Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements – continuation | Notes to the financial statements<br />

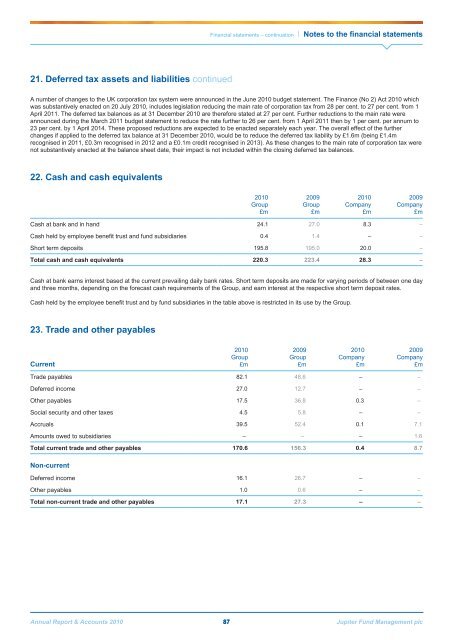

21. Deferred tax assets and liabilities continued<br />

A number of changes to the UK corporation tax system were announced in the June <strong>2010</strong> budget statement. The Finance (No 2) Act <strong>2010</strong> which<br />

was substantively enacted on 20 July <strong>2010</strong>, includes legislation reducing the main rate of corporation tax from 28 per cent. to 27 per cent. from 1<br />

April 2011. The deferred tax balances as at 31 December <strong>2010</strong> are therefore stated at 27 per cent. Further reductions to the main rate were<br />

announced during the March 2011 budget statement to reduce the rate further to 26 per cent. from 1 April 2011 then by 1 per cent. per annum to<br />

23 per cent. by 1 April 2014. These proposed reductions are expected to be enacted separately each year. The overall effect of the further<br />

changes if applied to the deferred tax balance at 31 December <strong>2010</strong>, would be to reduce the deferred tax liability by £1.6m (being £1.4m<br />

recognised in 2011, £0.3m recognised in 2012 and a £0.1m credit recognised in 2013). As these changes to the main rate of corporation tax were<br />

not substantively enacted at the balance sheet date, their impact is not included within the closing deferred tax balances.<br />

22. Cash and cash equivalents<br />

<strong>2010</strong><br />

Group<br />

£m<br />

2009<br />

Group<br />

£m<br />

<strong>2010</strong><br />

Company<br />

£m<br />

2009<br />

Company<br />

£m<br />

Cash at bank and in hand 24.1 27.0 8.3 –<br />

Cash held by employee benefit trust and fund subsidiaries 0.4 1.4 – –<br />

Short term deposits 195.8 195.0 20.0 –<br />

Total cash and cash equivalents 220.3 223.4 28.3 –<br />

Cash at bank earns interest based at the current prevailing daily bank rates. Short term deposits are made for varying periods of between one day<br />

and three months, depending on the forecast cash requirements of the Group, and earn interest at the respective short term deposit rates.<br />

Cash held by the employee benefit trust and by fund subsidiaries in the table above is restricted in its use by the Group.<br />

23. Trade and other payables<br />

Current<br />

<strong>2010</strong><br />

Group<br />

£m<br />

2009<br />

Group<br />

£m<br />

<strong>2010</strong><br />

Company<br />

£m<br />

2009<br />

Company<br />

£m<br />

Trade payables 82.1 48.6 – –<br />

Deferred income 27.0 12.7 – –<br />

Other payables 17.5 36.8 0.3 –<br />

Social security and other taxes 4.5 5.8 – –<br />

Accruals 39.5 52.4 0.1 7.1<br />

Amounts owed to subsidiaries – – – 1.6<br />

Total current trade and other payables 170.6 156.3 0.4 8.7<br />

Non-current<br />

Deferred income 16.1 26.7 – –<br />

Other payables 1.0 0.6 – –<br />

Total non-current trade and other payables 17.1 27.3 – –<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 87 <strong>Jupiter</strong> Fund <strong>Management</strong> plc