Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements – continuation | Notes to the financial statements<br />

18. Financial instruments continued<br />

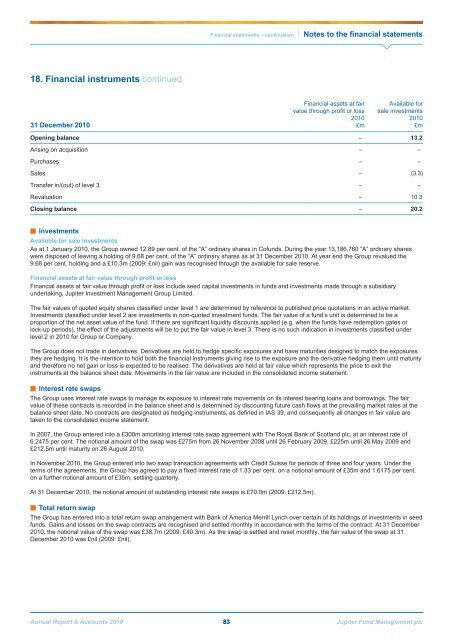

31 December <strong>2010</strong><br />

Financial assets at fair<br />

value through profit or loss<br />

<strong>2010</strong><br />

£m<br />

Available for<br />

sale investments<br />

<strong>2010</strong><br />

£m<br />

Opening balance – 13.2<br />

Arising on acquisition – –<br />

Purchases – –<br />

Sales – (3.3)<br />

Transfer in/(out) of level 3 – –<br />

Revaluation – 10.3<br />

Closing balance – 20.2<br />

■■Investments<br />

Available for sale investments<br />

As at 1 January <strong>2010</strong>, the Group owned 12.89 per cent. of the “A” ordinary shares in Cofunds. During the year 13,186,760 “A” ordinary shares<br />

were disposed of leaving a holding of 9.68 per cent. of the “A” ordinary shares as at 31 December <strong>2010</strong>. At year end the Group revalued the<br />

9.68 per cent. holding and a £10.3m (2009: £nil) gain was recognised through the available for sale reserve.<br />

Financial assets at fair value through profit or loss<br />

Financial assets at fair value through profit or loss include seed capital investments in funds and investments made through a subsidiary<br />

undertaking, <strong>Jupiter</strong> Investment <strong>Management</strong> Group Limited.<br />

The fair values of quoted equity shares classified under level 1 are determined by reference to published price quotations in an active market.<br />

Investments classified under level 2 are investments in non-quoted investment funds. The fair value of a fund’s unit is determined to be a<br />

proportion of the net asset value of the fund. If there are significant liquidity discounts applied (e.g. when the funds have redemption gates or<br />

lock-up periods), the effect of the adjustments will be to put the fair value in level 3. There is no such indication in investments classified under<br />

level 2 in <strong>2010</strong> for Group or Company.<br />

The Group does not trade in derivatives. Derivatives are held to hedge specific exposures and have maturities designed to match the exposures<br />

they are hedging. It is the intention to hold both the financial instruments giving rise to the exposure and the derivative hedging them until maturity<br />

and therefore no net gain or loss is expected to be realised. The derivatives are held at fair value which represents the price to exit the<br />

instruments at the balance sheet date. Movements in the fair value are included in the consolidated income statement.<br />

■■Interest rate swaps<br />

The Group uses interest rate swaps to manage its exposure to interest rate movements on its interest bearing loans and borrowings. The fair<br />

value of these contracts is recorded in the balance sheet and is determined by discounting future cash flows at the prevailing market rates at the<br />

balance sheet date. No contracts are designated as hedging instruments, as defined in IAS 39, and consequently all changes in fair value are<br />

taken to the consolidated income statement.<br />

In 2007, the Group entered into a £300m amortising interest rate swap agreement with The Royal Bank of Scotland plc, at an interest rate of<br />

6.2475 per cent. The notional amount of the swap was £275m from 26 November 2008 until 26 February 2009, £225m until 26 May 2009 and<br />

£212.5m until maturity on 26 August <strong>2010</strong>.<br />

In November <strong>2010</strong>, the Group entered into two swap transaction agreements with Credit Suisse for periods of three and four years. Under the<br />

terms of the agreements, the Group has agreed to pay a fixed interest rate of 1.33 per cent. on a notional amount of £35m and 1.6175 per cent.<br />

on a further notional amount of £35m, settling quarterly.<br />

At 31 December <strong>2010</strong>, the notional amount of outstanding interest rate swaps is £70.0m (2009: £212.5m).<br />

■■Total return swap<br />

The Group has entered into a total return swap arrangement with Bank of America Merrill Lynch over certain of its holdings of investments in seed<br />

funds. Gains and losses on the swap contracts are recognised and settled monthly in accordance with the terms of the contract. At 31 December<br />

<strong>2010</strong>, the notional value of the swap was £38.7m (2009: £40.3m). As the swap is settled and reset monthly, the fair value of the swap at 31<br />

December <strong>2010</strong> was £nil (2009: £nil).<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 83 <strong>Jupiter</strong> Fund <strong>Management</strong> plc