Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements – continuation | Notes to the financial statements<br />

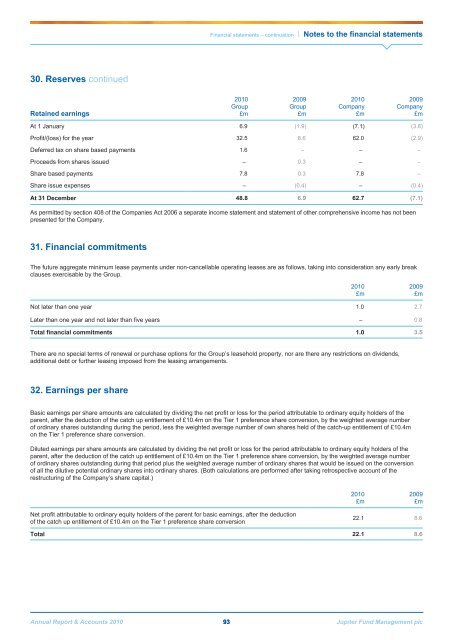

30. Reserves continued<br />

Retained earnings<br />

<strong>2010</strong><br />

Group<br />

£m<br />

2009<br />

Group<br />

£m<br />

<strong>2010</strong><br />

Company<br />

£m<br />

2009<br />

Company<br />

£m<br />

At 1 January 6.9 (1.9) (7.1) (3.8)<br />

Profit/(loss) for the year 32.5 8.6 62.0 (2.9)<br />

Deferred tax on share based payments 1.6 – – –<br />

Proceeds from shares issued – 0.3 – –<br />

Share based payments 7.8 0.3 7.8 –<br />

Share issue expenses – (0.4) – (0.4)<br />

At 31 December 48.8 6.9 62.7 (7.1)<br />

As permitted by section 408 of the Companies Act 2006 a separate income statement and statement of other comprehensive income has not been<br />

presented for the Company.<br />

31. Financial commitments<br />

The future aggregate minimum lease payments under non-cancellable operating leases are as follows, taking into consideration any early break<br />

clauses exercisable by the Group.<br />

<strong>2010</strong><br />

£m<br />

2009<br />

£m<br />

Not later than one year 1.0 2.7<br />

Later than one year and not later than five years – 0.8<br />

Total financial commitments 1.0 3.5<br />

There are no special terms of renewal or purchase options for the Group’s leasehold property, nor are there any restrictions on dividends,<br />

additional debt or further leasing imposed from the leasing arrangements.<br />

32. Earnings per share<br />

Basic earnings per share amounts are calculated by dividing the net profit or loss for the period attributable to ordinary equity holders of the<br />

parent, after the deduction of the catch up entitlement of £10.4m on the Tier 1 preference share conversion, by the weighted average number<br />

of ordinary shares outstanding during the period, less the weighted average number of own shares held of the catch-up entitlement of £10.4m<br />

on the Tier 1 preference share conversion.<br />

Diluted earnings per share amounts are calculated by dividing the net profit or loss for the period attributable to ordinary equity holders of the<br />

parent, after the deduction of the catch up entitlement of £10.4m on the Tier 1 preference share conversion, by the weighted average number<br />

of ordinary shares outstanding during that period plus the weighted average number of ordinary shares that would be issued on the conversion<br />

of all the dilutive potential ordinary shares into ordinary shares. (Both calculations are performed after taking retrospective account of the<br />

restructuring of the Company’s share capital.)<br />

<strong>2010</strong><br />

£m<br />

2009<br />

£m<br />

Net profit attributable to ordinary equity holders of the parent for basic earnings, after the deduction<br />

of the catch up entitlement of £10.4m on the Tier 1 preference share conversion<br />

22.1 8.6<br />

Total 22.1 8.6<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 93 <strong>Jupiter</strong> Fund <strong>Management</strong> plc