Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Governance | Directors’ report<br />

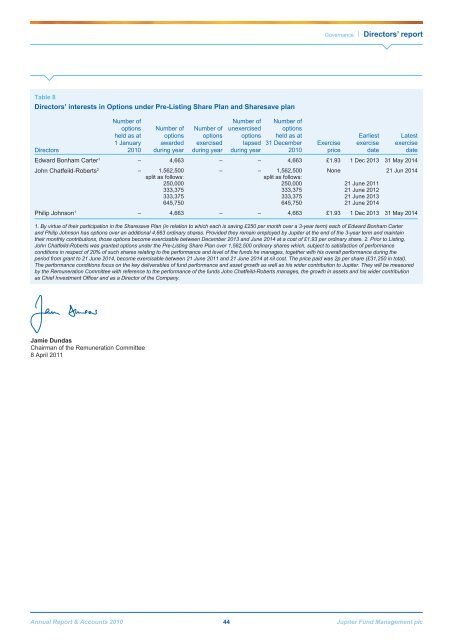

Table 8<br />

Directors’ interests in Options under Pre-Listing Share Plan and Sharesave plan<br />

Directors<br />

Number of<br />

options<br />

held as at<br />

1 January<br />

<strong>2010</strong><br />

Number of<br />

options<br />

awarded<br />

during year<br />

Number of<br />

options<br />

exercised<br />

during year<br />

Number of<br />

unexercised<br />

options<br />

lapsed<br />

during year<br />

Number of<br />

options<br />

held as at<br />

31 December<br />

<strong>2010</strong><br />

Exercise<br />

price<br />

Earliest<br />

exercise<br />

date<br />

Latest<br />

exercise<br />

date<br />

Edward Bonham Carter 1 – 4,663 – – 4,663 £1.93 1 Dec 2013 31 May 2014<br />

John Chatfeild-Roberts 2 – 1,562,500<br />

split as follows:<br />

250,000<br />

333,375<br />

333,375<br />

645,750<br />

– – 1,562,500<br />

split as follows:<br />

250,000<br />

333,375<br />

333,375<br />

645,750<br />

None<br />

21 June 2011<br />

21 June 2012<br />

21 June 2013<br />

21 June 2014<br />

21 Jun 2014<br />

Philip Johnson 1 – 4,663 – – 4,663 £1.93 1 Dec 2013 31 May 2014<br />

1. By virtue of their participation in the Sharesave Plan (in relation to which each is saving £250 per month over a 3-year term) each of Edward Bonham Carter<br />

and Philip Johnson has options over an additional 4,663 ordinary shares. Provided they remain employed by <strong>Jupiter</strong> at the end of the 3-year term and maintain<br />

their monthly contributions, those options become exercisable between December 2013 and June 2014 at a cost of £1.93 per ordinary share. 2. Prior to Listing,<br />

John Chatfeild-Roberts was granted options under the Pre-Listing Share Plan over 1,562,500 ordinary shares which, subject to satisfaction of performance<br />

conditions in respect of 20% of such shares relating to the performance and level of the funds he manages, together with his overall performance during the<br />

period from grant to 21 June 2014, become exercisable between 21 June 2011 and 21 June 2014 at nil cost. The price paid was 2p per share (£31,250 in total).<br />

The performance conditions focus on the key deliverables of fund performance and asset growth as well as his wider contribution to <strong>Jupiter</strong>. They will be measured<br />

by the Remuneration Committee with reference to the performance of the funds John Chatfeild-Roberts manages, the growth in assets and his wider contribution<br />

as Chief Investment Officer and as a Director of the Company.<br />

Jamie Dundas<br />

Chairman of the Remuneration Committee<br />

8 April 2011<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 44 <strong>Jupiter</strong> Fund <strong>Management</strong> plc