Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 7 1<br />

<strong>Campus</strong> <strong>Living</strong> Australia Trust<br />

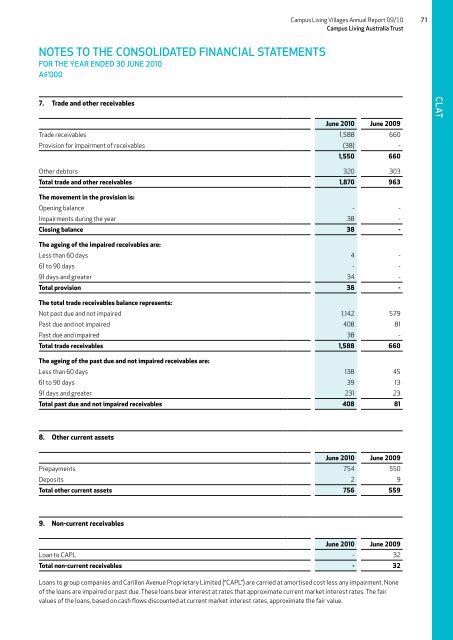

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

7. Trade and other receivables<br />

June 2010 June 2009<br />

Trade receivables 1,588 660<br />

Provision for impairment of receivables (38) -<br />

1,550 660<br />

CLAT<br />

Other debtors 320 303<br />

Total trade and other receivables 1,870 963<br />

The movement in the provision is:<br />

Opening balance - -<br />

Impairments during the year 38 -<br />

Closing balance 38 -<br />

The ageing of the impaired receivables are:<br />

Less than 60 days 4 -<br />

61 to 90 days - -<br />

91 days and greater 34 -<br />

Total provision 38 -<br />

The total trade receivables balance represents:<br />

Not past due and not impaired 1,142 579<br />

Past due and not impaired 408 81<br />

Past due and impaired 38 -<br />

Total trade receivables 1,588 660<br />

The ageing of the past due and not impaired receivables are:<br />

Less than 60 days 138 45<br />

61 to 90 days 39 13<br />

91 days and greater 231 23<br />

Total past due and not impaired receivables 408 81<br />

8. Other current assets<br />

June 2010 June 2009<br />

Prepayments 754 550<br />

Deposits 2 9<br />

Total other current assets 756 559<br />

9. Non-current receivables<br />

June 2010 June 2009<br />

Loan to CAPL - 32<br />

Total non-current receivables - 32<br />

Loans to group companies and Carillon Avenue Proprietary Limited (“CAPL”) are carried at amortised cost less any impairment. None<br />

of the loans are impaired or past due. These loans bear interest at rates that approximate current market interest rates. The fair<br />

values of the loans, based on cash flows discounted at current market interest rates, approximate the fair value.