Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Jupiter Annual Report 2010 - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements – continuation | Notes to the financial statements<br />

33. Share based payments continued<br />

■■The weighted average fair value per option granted/share award during the year is calculated as follows:<br />

The options granted over B shares were granted at the nominal price of the B shares which gives them the characteristics of nil cost options and<br />

therefore the fair value of these awards is based on the derived market price as at the date of the award.<br />

The fair value recognised in the results for the Sharesave Plan <strong>2010</strong> has been calculated at the date of grant using a Black-Scholes model with<br />

inputs as at that date, making reasonable assumptions over the proportion of options not vesting due to leaver conditions not being satisfied.<br />

The fair value recognised in the results for the Deferred Bonus Plan has been estimated using a Black-Scholes model with inputs as at 31<br />

December <strong>2010</strong>, in advance of the options being granted, making reasonable assumptions over the proportion of options not vesting due to<br />

leaver or performance conditions not being satisfied. This estimate will be revised in the following year’s results following the actual grant date,<br />

and any adjustment required will be applied to that year’s result.<br />

The fair value recognised in the results for the share awards in <strong>2010</strong> has been calculated at the date of grant using a European barrier and<br />

vanilla option model with inputs as at that date, making reasonable assumptions over the proportion of options not vesting due to leaver and/or<br />

performance conditions not being satisfied.<br />

■■The movement in the number of share options outstanding and their relative weighted average exercise<br />

prices are as follows:<br />

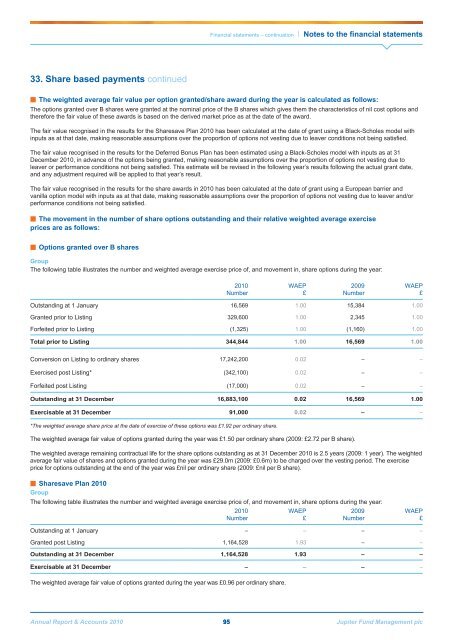

■■Options granted over B shares<br />

Group<br />

The following table illustrates the number and weighted average exercise price of, and movement in, share options during the year:<br />

<strong>2010</strong><br />

Number<br />

WAEP<br />

£<br />

2009<br />

Number<br />

WAEP<br />

£<br />

Outstanding at 1 January 16,569 1.00 15,384 1.00<br />

Granted prior to Listing 329,600 1.00 2,345 1.00<br />

Forfeited prior to Listing (1,325) 1.00 (1,160) 1.00<br />

Total prior to Listing 344,844 1.00 16,569 1.00<br />

Conversion on Listing to ordinary shares 17,242,200 0.02 – –<br />

Exercised post Listing* (342,100) 0.02 – –<br />

Forfeited post Listing (17,000) 0.02 – –<br />

Outstanding at 31 December 16,883,100 0.02 16,569 1.00<br />

Exercisable at 31 December 91,000 0.02 – –<br />

*The weighted average share price at the date of exercise of these options was £1.92 per ordinary share.<br />

The weighted average fair value of options granted during the year was £1.50 per ordinary share (2009: £2.72 per B share).<br />

The weighted average remaining contractual life for the share options outstanding as at 31 December <strong>2010</strong> is 2.5 years (2009: 1 year). The weighted<br />

average fair value of shares and options granted during the year was £29.0m (2009: £0.6m) to be charged over the vesting period. The exercise<br />

price for options outstanding at the end of the year was £nil per ordinary share (2009: £nil per B share).<br />

■■Sharesave Plan <strong>2010</strong><br />

Group<br />

The following table illustrates the number and weighted average exercise price of, and movement in, share options during the year:<br />

<strong>2010</strong><br />

Number<br />

WAEP<br />

£<br />

2009<br />

Number<br />

WAEP<br />

£<br />

Outstanding at 1 January – – – –<br />

Granted post Listing 1,164,528 1.93 – –<br />

Outstanding at 31 December 1,164,528 1.93 – –<br />

Exercisable at 31 December – – – –<br />

The weighted average fair value of options granted during the year was £0.96 per ordinary share.<br />

<strong>Annual</strong> <strong>Report</strong> & Accounts <strong>2010</strong> 95 <strong>Jupiter</strong> Fund <strong>Management</strong> plc