Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

Annual Report - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1 2 8 <strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> 09/10<br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2010<br />

A$’000<br />

CLOT<br />

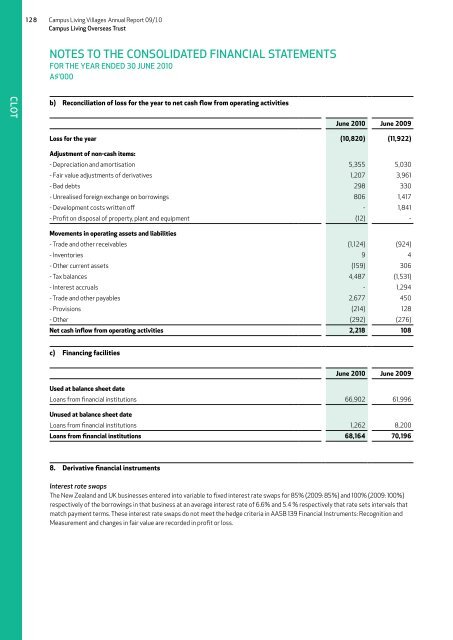

b) Reconciliation of loss for the year to net cash flow from operating activities<br />

June 2010 June 2009<br />

Loss for the year (10,820) (11,922)<br />

Adjustment of non-cash items:<br />

- Depreciation and amortisation 5,355 5,030<br />

- Fair value adjustments of derivatives 1,207 3,961<br />

- Bad debts 298 330<br />

- Unrealised foreign exchange on borrowings 806 1,417<br />

- Development costs written off - 1,841<br />

- Profit on disposal of property, plant and equipment (12) -<br />

Movements in operating assets and liabilities<br />

- Trade and other receivables (1,124) (924)<br />

- Inventories 9 4<br />

- Other current assets (159) 306<br />

- Tax balances 4,487 (1,531)<br />

- Interest accruals - 1,294<br />

- Trade and other payables 2,677 450<br />

- Provisions (214) 128<br />

- Other (292) (276)<br />

Net cash inflow from operating activities 2,218 108<br />

c) Financing facilities<br />

June 2010 June 2009<br />

Used at balance sheet date<br />

Loans from financial institutions 66,902 61,996<br />

Unused at balance sheet date<br />

Loans from financial institutions 1,262 8,200<br />

Loans from financial institutions 68,164 70,196<br />

8. Derivative financial instruments<br />

Interest rate swaps<br />

The New Zealand and UK businesses entered into variable to fixed interest rate swaps for 85% (2009: 85%) and 100% (2009: 100%)<br />

respectively of the borrowings in that business at an average interest rate of 6.6% and 5.4 % respectively that rate sets intervals that<br />

match payment terms. These interest rate swaps do not meet the hedge criteria in AASB 139 Financial Instruments: Recognition and<br />

Measurement and changes in fair value are recorded in profit or loss.