2 3<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> Fund<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

ab) New accounting standards<br />

AASB 9 Financial Instruments and AASB 2009-11<br />

Amendments to Australian Accounting Standards arising<br />

from AASB 9 (effective from 1 January 2013) AASB 9 Financial<br />

Instruments addresses the classification and measurement of<br />

financial assets and is likely to affect the group’s accounting<br />

for its financial assets. The standard is not applicable until<br />

1 January 2013 but is available for early adoption.<br />

Revised AASB 124 Related Party Disclosures and AASB<br />

2009-12 Amendments to Australian Accounting Standards<br />

(effective from 1 January 2011). In December 2009 the AASB<br />

issued a revised AASB 124 Related Party Disclosures. It is<br />

effective for accounting periods beginning on or after 1 January<br />

2011 and must be applied retrospectively. The amendment<br />

clarifies and simplifies the definition of a related party. When<br />

the amendments are applied, the Fund will need to disclose<br />

any transactions between its subsidiaries and its associates.<br />

However, there will be no impact on any of the amounts<br />

recognised in the financial statements.<br />

AASB 2010-3 Amendments to Australian Accounting<br />

Standards arising from the <strong>Annual</strong> Improvements Project and<br />

AASB 2010-4 Further Amendments to Australian Accounting<br />

Standards arising from the <strong>Annual</strong> Improvements Project<br />

(effective from 1 July 2010/1 January 2011). In June 2010,<br />

the AASB made a number of amendments to Australian<br />

Accounting Standards as a result of the IASB’s annual<br />

improvements project. The group will apply the amendments<br />

from 1 July 2010. It does not expect that any adjustments will<br />

be necessary as a result of applying the revised rules.<br />

Certain new accounting standards and interpretations have<br />

been published that are not mandatory for the 30 June 2010<br />

reporting period other than those mentioned above. The<br />

Fund has assessed the new standards and interpretations as<br />

unlikely to have a material impact.<br />

FUND<br />

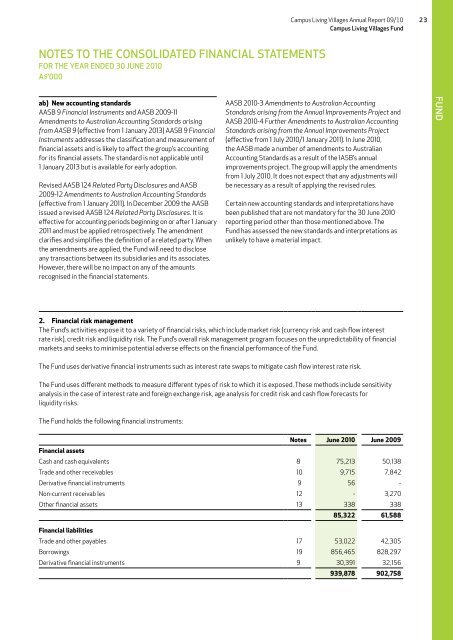

2. Financial risk management<br />

The Fund’s activities expose it to a variety of financial risks, which include market risk (currency risk and cash flow interest<br />

rate risk), credit risk and liquidity risk. The Fund’s overall risk management program focuses on the unpredictability of financial<br />

markets and seeks to minimise potential adverse effects on the financial performance of the Fund.<br />

The Fund uses derivative financial instruments such as interest rate swaps to mitigate cash flow interest rate risk.<br />

The Fund uses different methods to measure different types of risk to which it is exposed. These methods include sensitivity<br />

analysis in the case of interest rate and foreign exchange risk, age analysis for credit risk and cash flow forecasts for<br />

liquidity risks.<br />

The Fund holds the following financial instruments:<br />

Notes June 2010 June 2009<br />

Financial assets<br />

Cash and cash equivalents 8 75,213 50,138<br />

Trade and other receivables 10 9,715 7,842<br />

Derivative financial instruments 9 56 -<br />

Non-current receivab les 12 - 3,270<br />

Other financial assets 13 338 338<br />

85,322 61,588<br />

Financial liabilities<br />

Trade and other payables 17 53,022 42,305<br />

Borrowings 19 856,465 828,297<br />

Derivative financial instruments 9 30,391 32,156<br />

939,878 902,758