Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1 3 2 <strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10<br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

CLOT<br />

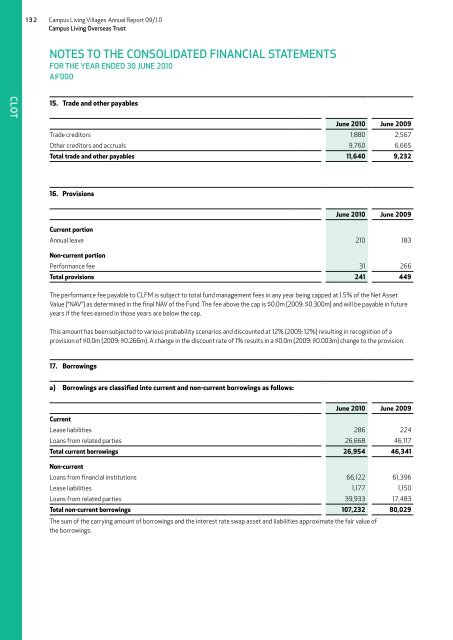

15. Trade and other payables<br />

June 2010 June 2009<br />

Trade creditors 1,880 2,567<br />

Other creditors and accruals 9,760 6,665<br />

Total trade and other payables 11,640 9,232<br />

16. Provisions<br />

June 2010 June 2009<br />

Current portion<br />

<strong>Annual</strong> leave 210 183<br />

Non-current portion<br />

Performance fee 31 266<br />

Total provisions 241 449<br />

The performance fee payable to CLFM is subject to total fund management fees in any year being capped at 1.5% of the Net Asset<br />

Value (“NAV”) as determined in the final NAV of the Fund. The fee above the cap is $0.0m (2009: $0.300m) and will be payable in future<br />

years if the fees earned in those years are below the cap.<br />

This amount has been subjected to various probability scenarios and discounted at 12% (2009: 12%) resulting in recognition of a<br />

provision of $0.0m (2009: $0.266m). A change in the discount rate of 1% results in a $0.0m (2009: $0.003m) change to the provision.<br />

17. Borrowings<br />

a) Borrowings are classified into current and non-current borrowings as follows:<br />

June 2010 June 2009<br />

Current<br />

Lease liabilities 286 224<br />

Loans from related parties 26,668 46,117<br />

Total current borrowings 26,954 46,341<br />

Non-current<br />

Loans from financial institutions 66,122 61,396<br />

Lease liabilities 1,177 1,150<br />

Loans from related parties 39,933 17,483<br />

Total non-current borrowings 107,232 80,029<br />

The sum of the carrying amount of borrowings and the interest rate swap asset and liabilities approximate the fair value of<br />

the borrowings.