Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements – continuation | Notes to the financial statements<br />

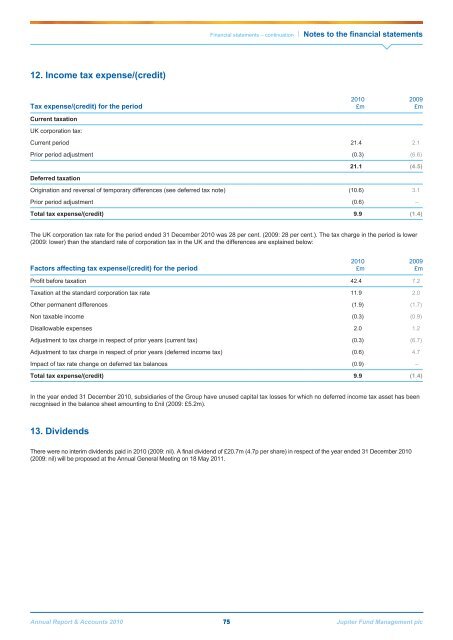

12. Income tax expense/(credit)<br />

Tax expense/(credit) for the period<br />

Current taxation<br />

UK corporation tax:<br />

<strong>2010</strong><br />

£m<br />

2009<br />

£m<br />

Current period 21.4 2.1<br />

Prior period adjustment (0.3) (6.6)<br />

21.1 (4.5)<br />

Deferred taxation<br />

Origination and reversal of temporary differences (see deferred tax note) (10.6) 3.1<br />

Prior period adjustment (0.6) –<br />

Total tax expense/(credit) 9.9 (1.4)<br />

The UK corporation tax rate for the period ended 31 December <strong>2010</strong> was 28 per cent. (2009: 28 per cent.). The tax charge in the period is lower<br />

(2009: lower) than the standard rate of corporation tax in the UK and the differences are explained below:<br />

Factors affecting tax expense/(credit) for the period<br />

<strong>2010</strong><br />

£m<br />

2009<br />

£m<br />

Profit before taxation 42.4 7.2<br />

Taxation at the standard corporation tax rate 11.9 2.0<br />

Other permanent differences (1.9) (1.7)<br />

Non taxable income (0.3) (0.9)<br />

Disallowable expenses 2.0 1.2<br />

Adjustment to tax charge in respect of prior years (current tax) (0.3) (6.7)<br />

Adjustment to tax charge in respect of prior years (deferred income tax) (0.6) 4.7<br />

Impact of tax rate change on deferred tax balances (0.9) –<br />

Total tax expense/(credit) 9.9 (1.4)<br />

In the year ended 31 December <strong>2010</strong>, subsidiaries of the Group have unused capital tax losses for which no deferred income tax asset has been<br />

recognised in the balance sheet amounting to £nil (2009: £5.2m).<br />

13. Dividends<br />

There were no interim dividends paid in <strong>2010</strong> (2009: nil). A final dividend of £20.7m (4.7p per share) in respect of the year ended 31 December <strong>2010</strong><br />

(2009: nil) will be proposed at the <strong>Annual</strong> General Meeting on 18 May 2011.<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 75 <strong>Jupiter</strong> Fund <strong>Management</strong> plc