Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10 1 2 3<br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

Management will institute the appropriate action and utilise the necessary derivative financial instruments should significant<br />

fluctuations or a change in agreement with the unit holders.<br />

CLOT<br />

Loans are made between entities within the Fund for purposes of providing funding for capital expenditure or the net<br />

investment in subsidiaries. The currency of the loan is generally denominated in the currency of the lender and the loans<br />

are valued at balance sheet spot rate at each reporting date. As at 30 June 2010 CLOT did not have any foreign currency<br />

denominated loans.<br />

b) Credit risk<br />

Credit risk arises from cash and cash equivalents, deposits with major banks and financial institutions, as well as credit<br />

exposure to students and universities, including outstanding receivables and committed transactions. Credit granted to<br />

customers is monitored regularly and past due receivables are followed up with customers. Student deposits are used as<br />

security and applied against outstanding amounts. Legal contracts provide the basis for collection of outstanding amounts<br />

relating to management and development contracts. Only banks and financial institutions with high credit ratings are used to<br />

deposit funds.<br />

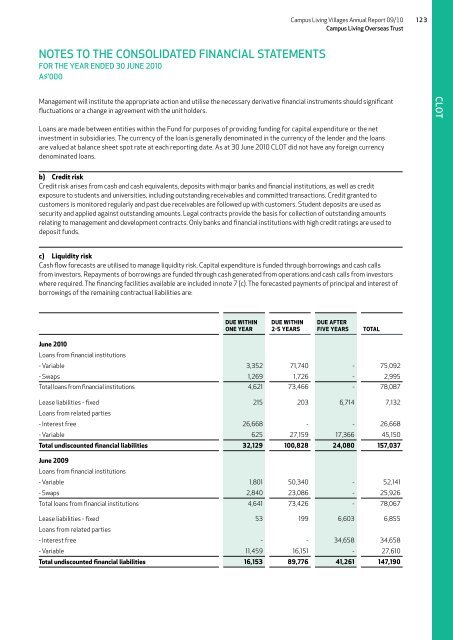

c) Liquidity risk<br />

Cash flow forecasts are utilised to manage liquidity risk. Capital expenditure is funded through borrowings and cash calls<br />

from investors. Repayments of borrowings are funded through cash generated from operations and cash calls from investors<br />

where required. The financing facilities available are included in note 7 (c). The forecasted payments of principal and interest of<br />

borrowings of the remaining contractual liabilities are:<br />

due within<br />

one year<br />

due within<br />

2-5 years<br />

due after<br />

five years<br />

total<br />

June 2010<br />

Loans from financial institutions<br />

- Variable 3,352 71,740 - 75,092<br />

- Swaps 1,269 1,726 - 2,995<br />

Total loans from financial institutions 4,621 73,466 - 78,087<br />

Lease liabilities - fixed 215 203 6,714 7,132<br />

Loans from related parties<br />

- Interest free 26,668 - - 26,668<br />

- Variable 625 27,159 17,366 45,150<br />

Total undiscounted financial liabilities 32,129 100,828 24,080 157,037<br />

June 2009<br />

Loans from financial institutions<br />

- Variable 1,801 50,340 - 52,141<br />

- Swaps 2,840 23,086 - 25,926<br />

Total loans from financial institutions 4,641 73,426 - 78,067<br />

Lease liabilities - fixed 53 199 6,603 6,855<br />

Loans from related parties<br />

- Interest free - - 34,658 34,658<br />

- Variable 11,459 16,151 - 27,610<br />

Total undiscounted financial liabilities 16,153 89,776 41,261 147,190