Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements – continuation | Notes to the financial statements<br />

34. Financial risk management continued<br />

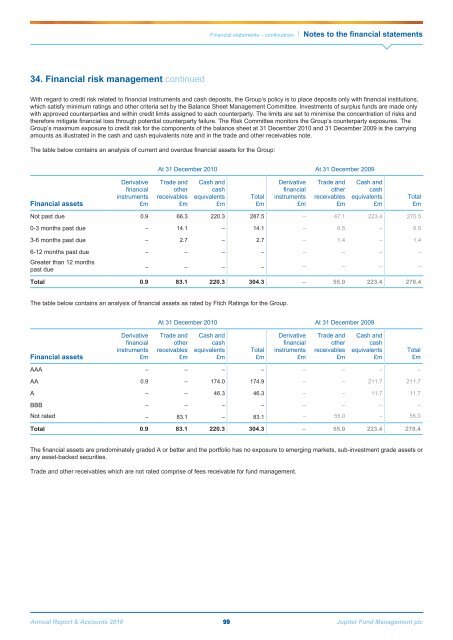

With regard to credit risk related to financial instruments and cash deposits, the Group’s policy is to place deposits only with financial institutions,<br />

which satisfy minimum ratings and other criteria set by the Balance Sheet <strong>Management</strong> Committee. Investments of surplus funds are made only<br />

with approved counterparties and within credit limits assigned to each counterparty. The limits are set to minimise the concentration of risks and<br />

therefore mitigate financial loss through potential counterparty failure. The Risk Committee monitors the Group’s counterparty exposures. The<br />

Group’s maximum exposure to credit risk for the components of the balance sheet at 31 December <strong>2010</strong> and 31 December 2009 is the carrying<br />

amounts as illustrated in the cash and cash equivalents note and in the trade and other receivables note.<br />

The table below contains an analysis of current and overdue financial assets for the Group:<br />

At 31 December <strong>2010</strong> At 31 December 2009<br />

Financial assets<br />

Derivative<br />

financial<br />

instruments<br />

£m<br />

Trade and<br />

other<br />

receivables<br />

£m<br />

Cash and<br />

cash<br />

equivalents<br />

£m<br />

Total<br />

£m<br />

Derivative<br />

financial<br />

instruments<br />

£m<br />

Trade and<br />

other<br />

receivables<br />

£m<br />

Cash and<br />

cash<br />

equivalents<br />

£m<br />

Total<br />

£m<br />

Not past due 0.9 66.3 220.3 287.5 – 47.1 223.4 270.5<br />

0-3 months past due – 14.1 – 14.1 – 6.5 – 6.5<br />

3-6 months past due – 2.7 – 2.7 – 1.4 – 1.4<br />

6-12 months past due – – – – – – – –<br />

Greater than 12 months<br />

past due<br />

– – – – – – – –<br />

Total 0.9 83.1 220.3 304.3 – 55.0 223.4 278.4<br />

The table below contains an analysis of financial assets as rated by Fitch Ratings for the Group.<br />

At 31 December <strong>2010</strong> At 31 December 2009<br />

Financial assets<br />

Derivative<br />

financial<br />

instruments<br />

£m<br />

Trade and<br />

other<br />

receivables<br />

£m<br />

Cash and<br />

cash<br />

equivalents<br />

£m<br />

Total<br />

£m<br />

Derivative<br />

financial<br />

instruments<br />

£m<br />

Trade and<br />

other<br />

receivables<br />

£m<br />

Cash and<br />

cash<br />

equivalents<br />

£m<br />

Total<br />

£m<br />

AAA – – – – – – – –<br />

AA 0.9 – 174.0 174.9 – – 211.7 211.7<br />

A – – 46.3 46.3 – – 11.7 11.7<br />

BBB – – – – – – – –<br />

Not rated – 83.1 – 83.1 – 55.0 – 55.0<br />

Total 0.9 83.1 220.3 304.3 – 55.0 223.4 278.4<br />

The financial assets are predominately graded A or better and the portfolio has no exposure to emerging markets, sub-investment grade assets or<br />

any asset-backed securities.<br />

Trade and other receivables which are not rated comprise of fees receivable for fund management.<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 99 <strong>Jupiter</strong> Fund <strong>Management</strong> plc