Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Governance | Directors’ report<br />

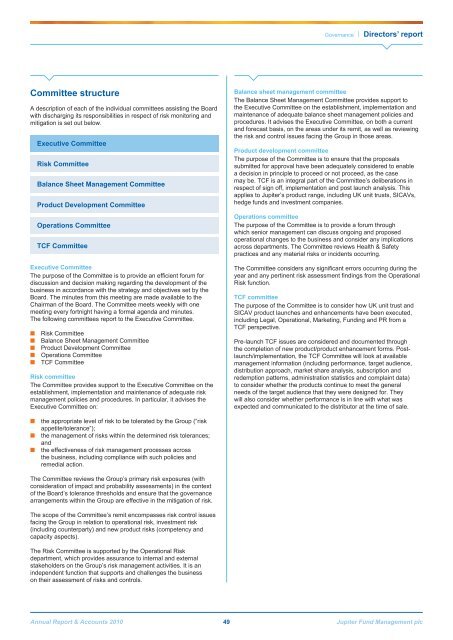

Committee structure<br />

A description of each of the individual committees assisting the Board<br />

with discharging its responsibilities in respect of risk monitoring and<br />

mitigation is set out below.<br />

Executive Committee<br />

Risk Committee<br />

Balance Sheet <strong>Management</strong> Committee<br />

Product Development Committee<br />

Operations Committee<br />

TCF Committee<br />

Executive Committee<br />

The purpose of the Committee is to provide an efficient forum for<br />

discussion and decision making regarding the development of the<br />

business in accordance with the strategy and objectives set by the<br />

Board. The minutes from this meeting are made available to the<br />

Chairman of the Board. The Committee meets weekly with one<br />

meeting every fortnight having a formal agenda and minutes.<br />

The following committees report to the Executive Committee.<br />

■■<br />

Risk Committee<br />

■■<br />

Balance Sheet <strong>Management</strong> Committee<br />

■■<br />

Product Development Committee<br />

■■<br />

Operations Committee<br />

■■<br />

TCF Committee<br />

Risk committee<br />

The Committee provides support to the Executive Committee on the<br />

establishment, implementation and maintenance of adequate risk<br />

management policies and procedures. In particular, it advises the<br />

Executive Committee on:<br />

Balance sheet management committee<br />

The Balance Sheet <strong>Management</strong> Committee provides support to<br />

the Executive Committee on the establishment, implementation and<br />

maintenance of adequate balance sheet management policies and<br />

procedures. It advises the Executive Committee, on both a current<br />

and forecast basis, on the areas under its remit, as well as reviewing<br />

the risk and control issues facing the Group in those areas.<br />

Product development committee<br />

The purpose of the Committee is to ensure that the proposals<br />

submitted for approval have been adequately considered to enable<br />

a decision in principle to proceed or not proceed, as the case<br />

may be. TCF is an integral part of the Committee’s deliberations in<br />

respect of sign off, implementation and post launch analysis. This<br />

applies to <strong>Jupiter</strong>’s product range, including UK unit trusts, SICAVs,<br />

hedge funds and investment companies.<br />

Operations committee<br />

The purpose of the Committee is to provide a forum through<br />

which senior management can discuss ongoing and proposed<br />

operational changes to the business and consider any implications<br />

across departments. The Committee reviews Health & Safety<br />

practices and any material risks or incidents occurring.<br />

The Committee considers any significant errors occurring during the<br />

year and any pertinent risk assessment findings from the Operational<br />

Risk function.<br />

TCF committee<br />

The purpose of the Committee is to consider how UK unit trust and<br />

SICAV product launches and enhancements have been executed,<br />

including Legal, Operational, Marketing, Funding and PR from a<br />

TCF perspective.<br />

Pre-launch TCF issues are considered and documented through<br />

the completion of new product/product enhancement forms. Postlaunch/implementation,<br />

the TCF Committee will look at available<br />

management information (including performance, target audience,<br />

distribution approach, market share analysis, subscription and<br />

redemption patterns, administration statistics and complaint data)<br />

to consider whether the products continue to meet the general<br />

needs of the target audience that they were designed for. They<br />

will also consider whether performance is in line with what was<br />

expected and communicated to the distributor at the time of sale.<br />

■■<br />

■■<br />

■■<br />

the appropriate level of risk to be tolerated by the Group (“risk<br />

appetite/tolerance”);<br />

the management of risks within the determined risk tolerances;<br />

and<br />

the effectiveness of risk management processes across<br />

the business, including compliance with such policies and<br />

remedial action.<br />

The Committee reviews the Group’s primary risk exposures (with<br />

consideration of impact and probability assessments) in the context<br />

of the Board’s tolerance thresholds and ensure that the governance<br />

arrangements within the Group are effective in the mitigation of risk.<br />

The scope of the Committee’s remit encompasses risk control issues<br />

facing the Group in relation to operational risk, investment risk<br />

(including counterparty) and new product risks (competency and<br />

capacity aspects).<br />

The Risk Committee is supported by the Operational Risk<br />

department, which provides assurance to internal and external<br />

stakeholders on the Group’s risk management activities. It is an<br />

independent function that supports and challenges the business<br />

on their assessment of risks and controls.<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 49 <strong>Jupiter</strong> Fund <strong>Management</strong> plc