Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8 6 <strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10<br />

<strong>Campus</strong> <strong>Living</strong> Finance Trust<br />

DIRECTORS’ REPORT<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

CLFT<br />

Introduction<br />

The directors of <strong>Campus</strong> <strong>Living</strong> Funds Management Limited<br />

(“CLFM”) as the Responsible Entity (“RE”) of the <strong>Campus</strong> <strong>Living</strong><br />

<strong>Villages</strong> Fund (“the Fund”) present their report on <strong>Campus</strong><br />

<strong>Living</strong> Finance Trust (“CLFT”) for the year ended 30 June 2010.<br />

Fund structure and formation<br />

The Fund is a stapled arrangement of four trusts and their<br />

subsidiaries (“consolidated entity”) and was established<br />

on 9 January 2007. The four trusts are <strong>Campus</strong> <strong>Living</strong> Land<br />

Trust (USA) (“CLLT (USA)”) which is deemed to be the parent<br />

entity for accounting purposes, <strong>Campus</strong> <strong>Living</strong> Finance Trust<br />

(“CLFT”), <strong>Campus</strong> <strong>Living</strong> Australia Trust (“CLAT”) and <strong>Campus</strong><br />

<strong>Living</strong> Overseas Trust (“CLOT”). The units of the four trusts<br />

forming the Fund can only be purchased or sold in their current<br />

stapled arrangement.<br />

Directors<br />

The following persons were the only directors of CLFM and<br />

were in office during the whole of the financial year and up to<br />

the date of this report except where otherwise stated:<br />

Professor John Niland AC<br />

Professor Steve Burdon<br />

Walter Carpenter<br />

Gayle Tollifson (appointed 16 April 2010)<br />

Nicholas James<br />

Principal activities<br />

The principal business activity of CLFT is to provide financing<br />

to the other trusts in the stapled arrangement and the<br />

controlled entities of those trusts.<br />

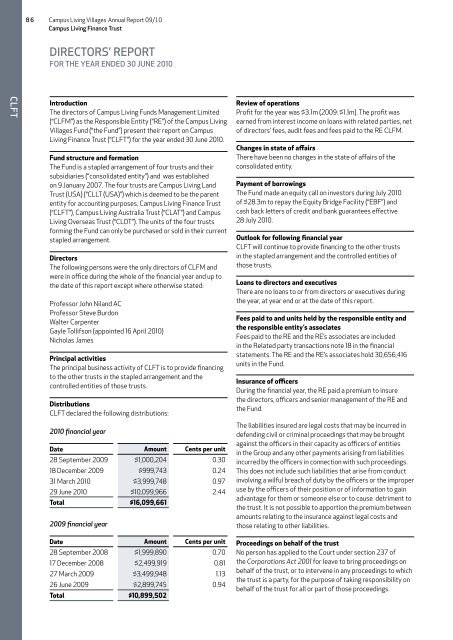

Distributions<br />

CLFT declared the following distributions:<br />

2010 financial year<br />

Date Amount Cents per unit<br />

28 September 2009 $1,000,204 0.30<br />

18 December 2009 $999,743 0.24<br />

31 March 2010 $3,999,748 0.97<br />

29 June 2010 $10,099,966 2.44<br />

Total $16,099,661<br />

2009 financial year<br />

Review of operations<br />

Profit for the year was $3.1m (2009: $1.1m). The profit was<br />

earned from interest income on loans with related parties, net<br />

of directors’ fees, audit fees and fees paid to the RE CLFM.<br />

Changes in state of affairs<br />

There have been no changes in the state of affairs of the<br />

consolidated entity.<br />

Payment of borrowings<br />

The Fund made an equity call on investors during July 2010<br />

of $28.3m to repay the Equity Bridge Facility (“EBF”) and<br />

cash back letters of credit and bank guarantees effective<br />

28 July 2010.<br />

Outlook for following financial year<br />

CLFT will continue to provide financing to the other trusts<br />

in the stapled arrangement and the controlled entities of<br />

those trusts.<br />

Loans to directors and executives<br />

There are no loans to or from directors or executives during<br />

the year, at year end or at the date of this report.<br />

Fees paid to and units held by the responsible entity and<br />

the responsible entity’s associates<br />

Fees paid to the RE and the RE’s associates are included<br />

in the Related party transactions note 18 in the financial<br />

statements. The RE and the RE’s associates hold 30,656,416<br />

units in the Fund.<br />

Insurance of officers<br />

During the financial year, the RE paid a premium to insure<br />

the directors, officers and senior management of the RE and<br />

the Fund.<br />

The liabilities insured are legal costs that may be incurred in<br />

defending civil or criminal proceedings that may be brought<br />

against the officers in their capacity as officers of entities<br />

in the Group and any other payments arising from liabilities<br />

incurred by the officers in connection with such proceedings.<br />

This does not include such liabilities that arise from conduct<br />

involving a wilful breach of duty by the officers or the improper<br />

use by the officers of their position or of information to gain<br />

advantage for them or someone else or to cause detriment to<br />

the trust. It is not possible to apportion the premium between<br />

amounts relating to the insurance against legal costs and<br />

those relating to other liabilities.<br />

Date Amount Cents per unit<br />

28 September 2008 $1,999,890 0.70<br />

17 December 2008 $2,499,919 0.81<br />

27 March 2009 $3,499,948 1.13<br />

26 June 2009 $2,899,745 0.94<br />

Total $10,899,502<br />

Proceedings on behalf of the trust<br />

No person has applied to the Court under section 237 of<br />

the Corporations Act 2001 for leave to bring proceedings on<br />

behalf of the trust, or to intervene in any proceedings to which<br />

the trust is a party, for the purpose of taking responsibility on<br />

behalf of the trust for all or part of those proceedings.