Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements – continuation | Notes to the financial statements<br />

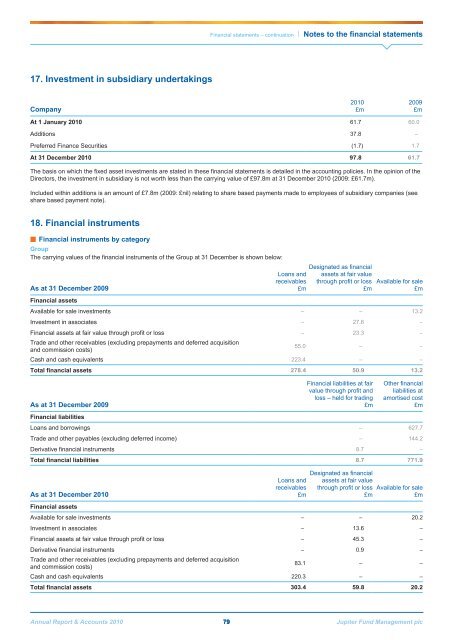

17. Investment in subsidiary undertakings<br />

Company<br />

<strong>2010</strong><br />

£m<br />

2009<br />

£m<br />

At 1 January <strong>2010</strong> 61.7 60.0<br />

Additions 37.8 –<br />

Preferred Finance Securities (1.7) 1.7<br />

At 31 December <strong>2010</strong> 97.8 61.7<br />

The basis on which the fixed asset investments are stated in these financial statements is detailed in the accounting policies. In the opinion of the<br />

Directors, the investment in subsidiary is not worth less than the carrying value of £97.8m at 31 December <strong>2010</strong> (2009: £61.7m).<br />

Included within additions is an amount of £7.8m (2009: £nil) relating to share based payments made to employees of subsidiary companies (see<br />

share based payment note).<br />

18. Financial instruments<br />

■■Financial instruments by category<br />

Group<br />

The carrying values of the financial instruments of the Group at 31 December is shown below:<br />

As at 31 December 2009<br />

Loans and<br />

receivables<br />

£m<br />

Designated as financial<br />

assets at fair value<br />

through profit or loss<br />

£m<br />

Available for sale<br />

£m<br />

Financial assets<br />

Available for sale investments – – 13.2<br />

Investment in associates – 27.6 –<br />

Financial assets at fair value through profit or loss – 23.3 –<br />

Trade and other receivables (excluding prepayments and deferred acquisition<br />

and commission costs)<br />

55.0 – –<br />

Cash and cash equivalents 223.4 – –<br />

Total financial assets 278.4 50.9 13.2<br />

As at 31 December 2009<br />

Financial liabilities at fair<br />

value through profit and<br />

loss – held for trading<br />

£m<br />

Other financial<br />

liabilities at<br />

amortised cost<br />

£m<br />

Financial liabilities<br />

Loans and borrowings – 627.7<br />

Trade and other payables (excluding deferred income) – 144.2<br />

Derivative financial instruments 8.7 –<br />

Total financial liabilities 8.7 771.9<br />

As at 31 December <strong>2010</strong><br />

Loans and<br />

receivables<br />

£m<br />

Designated as financial<br />

assets at fair value<br />

through profit or loss<br />

£m<br />

Available for sale<br />

£m<br />

Financial assets<br />

Available for sale investments – – 20.2<br />

Investment in associates – 13.6 –<br />

Financial assets at fair value through profit or loss – 45.3 –<br />

Derivative financial instruments – 0.9 –<br />

Trade and other receivables (excluding prepayments and deferred acquisition<br />

and commission costs)<br />

83.1 – –<br />

Cash and cash equivalents 220.3 – –<br />

Total financial assets 303.4 59.8 20.2<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 79 <strong>Jupiter</strong> Fund <strong>Management</strong> plc