Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Business review | Directors’ report<br />

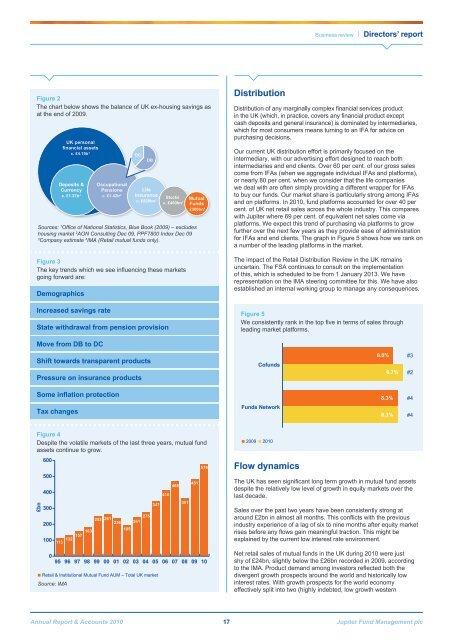

Figure 2<br />

The chart below shows the balance of UK ex-housing savings as<br />

at the end of 2009.<br />

UK personal<br />

financial assets<br />

c. £4.15tr 1<br />

Deposits & Occupational<br />

Currency Pensions Life<br />

c. £1.37tr 1 c. £1.42tr 2 Insurance Stocks Mutual<br />

c. £820bn 3 c. £460bn 1<br />

Funds<br />

£300bn 4<br />

Sources: 1 Office of National Statistics, Blue Book (2009) – excludes<br />

housing market 2 AON Consulting Dec 09, PPF7800 Index Dec 09<br />

3<br />

Company estimate 4 IMA (Retail mutual funds only).<br />

Figure 3<br />

The key trends which we see influencing these markets<br />

going forward are:<br />

Demographics<br />

Increased savings rate<br />

State withdrawal from pension provision<br />

DC<br />

DB<br />

Distribution<br />

Distribution of any marginally complex financial services product<br />

in the UK (which, in practice, covers any financial product except<br />

cash deposits and general insurance) is dominated by intermediaries,<br />

which for most consumers means turning to an IFA for advice on<br />

purchasing decisions.<br />

Our current UK distribution effort is primarily focused on the<br />

intermediary, with our advertising effort designed to reach both<br />

intermediaries and end clients. Over 60 per cent. of our gross sales<br />

come from IFAs (when we aggregate individual IFAs and platforms),<br />

or nearly 80 per cent. when we consider that the life companies<br />

we deal with are often simply providing a different wrapper for IFAs<br />

to buy our funds. Our market share is particularly strong among IFAs<br />

and on platforms. In <strong>2010</strong>, fund platforms accounted for over 40 per<br />

cent. of UK net retail sales across the whole industry. This compares<br />

with <strong>Jupiter</strong> where 69 per cent. of equivalent net sales come via<br />

platforms. We expect this trend of purchasing via platforms to grow<br />

further over the next few years as they provide ease of administration<br />

for IFAs and end clients. The graph in Figure 5 shows how we rank on<br />

a number of the leading platforms in the market.<br />

The impact of the Retail Distribution Review in the UK remains<br />

uncertain. The FSA continues to consult on the implementation<br />

of this, which is scheduled to be from 1 January 2013. We have<br />

representation on the IMA steering committee for this. We have also<br />

established an internal working group to manage any consequences.<br />

Figure 5<br />

We consistently rank in the top five in terms of sales through<br />

leading market platforms.<br />

Move from DB to DC<br />

Shift towards transparent products<br />

Pressure on insurance products<br />

Cofunds<br />

8.0%<br />

8.7%<br />

#3<br />

#2<br />

Some inflation protection<br />

8.3%<br />

#4<br />

Tax changes<br />

Funds Network<br />

8.3%<br />

#4<br />

Figure 4<br />

Despite the volatile markets of the last three years, mutual fund<br />

assets continue to grow.<br />

£bn<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

183<br />

157<br />

132<br />

113<br />

253 261<br />

236<br />

195<br />

275<br />

241<br />

347<br />

410<br />

468<br />

361<br />

481<br />

578<br />

2009 <strong>2010</strong><br />

Flow dynamics<br />

The UK has seen significant long term growth in mutual fund assets<br />

despite the relatively low level of growth in equity markets over the<br />

last decade.<br />

Sales over the past two years have been consistently strong at<br />

around £2bn in almost all months. This conflicts with the previous<br />

industry experience of a lag of six to nine months after equity market<br />

rises before any flows gain meaningful traction. This might be<br />

explained by the current low interest rate environment.<br />

0<br />

95 96 97 98 99 00 01 02 03 04 05<br />

Retail & Institutional Mutual Fund AUM – Total UK market<br />

Source: IMA<br />

06<br />

07<br />

08<br />

09<br />

10<br />

Net retail sales of mutual funds in the UK during <strong>2010</strong> were just<br />

shy of £24bn, slightly below the £26bn recorded in 2009, according<br />

to the IMA. Product demand among investors reflected both the<br />

divergent growth prospects around the world and historically low<br />

interest rates. With growth prospects for the world economy<br />

effectively split into two (highly indebted, low growth western<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 17 <strong>Jupiter</strong> Fund <strong>Management</strong> plc