Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements – continuation | Notes to the financial statements<br />

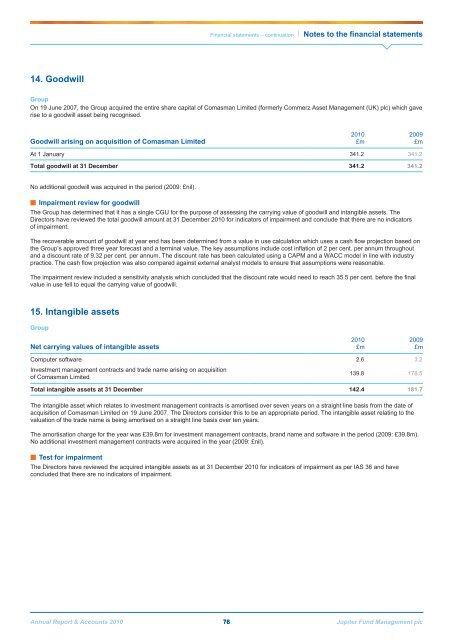

14. Goodwill<br />

Group<br />

On 19 June 2007, the Group acquired the entire share capital of Comasman Limited (formerly Commerz <strong>Asset</strong> <strong>Management</strong> (UK) plc) which gave<br />

rise to a goodwill asset being recognised.<br />

Goodwill arising on acquisition of Comasman Limited<br />

<strong>2010</strong><br />

£m<br />

2009<br />

£m<br />

At 1 January 341.2 341.2<br />

Total goodwill at 31 December 341.2 341.2<br />

No additional goodwill was acquired in the period (2009: £nil).<br />

■■Impairment review for goodwill<br />

The Group has determined that it has a single CGU for the purpose of assessing the carrying value of goodwill and intangible assets. The<br />

Directors have reviewed the total goodwill amount at 31 December <strong>2010</strong> for indicators of impairment and conclude that there are no indicators<br />

of impairment.<br />

The recoverable amount of goodwill at year end has been determined from a value in use calculation which uses a cash flow projection based on<br />

the Group’s approved three year forecast and a terminal value. The key assumptions include cost inflation of 2 per cent. per annum throughout<br />

and a discount rate of 9.32 per cent. per annum. The discount rate has been calculated using a CAPM and a WACC model in line with industry<br />

practice. The cash flow projection was also compared against external analyst models to ensure that assumptions were reasonable.<br />

The impairment review included a sensitivity analysis which concluded that the discount rate would need to reach 35.5 per cent. before the final<br />

value in use fell to equal the carrying value of goodwill.<br />

15. Intangible assets<br />

Group<br />

Net carrying values of intangible assets<br />

<strong>2010</strong><br />

£m<br />

2009<br />

£m<br />

Computer software 2.6 3.2<br />

Investment management contracts and trade name arising on acquisition<br />

of Comasman Limited<br />

139.8 178.5<br />

Total intangible assets at 31 December 142.4 181.7<br />

The intangible asset which relates to investment management contracts is amortised over seven years on a straight line basis from the date of<br />

acquisition of Comasman Limited on 19 June 2007. The Directors consider this to be an appropriate period. The intangible asset relating to the<br />

valuation of the trade name is being amortised on a straight line basis over ten years.<br />

The amortisation charge for the year was £39.8m for investment management contracts, brand name and software in the period (2009: £39.8m).<br />

No additional investment management contracts were acquired in the year (2009: £nil).<br />

■■Test for impairment<br />

The Directors have reviewed the acquired intangible assets as at 31 December <strong>2010</strong> for indicators of impairment as per IAS 36 and have<br />

concluded that there are no indicators of impairment.<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 76 <strong>Jupiter</strong> Fund <strong>Management</strong> plc