Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 6 9<br />

<strong>Campus</strong> <strong>Living</strong> Australia Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

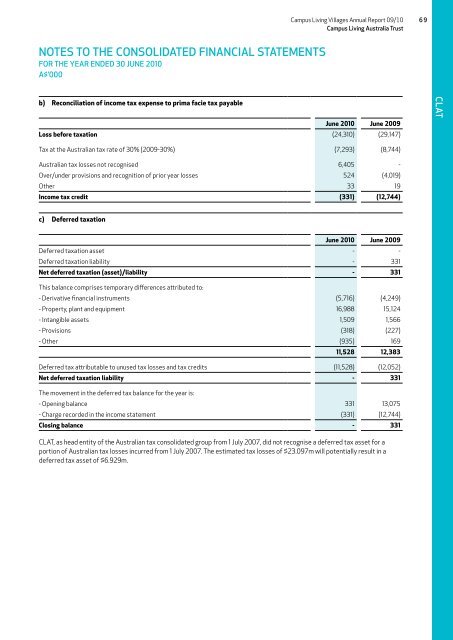

b) Reconciliation of income tax expense to prima facie tax payable<br />

June 2010 June 2009<br />

Loss before taxation (24,310) (29,147)<br />

CLAT<br />

Tax at the Australian tax rate of 30% (2009-30%) (7,293) (8,744)<br />

Australian tax losses not recognised 6,405 -<br />

Over/under provisions and recognition of prior year losses 524 (4,019)<br />

Other 33 19<br />

Income tax credit (331) (12,744)<br />

c) Deferred taxation<br />

June 2010 June 2009<br />

Deferred taxation asset - -<br />

Deferred taxation liability - 331<br />

Net deferred taxation (asset)/liability - 331<br />

This balance comprises temporary differences attributed to:<br />

- Derivative financial instruments (5,716) (4,249)<br />

- Property, plant and equipment 16,988 15,124<br />

- Intangible assets 1,509 1,566<br />

- Provisions (318) (227)<br />

- Other (935) 169<br />

11,528 12,383<br />

Deferred tax attributable to unused tax losses and tax credits (11,528) (12,052)<br />

Net deferred taxation liability - 331<br />

The movement in the deferred tax balance for the year is:<br />

- Opening balance 331 13,075<br />

- Charge recorded in the income statement (331) (12,744)<br />

Closing balance - 331<br />

CLAT, as head entity of the Australian tax consolidated group from 1 July 2007, did not recognise a deferred tax asset for a<br />

portion of Australian tax losses incurred from 1 July 2007. The estimated tax losses of $23.097m will potentially result in a<br />

deferred tax asset of $6.929m.