Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Business review | Directors’ report<br />

Net revenue<br />

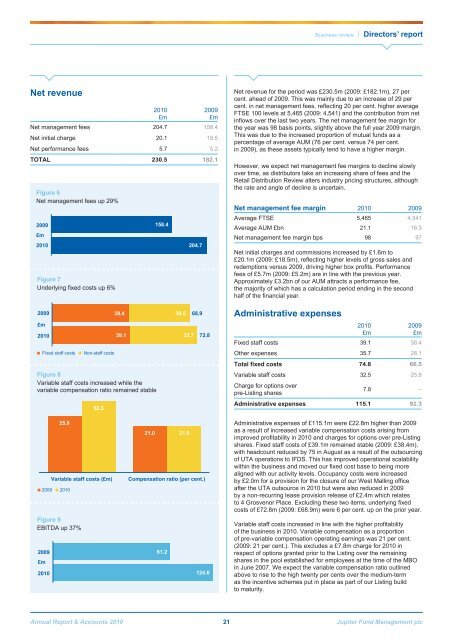

Figure 7<br />

Underlying fixed costs up 6%<br />

<strong>2010</strong><br />

£m<br />

2009<br />

£m<br />

Net management fees 204.7 158.4<br />

Net initial charge 20.1 18.5<br />

Net performance fees 5.7 5.2<br />

TOTAL 230.5 182.1<br />

Figure 6<br />

Net management fees up 29%<br />

2009<br />

£m<br />

<strong>2010</strong><br />

158.4<br />

204.7<br />

Net revenue for the period was £230.5m (2009: £182.1m), 27 per<br />

cent. ahead of 2009. This was mainly due to an increase of 29 per<br />

cent. in net management fees, reflecting 20 per cent. higher average<br />

FTSE 100 levels at 5,465 (2009: 4,541) and the contribution from net<br />

inflows over the last two years. The net management fee margin for<br />

the year was 98 basis points, slightly above the full year 2009 margin.<br />

This was due to the increased proportion of mutual funds as a<br />

percentage of average AUM (76 per cent. versus 74 per cent.<br />

in 2009), as these assets typically tend to have a higher margin.<br />

However, we expect net management fee margins to decline slowly<br />

over time, as distributors take an increasing share of fees and the<br />

Retail Distribution Review alters industry pricing structures, although<br />

the rate and angle of decline is uncertain.<br />

Net management fee margin <strong>2010</strong> 2009<br />

Average FTSE 5,465 4,541<br />

Average AUM £bn 21.1 16.3<br />

Net management fee margin bps 98 97<br />

Net initial charges and commissions increased by £1.6m to<br />

£20.1m (2009: £18.5m), reflecting higher levels of gross sales and<br />

redemptions versus 2009, driving higher box profits. Performance<br />

fees of £5.7m (2009: £5.2m) are in line with the previous year.<br />

Approximately £3.2bn of our AUM attracts a performance fee,<br />

the majority of which has a calculation period ending in the second<br />

half of the financial year.<br />

2009<br />

£m<br />

<strong>2010</strong><br />

Fixed staff costs<br />

Non-staff costs<br />

38.4<br />

39.1<br />

Figure 8<br />

Variable staff costs increased while the<br />

variable compensation ratio remained stable<br />

32.5<br />

30.5 68.9<br />

33.7 72.8<br />

Administrative expenses<br />

<strong>2010</strong><br />

£m<br />

2009<br />

£m<br />

Fixed staff costs 39.1 38.4<br />

Other expenses 35.7 28.1<br />

Total fixed costs 74.8 66.5<br />

Variable staff costs 32.5 25.8<br />

Charge for options over<br />

pre-Listing shares<br />

7.8 –<br />

Administrative expenses 115.1 92.3<br />

Figure 9<br />

EBITDA up 37%<br />

2009<br />

£m<br />

2009<br />

<strong>2010</strong><br />

25.8<br />

Variable staff costs (£m)<br />

<strong>2010</strong><br />

21.0 21.0<br />

Compensation ratio (per cent.)<br />

91.2<br />

124.6<br />

Administrative expenses of £115.1m were £22.8m higher than 2009<br />

as a result of increased variable compensation costs arising from<br />

improved profitability in <strong>2010</strong> and charges for options over pre-Listing<br />

shares. Fixed staff costs of £39.1m remained stable (2009: £38.4m),<br />

with headcount reduced by 75 in August as a result of the outsourcing<br />

of UTA operations to IFDS. This has improved operational scalability<br />

within the business and moved our fixed cost base to being more<br />

aligned with our activity levels. Occupancy costs were increased<br />

by £2.0m for a provision for the closure of our West Malling office<br />

after the UTA outsource in <strong>2010</strong> but were also reduced in 2009<br />

by a non-recurring lease provision release of £2.4m which relates<br />

to 4 Grosvenor Place. Excluding these two items, underlying fixed<br />

costs of £72.8m (2009: £68.9m) were 6 per cent. up on the prior year.<br />

Variable staff costs increased in line with the higher profitability<br />

of the business in <strong>2010</strong>. Variable compensation as a proportion<br />

of pre-variable compensation operating earnings was 21 per cent.<br />

(2009: 21 per cent.). This excludes a £7.8m charge for <strong>2010</strong> in<br />

respect of options granted prior to the Listing over the remaining<br />

shares in the pool established for employees at the time of the MBO<br />

in June 2007. We expect the variable compensation ratio outlined<br />

above to rise to the high twenty per cents over the medium-term<br />

as the incentive schemes put in place as part of our Listing build<br />

to maturity.<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 21 <strong>Jupiter</strong> Fund <strong>Management</strong> plc