Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 1 2 7<br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

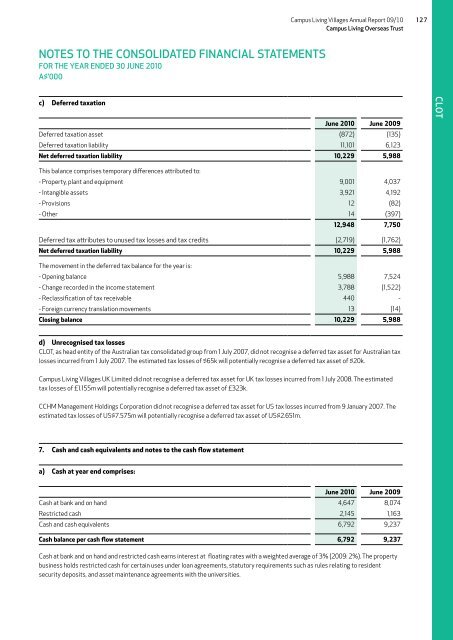

c) Deferred taxation<br />

June 2010 June 2009<br />

Deferred taxation asset (872) (135)<br />

Deferred taxation liability 11,101 6,123<br />

Net deferred taxation liability 10,229 5,988<br />

CLOT<br />

This balance comprises temporary differences attributed to:<br />

- Property, plant and equipment 9,001 4,037<br />

- Intangible assets 3,921 4,192<br />

- Provisions 12 (82)<br />

- Other 14 (397)<br />

12,948 7,750<br />

Deferred tax attributes to unused tax losses and tax credits (2,719) (1,762)<br />

Net deferred taxation liability 10,229 5,988<br />

The movement in the deferred tax balance for the year is:<br />

- Opening balance 5,988 7,524<br />

- Change recorded in the income statement 3,788 (1,522)<br />

- Reclassification of tax receivable 440 -<br />

- Foreign currency translation movements 13 (14)<br />

Closing balance 10,229 5,988<br />

d) Unrecognised tax losses<br />

CLOT, as head entity of the Australian tax consolidated group from 1 July 2007, did not recognise a deferred tax asset for Australian tax<br />

losses incurred from 1 July 2007. The estimated tax losses of $65k will potentially recognise a deferred tax asset of $20k.<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> UK Limited did not recognise a deferred tax asset for UK tax losses incurred from 1 July 2008. The estimated<br />

tax losses of £1.155m will potentially recognise a deferred tax asset of £323k.<br />

CCHM Management Holdings Corporation did not recognise a deferred tax asset for US tax losses incurred from 9 January 2007. The<br />

estimated tax losses of US$7.575m will potentially recognise a deferred tax asset of US$2.651m.<br />

7. Cash and cash equivalents and notes to the cash flow statement<br />

a) Cash at year end comprises:<br />

June 2010 June 2009<br />

Cash at bank and on hand 4,647 8,074<br />

Restricted cash 2,145 1,163<br />

Cash and cash equivalents 6,792 9,237<br />

Cash balance per cash flow statement 6,792 9,237<br />

Cash at bank and on hand and restricted cash earns interest at floating rates with a weighted average of 3% (2009: 2%). The property<br />

business holds restricted cash for certain uses under loan agreements, statutory requirements such as rules relating to resident<br />

security deposits, and asset maintenance agreements with the universities.