Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 4 1<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> Fund<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

Sub-lease of university accommodation<br />

The ground lease from certain universities is sub-leased to the related accommodation companies at a margin.<br />

FUND<br />

Development fees<br />

The development companies that manage the construction of new facilities charge a development management fee to the<br />

companies that own the new facilities. The fee is based on a percentage of construction cost. Development fees earned on<br />

acquisition of an asset are determined on a sliding scale that is market related.<br />

Bid costs for new sites are incurred by development companies and charged to the subsidiary that will earn<br />

revenue from the new contract and own the new facilities.<br />

Loans and interest<br />

Loans are made between subsidiary companies and stapled entities to provide short term financing and better utilise group<br />

funds. Loans are also in place between stapled entities and subsidiary companies from the formation of the stapled entity.<br />

Interest is charged on loans between entities within the Fund at rates that approximate bank lending rates. CLFT obtained<br />

financing from Transfield Finance Pty Limited in the current year and repaid the loan of $1.34m during the year. Interest charged<br />

on this loan was $0.01m and was market related.<br />

Dividends and distributions<br />

Dividends and distributions are declared from subsidiary companies to entities within the Fund.<br />

Fund manager fees paid to the Responsible Entity<br />

The Fund manager fees are allocated to each trust based on the NAV of the trust. The constitutions of the individual trusts<br />

prescribe the method of calculation of the fund manager fees, which is borne by the individual trusts. The total fees payable to<br />

CLFM are subject to the total fund management fees in any year being capped at 1.5% of the NAV of the trust as determined<br />

and calculated in the final NAV of the Fund. The fees above the cap will be payable in future years if the fees earned in those<br />

years are below the cap at that date. This amount is recorded as a provision (refer note 18) and is discounted to reflect the<br />

estimated timing and value of the future payment.<br />

Management fees paid to the Responsible Entity (“RE”) CLFM include base fees $1,476,384 (2009: $1,408,575), and<br />

performance fees below the cap $4,196,015 (2009: $2,996,000), and Performance fees above the cap are included in provisions<br />

(refer note 18).<br />

Directors’ fees paid to Responsible Entity<br />

Directors’ fees of $303,142 (2009: $407,575) have been paid to the non-executive directors of the RE.<br />

Support service costs<br />

The Fund paid CLFM $27,850 (2009: $1,265,074) in equity raising costs and paid Transfield Corporate $377,689 (2009:<br />

$1,031,725) for development projects, $939,503 for IT services and hardware and $1,264,030 (2009: $373,764) for<br />

secondment of staff.<br />

Sydney head office premises<br />

The Fund leases head office premises from Transfield Corporate and paid rent of $377,098 (2009: $366,000).<br />

Lease<br />

<strong>Campus</strong> <strong>Living</strong> Flemington Road paid a lease payment of $3,839,216 (2009: $3,567,773) to Transfield Siruya joint venture.<br />

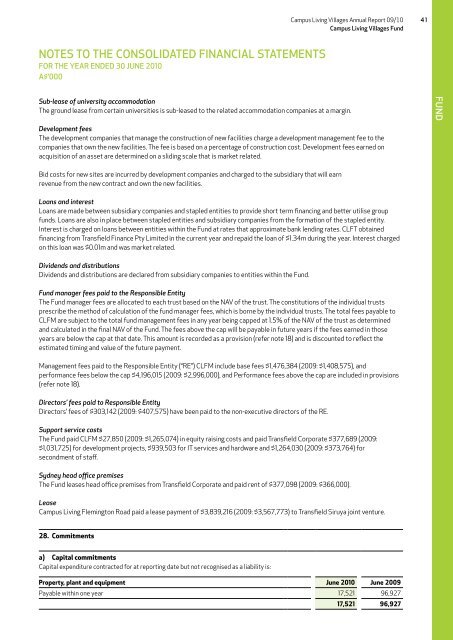

28. Commitments<br />

a) Capital commitments<br />

Capital expenditure contracted for at reporting date but not recognised as a liability is:<br />

Property, plant and equipment June 2010 June 2009<br />

Payable within one year 17,521 96,927<br />

17,521 96,927