Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Governance | Directors’ report<br />

The Committee’s policy is that service agreements for executive<br />

Directors should not contain any provision for compensation on early<br />

termination and that the Company and its Directors should instead<br />

each rely on the position under law. In the event that compensation<br />

for early termination is payable, the Committee’s policy is to seek to<br />

keep such compensation to an appropriate level. There are no<br />

specific provisions in the service agreements providing for<br />

compensation payable by the Company on termination without<br />

cause or on change of control.<br />

For Jamie Dundas, Liz Airey, Matteo Dante Perruccio and Lorraine<br />

Trainer, the appointments are for a fixed term of three years from<br />

the respective commencement dates unless renewed or unless<br />

terminated by either party on three months’ written notice.<br />

For Richard I. Morris, Jr. and Michael Wilson, the appointments are for<br />

an indefinite period unless terminated by each of these Directors on<br />

three months’ written notice to the Company at any time, or by the<br />

Company on three months’ written notice to the Director which may be<br />

given at any time if: (1) in respect of Richard I. Morris, Jr., the<br />

percentage of the ordinary shares of the Company in issue from time<br />

to time owned by TA Associates, Inc (together with its Associates) on<br />

an aggregated basis falls below 15 per cent; and (2) in respect of<br />

Michael Wilson, the percentage of the ordinary shares of the Company<br />

in issue from time to time owned by TA Associates, Inc (together with<br />

its Associates) on an aggregated basis falls below 10 per cent.<br />

Directors’ share interests<br />

Prior to 25 May <strong>2010</strong>, the shares in the Company were divided into<br />

four classes: A ordinary shares, B ordinary shares, Tier 1 preference<br />

shares and Tier 2 preference shares, each with a nominal value of £1.<br />

Pursuant to the Listing share capital reorganisation, each A share<br />

and each B share was sub-divided and converted into 50 ordinary<br />

shares of 2p each and each Tier 1 and Tier 2 preference share was<br />

sub-divided and converted into ordinary shares such that the value<br />

was equal to the aggregate entitlement of the Tier 1 and Tier 2<br />

preference shares at the date of Listing. In the interests of simplicity,<br />

all of the shareholdings given in this report are stated on the basis of<br />

the capital structure following the Listing share capital reorganisation<br />

despite the fact that this did not occur until immediately prior to Listing.<br />

The majority of the shares held by the executive Directors are subject<br />

to vesting and lock-in arrangements pursuant to which shares vest<br />

and are released from the lock-in arrangements on the first, second<br />

and third anniversaries of Listing. Shares held by Jamie Dundas and<br />

Matteo Dante Perruccio are subject to lock-in obligations over the<br />

same timescale.<br />

The interests of the Directors and their connected persons in shares<br />

of the Company at 31 December <strong>2010</strong> are set out in Table 2.<br />

Details of the terms of appointment of the non-executive Directors are set out in Table 1.<br />

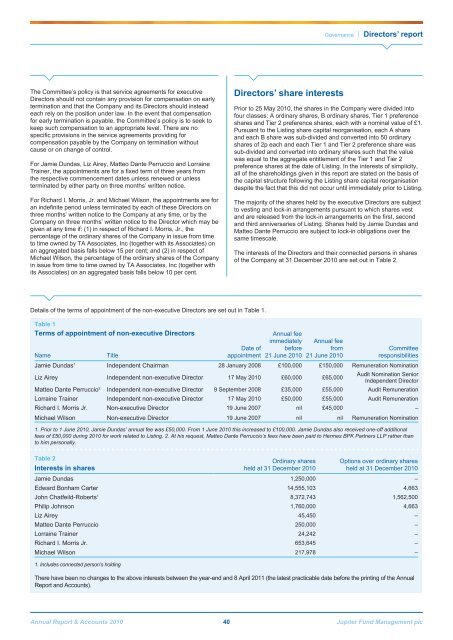

Table 1<br />

Terms of appointment of non-executive Directors<br />

Date of<br />

appointment<br />

<strong>Annual</strong> fee<br />

immediately<br />

before<br />

21 June <strong>2010</strong><br />

<strong>Annual</strong> fee<br />

from<br />

21 June <strong>2010</strong><br />

Committee<br />

responsibilities<br />

Name<br />

Title<br />

Jamie Dundas 1 Independent Chairman 28 January 2008 £100,000 £150,000 Remuneration Nomination<br />

Liz Airey Independent non-executive Director 17 May <strong>2010</strong> £60,000 £65,000<br />

Audit Nomination Senior<br />

Independent Director<br />

Matteo Dante Perruccio 2 Independent non-executive Director 9 September 2008 £35,000 £55,000 Audit Remuneration<br />

Lorraine Trainer Independent non-executive Director 17 May <strong>2010</strong> £50,000 £55,000 Audit Remuneration<br />

Richard I. Morris Jr. Non-executive Director 19 June 2007 nil £45,000 –<br />

Michael Wilson Non-executive Director 19 June 2007 nil nil Remuneration Nomination<br />

1. Prior to 1 June <strong>2010</strong>, Jamie Dundas’ annual fee was £50,000. From 1 June <strong>2010</strong> this increased to £100,000. Jamie Dundas also received one-off additional<br />

fees of £50,000 during <strong>2010</strong> for work related to Listing. 2. At his request, Matteo Dante Perruccio’s fees have been paid to Hermes BPK Partners LLP rather than<br />

to him personally.<br />

Table 2<br />

Interests in shares<br />

Ordinary shares<br />

held at 31 December <strong>2010</strong><br />

Options over ordinary shares<br />

held at 31 December <strong>2010</strong><br />

Jamie Dundas 1,250,000 –<br />

Edward Bonham Carter 14,555,103 4,663<br />

John Chatfeild-Roberts 1 8,372,743 1,562,500<br />

Philip Johnson 1,760,000 4,663<br />

Liz Airey 45,450 –<br />

Matteo Dante Perruccio 250,000 –<br />

Lorraine Trainer 24,242 –<br />

Richard I. Morris Jr. 653,645 –<br />

Michael Wilson 217,978 –<br />

1. Includes connected person’s holding<br />

There have been no changes to the above interests between the year-end and 8 April 2011 (the latest practicable date before the printing of the <strong>Annual</strong><br />

<strong>Report</strong> and Accounts).<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 40 <strong>Jupiter</strong> Fund <strong>Management</strong> plc