BROOKER ANNUAL REPORT 2012

BROOKER ANNUAL REPORT 2012

BROOKER ANNUAL REPORT 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual Report <strong>2012</strong><br />

The Brooker Group Public Co Ltd<br />

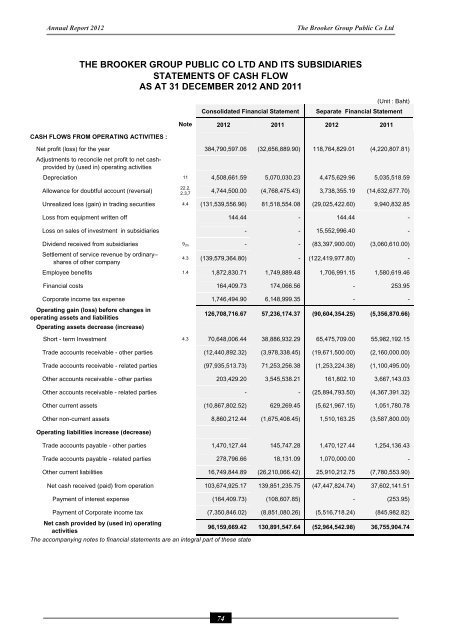

THE <strong>BROOKER</strong> GROUP PUBLIC CO LTD AND ITS SUBSIDIARIES<br />

STATEMENTS OF CASH FLOW<br />

AS AT 31 DECEMBER <strong>2012</strong> AND 2011<br />

(Unit : Baht)<br />

Consolidated Financial Statement<br />

Separate Financial Statement<br />

Note <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

CASH FLOWS FROM OPERATING ACTIVITIES :<br />

Net profit (loss) for the year 384,790,597.06 (32,656,889.90) 118,764,829.01 (4,220,807.81)<br />

Adjustments to reconcile net profit to net cashprovided<br />

by (used in) operating activities<br />

Depreciation 11 4,508,661.59 5,070,030.23 4,475,629.96 5,035,518.59<br />

Allowance for doubtful account (reversal)<br />

22.2,<br />

2.3,7 4,744,500.00 (4,768,475.43) 3,738,355.19 (14,632,677.70)<br />

Unrealized loss (gain) in trading securities 4.4 (131,539,556.96) 81,518,554.08 (29,025,422.60) 9,940,832.85<br />

Loss from equipment written off 144.44 - 144.44 -<br />

Loss on sales of investment in subsidiaries - - 15,552,996.40 -<br />

Dividend received from subsidiaries 9 (3) - - (83,397,900.00) (3,060,610.00)<br />

Settlement of service revenue by ordinary–<br />

shares of other company<br />

4.3 (139,579,364.80) - (122,419,977.80) -<br />

Employee benefits 1.4 1,872,830.71 1,749,889.48 1,706,991.15 1,580,619.46<br />

Financial costs 164,409.73 174,066.56 - 253.95<br />

Corporate income tax expense 1,746,494.90 6,148,999.35 - -<br />

Operating gain (loss) before changes in<br />

operating assets and liabilities<br />

Operating assets decrease (increase)<br />

126,708,716.67 57,236,174.37 (90,604,354.25) (5,356,870.66)<br />

Short - term Investment 4.3 70,648,006.44 38,886,932.29 65,475,709.00 55,982,192.15<br />

Trade accounts receivable - other parties (12,440,892.32) (3,978,338.45) (19,671,500.00) (2,160,000.00)<br />

Trade accounts receivable - related parties (97,935,513.73) 71,253,256.38 (1,253,224.38) (1,100,495.00)<br />

Other accounts receivable - other parties 203,429.20 3,545,538.21 161,802.10 3,667,143.03<br />

Other accounts receivable - related parties - - (25,894,793.50) (4,367,391.32)<br />

Other current assets (10,867,802.52) 629,269.45 (5,621,967.15) 1,051,780.78<br />

Other non-current assets 8,860,212.44 (1,675,408.45) 1,510,163.25 (3,587,800.00)<br />

Operating liabilities increase (decrease)<br />

Trade accounts payable - other parties 1,470,127.44 145,747.28 1,470,127.44 1,254,136.43<br />

Trade accounts payable - related parties 278,796.66 18,131.09 1,070,000.00 -<br />

Other current liabilities 16,749,844.89 (26,210,066.42) 25,910,212.75 (7,780,553.90)<br />

Net cash received (paid) from operation 103,674,925.17 139,851,235.75 (47,447,824.74) 37,602,141.51<br />

Payment of interest expense (164,409.73) (108,607.85) - (253.95)<br />

Payment of Corporate income tax (7,350,846.02) (8,851,080.26) (5,516,718.24) (845,982.82)<br />

Net cash provided by (used in) operating<br />

96,159,669.42 130,891,547.64 (52,964,542.98) 36,755,904.74<br />

activities<br />

The accompanying notes to financial statements are an integral part of these state<br />

74