Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Operational review | Who we are<br />

Fund management<br />

We have a single investment platform comprising 39 fund managers<br />

based in London, who are responsible for managing our range of<br />

funds across different client segments and products. Fund managers<br />

may manage a number of portfolios across our various product lines<br />

including mutual funds, segregated mandates, investment trusts and<br />

hedge funds. Private client assets are managed separately by 11<br />

private client fund managers.<br />

Although we are predominantly an equities-focused investment<br />

manager, our investment capabilities span a broad range of themes.<br />

These cover different aspects of investing in UK equities, including<br />

growth and income styles, European and emerging markets equities<br />

and specialist areas, such as financial sector equities. As well as<br />

these long-only equity styles, we also have capabilities in fund of<br />

funds, absolute return and fixed income.<br />

Philosophy and culture<br />

Our investment philosophy is to seek to generate investment<br />

outperformance against relevant benchmarks over the medium<br />

to long term without exposing our clients to unnecessary risk.<br />

We believe that talented fund managers perform best if they are<br />

given the freedom to invest as they see fit, subject to the constraints<br />

set by each fund’s investment objectives. While our fund managers<br />

work as a closely knit team, sharing stock ideas and debating market<br />

prospects, each manager has individual responsibility for their own<br />

portfolios and is held accountable for the investment performance<br />

of the funds they manage. Our investment process is not run<br />

by a committee and there is no house view on markets, asset<br />

allocation or core lists of stocks. We believe that such committeebased<br />

approaches can result in investment decisions that move<br />

towards consensus and result in weak compromises and mediocre<br />

performance. Instead, our fund managers take an active approach<br />

to managing their investments and have considerable scope to<br />

adopt investment positions against prevailing consensus in the<br />

market and the portfolio’s benchmark in order to achieve investment<br />

outperformance for our clients. Our fund managers tend to emphasise<br />

stock selection, rather than specifically targeting relative sector<br />

or geographic weightings. In addition to making fund managers<br />

clearly accountable for investment performance, we encourage<br />

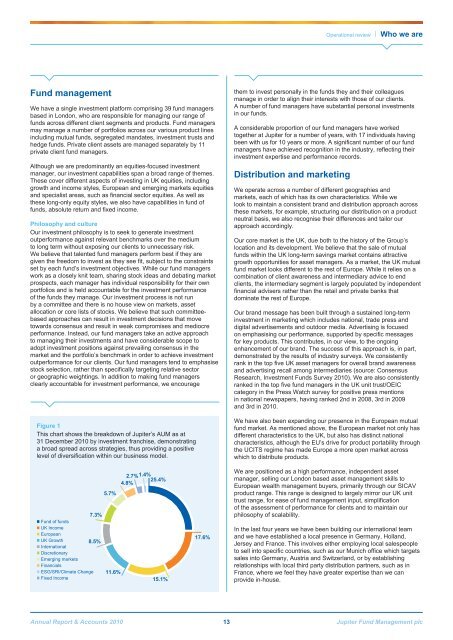

Figure 1<br />

This chart shows the breakdown of <strong>Jupiter</strong>’s AUM as at<br />

31 December <strong>2010</strong> by investment franchise, demonstrating<br />

a broad spread across strategies, thus providing a positive<br />

level of diversification within our business model.<br />

them to invest personally in the funds they and their colleagues<br />

manage in order to align their interests with those of our clients.<br />

A number of fund managers have substantial personal investments<br />

in our funds.<br />

A considerable proportion of our fund managers have worked<br />

together at <strong>Jupiter</strong> for a number of years, with 17 individuals having<br />

been with us for 10 years or more. A significant number of our fund<br />

managers have achieved recognition in the industry, reflecting their<br />

investment expertise and performance records.<br />

Distribution and marketing<br />

We operate across a number of different geographies and<br />

markets, each of which has its own characteristics. While we<br />

look to maintain a consistent brand and distribution approach across<br />

these markets, for example, structuring our distribution on a product<br />

neutral basis, we also recognise their differences and tailor our<br />

approach accordingly.<br />

Our core market is the UK, due both to the history of the Group’s<br />

location and its development. We believe that the sale of mutual<br />

funds within the UK long-term savings market contains attractive<br />

growth opportunities for asset managers. As a market, the UK mutual<br />

fund market looks different to the rest of Europe. While it relies on a<br />

combination of client awareness and intermediary advice to end<br />

clients, the intermediary segment is largely populated by independent<br />

financial advisers rather than the retail and private banks that<br />

dominate the rest of Europe.<br />

Our brand message has been built through a sustained long-term<br />

investment in marketing which includes national, trade press and<br />

digital advertisements and outdoor media. Advertising is focused<br />

on emphasising our performance, supported by specific messages<br />

for key products. This contributes, in our view, to the ongoing<br />

enhancement of our brand. The success of this approach is, in part,<br />

demonstrated by the results of industry surveys. We consistently<br />

rank in the top five UK asset managers for overall brand awareness<br />

and advertising recall among intermediaries (source: Consensus<br />

Research, Investment Funds Survey <strong>2010</strong>). We are also consistently<br />

ranked in the top five fund managers in the UK unit trust/OEIC<br />

category in the Press Watch survey for positive press mentions<br />

in national newspapers, having ranked 2nd in 2008, 3rd in 2009<br />

and 3rd in <strong>2010</strong>.<br />

We have also been expanding our presence in the European mutual<br />

fund market. As mentioned above, the European market not only has<br />

different characteristics to the UK, but also has distinct national<br />

characteristics, although the EU’s drive for product portability through<br />

the UCITS regime has made Europe a more open market across<br />

which to distribute products.<br />

7.3%<br />

Fund of funds<br />

UK Income<br />

European<br />

UK Growth 8.5%<br />

International<br />

Discretionary<br />

Emerging markets<br />

Financials<br />

ESG/SRI/Climate Change<br />

Fixed Income<br />

5.7%<br />

11.6%<br />

2.7% 1.4% 25.4%<br />

4.8%<br />

15.1%<br />

17.6%<br />

We are positioned as a high performance, independent asset<br />

manager, selling our London based asset management skills to<br />

European wealth management buyers, primarily through our SICAV<br />

product range. This range is designed to largely mirror our UK unit<br />

trust range, for ease of fund management input, simplification<br />

of the assessment of performance for clients and to maintain our<br />

philosophy of scalability.<br />

In the last four years we have been building our international team<br />

and we have established a local presence in Germany, Holland,<br />

Jersey and France. This involves either employing local salespeople<br />

to sell into specific countries, such as our Munich office which targets<br />

sales into Germany, Austria and Switzerland, or by establishing<br />

relationships with local third party distribution partners, such as in<br />

France, where we feel they have greater expertise than we can<br />

provide in-house.<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 13 <strong>Jupiter</strong> Fund <strong>Management</strong> plc