Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3 8 <strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> Fund<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

FUND<br />

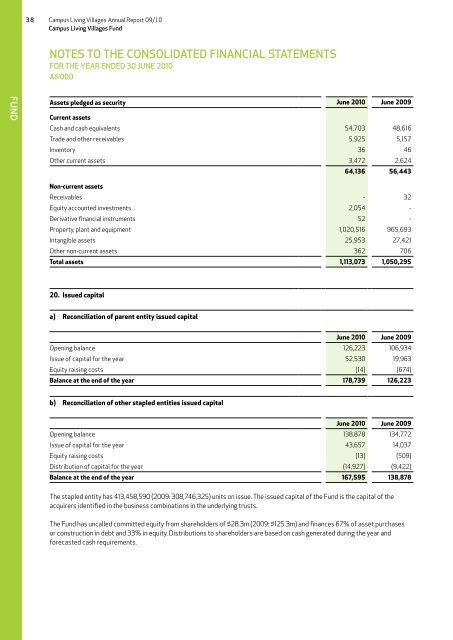

Assets pledged as security June 2010 June 2009<br />

Current assets<br />

Cash and cash equivalents 54,703 48,616<br />

Trade and other receivables 5,925 5,157<br />

Inventory 36 46<br />

Other current assets 3,472 2,624<br />

64,136 56,443<br />

Non-current assets<br />

Receivables - 32<br />

Equity accounted investments 2,054 -<br />

Derivative financial instruments 52 -<br />

Property, plant and equipment 1,020,516 965,693<br />

Intangible assets 25,953 27,421<br />

Other non-current assets 362 706<br />

Total assets 1,113,073 1,050,295<br />

20. Issued capital<br />

a) Reconciliation of parent entity issued capital<br />

June 2010 June 2009<br />

Opening balance 126,223 106,934<br />

Issue of capital for the year 52,530 19,963<br />

Equity raising costs (14) (674)<br />

Balance at the end of the year 178,739 126,223<br />

b) Reconciliation of other stapled entities issued capital<br />

June 2010 June 2009<br />

Opening balance 138,878 134,772<br />

Issue of capital for the year 43,657 14,037<br />

Equity raising costs (13) (509)<br />

Distribution of capital for the year (14,927) (9,422)<br />

Balance at the end of the year 167,595 138,878<br />

The stapled entity has 413,458,590 (2009: 308,746,325) units on issue. The issued capital of the Fund is the capital of the<br />

acquirers identified in the business combinations in the underlying trusts.<br />

The Fund has uncalled committed equity from shareholders of $28.3m (2009: $125.3m) and finances 67% of asset purchases<br />

or construction in debt and 33% in equity. Distributions to shareholders are based on cash generated during the year and<br />

forecasted cash requirements.