Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 6 5<br />

<strong>Campus</strong> <strong>Living</strong> Australia Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

Certain new accounting standards and interpretations have been published that are not mandatory for the 30 June 2010<br />

reporting period other than those mentioned above. The Fund has assessed the new standards and interpretations as unlikely to<br />

have a material impact.<br />

CLAT<br />

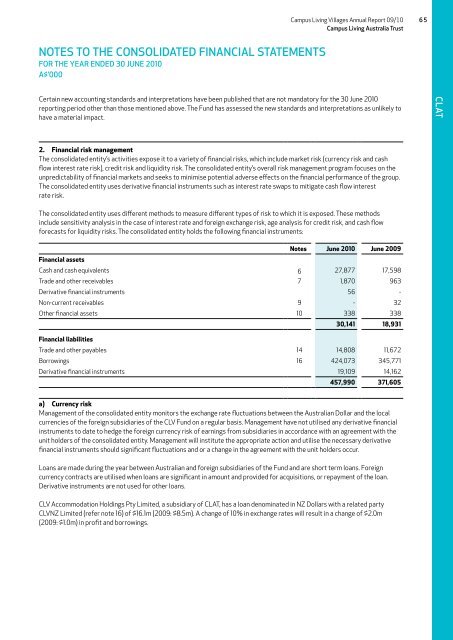

2. Financial risk management<br />

The consolidated entity’s activities expose it to a variety of financial risks, which include market risk (currency risk and cash<br />

flow interest rate risk), credit risk and liquidity risk. The consolidated entity’s overall risk management program focuses on the<br />

unpredictability of financial markets and seeks to minimise potential adverse effects on the financial performance of the group.<br />

The consolidated entity uses derivative financial instruments such as interest rate swaps to mitigate cash flow interest<br />

rate risk.<br />

The consolidated entity uses different methods to measure different types of risk to which it is exposed. These methods<br />

include sensitivity analysis in the case of interest rate and foreign exchange risk, age analysis for credit risk, and cash flow<br />

forecasts for liquidity risks. The consolidated entity holds the following financial instruments:<br />

Notes June 2010 June 2009<br />

Financial assets<br />

Cash and cash equivalents 6 27,877 17,598<br />

Trade and other receivables 7 1,870 963<br />

Derivative financial instruments 56 -<br />

Non-current receivables 9 - 32<br />

Other financial assets 10 338 338<br />

30,141 18,931<br />

Financial liabilities<br />

Trade and other payables 14 14,808 11,672<br />

Borrowings 16 424,073 345,771<br />

Derivative financial instruments 19,109 14,162<br />

457,990 371,605<br />

a) Currency risk<br />

Management of the consolidated entity monitors the exchange rate fluctuations between the Australian Dollar and the local<br />

currencies of the foreign subsidiaries of the CLV Fund on a regular basis. Management have not utilised any derivative financial<br />

instruments to date to hedge the foreign currency risk of earnings from subsidiaries in accordance with an agreement with the<br />

unit holders of the consolidated entity. Management will institute the appropriate action and utilise the necessary derivative<br />

financial instruments should significant fluctuations and or a change in the agreement with the unit holders occur.<br />

Loans are made during the year between Australian and foreign subsidiaries of the Fund and are short term loans. Foreign<br />

currency contracts are utilised when loans are significant in amount and provided for acquisitions, or repayment of the loan.<br />

Derivative instruments are not used for other loans.<br />

CLV Accommodation Holdings Pty Limited, a subsidiary of CLAT, has a loan denominated in NZ Dollars with a related party<br />

CLVNZ Limited (refer note 16) of $16.1m (2009: $8.5m). A change of 10% in exchange rates will result in a change of $2.0m<br />

(2009: $1.0m) in profit and borrowings.