Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements – continuation | Notes to the financial statements<br />

35. Related parties<br />

The Group<br />

The Group manages, through its subsidiaries, a number of investment trusts, unit trusts and overseas funds. The subsidiary companies receive<br />

management fees from these entities for managing the assets and in some instances receive performance fees. The precise fee arrangements<br />

for the different entities are disclosed within the financial statements of each entity or within other information which is publicly available.<br />

The Group manages a number of collective investment vehicles and by virtue of the investment management agreements in place between the<br />

Group and these vehicles, they may be considered to be related parties. The Group acts as manager for 35 (2009: 34) authorised unit trusts.<br />

Each unit trust is jointly administered with the trustees, The Royal Bank of Scotland plc. The aggregate total value of transactions for the period<br />

was £3,237.2m (2009: £2,796.6m) for unit trust creations and £1,744.8m (2009: £978.0m) for unit trust redemptions. The actual aggregate<br />

amount due to the trustees at the end of the accounting year in respect of transactions awaiting settlement was £10.0m (2009: £34.5m).<br />

The amount received in respect of gross management and registration charges was £269.8m (2009: £200.8m). At the end of the year, there was<br />

£6.5m (2009: £4.7m) outstanding for annual management fees and £1.0m (2009: £0.8m) in respect of registration fees.<br />

The Group has a total net investment in collective investment vehicles of £53.2m (2009: £50.9m) and received distributions of £0.1m (2009:<br />

£0.1m) and investment management and performance fees of £244.3m (2009: £190.4m).<br />

The majority of the Directors of the investment trusts are independent of the Group.<br />

Included within the financial instruments note are seed capital investments in funds managed by the Group.<br />

The Group also considers transactions with its key management personnel as related party transactions. Key management personnel are<br />

considered to be members of the Executive Committee who manage the main operating activities of the Group. The emoluments of key<br />

management personnel are shown in the Directors’ emoluments and key management personnel note and further disclosure on Directors is<br />

within the Remuneration report. Except for those that have been disclosed, there are no other transactions, arrangements or agreements made<br />

for persons who were Directors of the Group during the period. For members of key management personnel, payments in relation to previously<br />

held Preferred Finance Securities amounted to £15.8m (2009: £nil). Preference share holdings by key management personnel of £4.1m were<br />

converted to 2.5m of ordinary shares in June <strong>2010</strong>.<br />

TA Associates Inc. are also considered a related party of the Group. Transactions with TA Associates Inc. in relation to the repayment by the<br />

Group of Preferred Finance Securities amounted to £201.0m. £152.3m of this was paid in cash and the remaining £48.7m was converted into<br />

ordinary shares. £0.6m of this is shown within share capital and £48.1m is shown as part of share premium.<br />

Company<br />

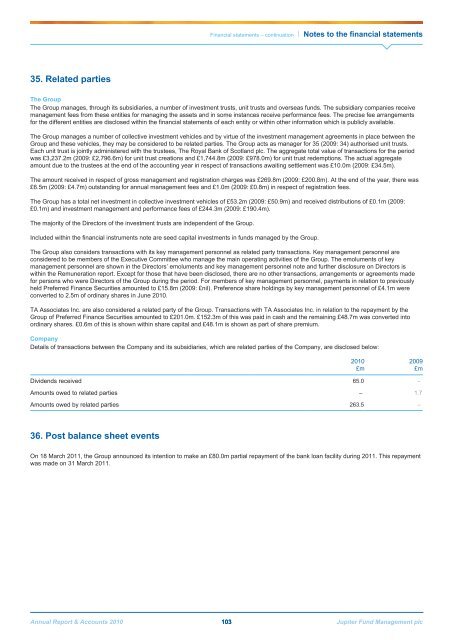

Details of transactions between the Company and its subsidiaries, which are related parties of the Company, are disclosed below:<br />

<strong>2010</strong><br />

£m<br />

2009<br />

£m<br />

Dividends received 65.0 –<br />

Amounts owed to related parties – 1.7<br />

Amounts owed by related parties 263.5 –<br />

36. Post balance sheet events<br />

On 18 March 2011, the Group announced its intention to make an £80.0m partial repayment of the bank loan facility during 2011. This repayment<br />

was made on 31 March 2011.<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 103 <strong>Jupiter</strong> Fund <strong>Management</strong> plc