Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Business review | Directors’ report<br />

markets on the one side and low debt, high growth emerging<br />

markets on the other), product demand was equally polarised.<br />

After falling behind sales of bond funds in 2008, equity funds<br />

returned to the top spot in <strong>2010</strong>, followed closely by bond funds.<br />

Concerns over sovereign debts in Europe and muted growth<br />

prospects across western economies dampened investors’ appetite<br />

for mature market equities. Demand for cautiously managed funds<br />

was high, benefiting strategic and global bond fund sectors as well<br />

as absolute return and cautious managed sectors. At the other end<br />

of the scale, demand for global growth funds remained high, along<br />

with emerging market equity products, reflecting the better growth<br />

prospects for these nascent economies.<br />

investment performance remains strong. Across the year, investor<br />

appetite for risk returned and the IMA reported that the UK net retail<br />

flows into equities during <strong>2010</strong> totalled £7bn.<br />

This growth underlines the strength of demand for equities, where<br />

we have a significant presence. This can, in turn, fuel further growth.<br />

However, prospective flows are hard to predict, both in absolute terms<br />

and which sectors investors will favour. The key factors affecting<br />

these have been, and are likely to remain, recent returns, relative<br />

growth prospects, inflation, interest rates and disposable income.<br />

In any short-term period, these factors may result in different flow<br />

dynamics than the longer-term trends outlined above.<br />

Although difficult to prove at this stage of the cycle, and given there<br />

is no past history in the UK of such low interest rates, the trend<br />

of using mutual funds as a source of returns over cash deposit<br />

equivalents can only be helpful to the industry, and <strong>Jupiter</strong>, provided<br />

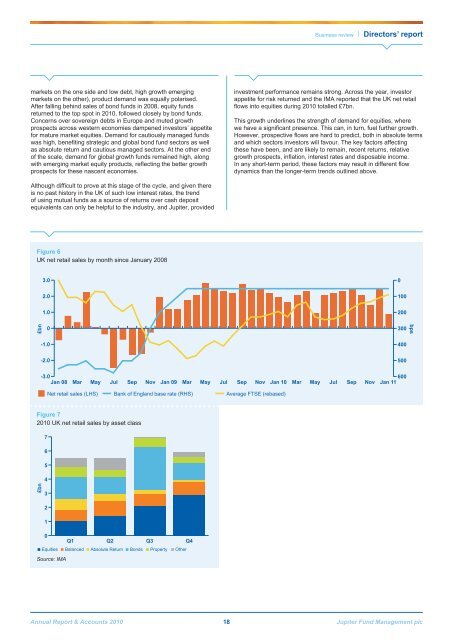

Figure 6<br />

UK net retail sales by month since January 2008<br />

3.0<br />

2.0<br />

1.0<br />

0<br />

100<br />

200<br />

£bn<br />

0<br />

300<br />

bps<br />

-1.0<br />

400<br />

-2.0<br />

500<br />

-3.0<br />

Jan 08<br />

Mar<br />

May<br />

Jul<br />

Sep<br />

Nov<br />

Jan 09<br />

Mar<br />

May<br />

Jul<br />

Sep<br />

Nov<br />

Jan 10<br />

Mar<br />

May<br />

Jul<br />

Sep<br />

Nov<br />

600<br />

Jan 11<br />

Net retail sales (LHS)<br />

Bank of England base rate (RHS)<br />

Average FTSE (rebased)<br />

Figure 7<br />

<strong>2010</strong> UK net retail sales by asset class<br />

7<br />

6<br />

5<br />

4<br />

£bn<br />

3<br />

2<br />

1<br />

0<br />

Q1<br />

Q2<br />

Q3<br />

Q4<br />

Equities Balanced Absolute Return<br />

Bonds<br />

Property<br />

Other<br />

Source: IMA<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 18 <strong>Jupiter</strong> Fund <strong>Management</strong> plc