Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1 2 4 <strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10<br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

CLOT<br />

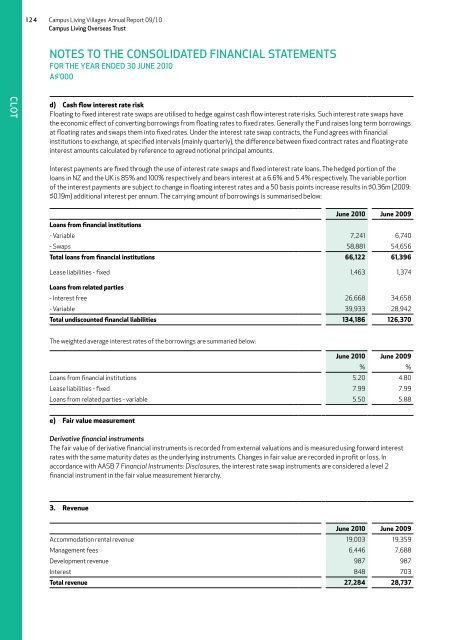

d) Cash flow interest rate risk<br />

Floating to fixed interest rate swaps are utilised to hedge against cash flow interest rate risks. Such interest rate swaps have<br />

the economic effect of converting borrowings from floating rates to fixed rates. Generally the Fund raises long term borrowings<br />

at floating rates and swaps them into fixed rates. Under the interest rate swap contracts, the Fund agrees with financial<br />

institutions to exchange, at specified intervals (mainly quarterly), the difference between fixed contract rates and floating-rate<br />

interest amounts calculated by reference to agreed notional principal amounts.<br />

Interest payments are fixed through the use of interest rate swaps and fixed interest rate loans. The hedged portion of the<br />

loans in NZ and the UK is 85% and 100% respectively and bears interest at a 6.6% and 5.4% respectively. The variable portion<br />

of the interest payments are subject to change in floating interest rates and a 50 basis points increase results in $0.36m (2009:<br />

$0.19m) additional interest per annum. The carrying amount of borrowings is summarised below:<br />

June 2010 June 2009<br />

Loans from financial institutions<br />

- Variable 7,241 6,740<br />

- Swaps 58,881 54,656<br />

Total loans from financial institutions 66,122 61,396<br />

Lease liabilities - fixed 1,463 1,374<br />

Loans from related parties<br />

- Interest free 26,668 34,658<br />

- Variable 39,933 28,942<br />

Total undiscounted financial liabilities 134,186 126,370<br />

The weighted average interest rates of the borrowings are summaried below:<br />

June 2010 June 2009<br />

% %<br />

Loans from financial institutions 5.20 4.80<br />

Lease liabilities - fixed 7.99 7.99<br />

Loans from related parties - variable 5.50 5.88<br />

e) Fair value measurement<br />

Derivative financial instruments<br />

The fair value of derivative financial instruments is recorded from external valuations and is measured using forward interest<br />

rates with the same maturity dates as the underlying instruments. Changes in fair value are recorded in profit or loss. In<br />

accordance with AASB 7 Financial Instruments: Disclosures, the interest rate swap instruments are considered a level 2<br />

financial instrument in the fair value measurement hierarchy.<br />

3. Revenue<br />

June 2010 June 2009<br />

Accommodation rental revenue 19,003 19,359<br />

Management fees 6,446 7,688<br />

Development revenue 987 987<br />

Interest 848 703<br />

Total revenue 27,284 28,737