Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 3 7<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> Fund<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

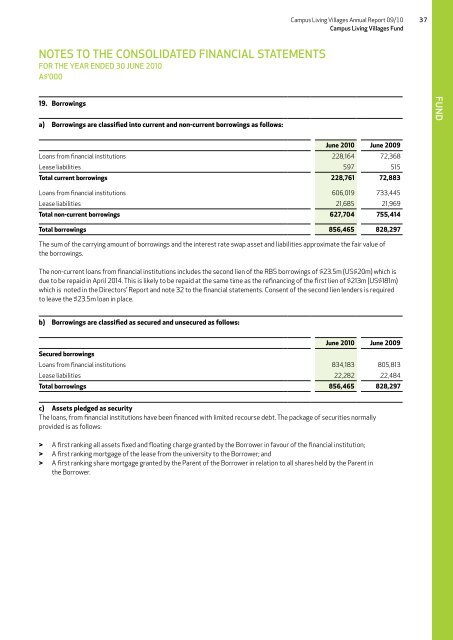

19. Borrowings<br />

a) Borrowings are classified into current and non-current borrowings as follows:<br />

FUND<br />

June 2010 June 2009<br />

Loans from financial institutions 228,164 72,368<br />

Lease liabilities 597 515<br />

Total current borrowings 228,761 72,883<br />

Loans from financial institutions 606,019 733,445<br />

Lease liabilities 21,685 21,969<br />

Total non-current borrowings 627,704 755,414<br />

Total borrowings 856,465 828,297<br />

The sum of the carrying amount of borrowings and the interest rate swap asset and liabilities approximate the fair value of<br />

the borrowings.<br />

The non-current loans from financial institutions includes the second lien of the RBS borrowings of $23.5m (US$20m) which is<br />

due to be repaid in April 2014. This is likely to be repaid at the same time as the refinancing of the first lien of $213m (US$181m)<br />

which is noted in the Directors’ <strong>Report</strong> and note 32 to the financial statements. Consent of the second lien lenders is required<br />

to leave the $23.5m loan in place.<br />

b) Borrowings are classified as secured and unsecured as follows:<br />

June 2010 June 2009<br />

Secured borrowings<br />

Loans from financial institutions 834,183 805,813<br />

Lease liabilities 22,282 22,484<br />

Total borrowings 856,465 828,297<br />

c) Assets pledged as security<br />

The loans, from financial institutions have been financed with limited recourse debt. The package of securities normally<br />

provided is as follows:<br />

> > A first ranking all assets fixed and floating charge granted by the Borrower in favour of the financial institution;<br />

> > A first ranking mortgage of the lease from the university to the Borrower; and<br />

> > A first ranking share mortgage granted by the Parent of the Borrower in relation to all shares held by the Parent in<br />

the Borrower.