Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

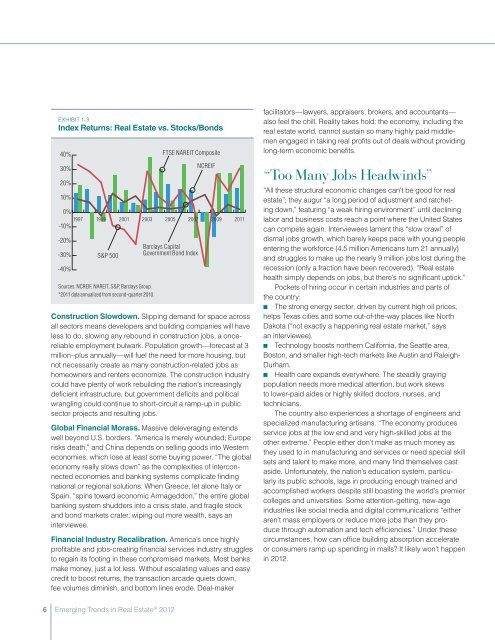

Exhibit 1-3<br />

Index Returns: <strong>Real</strong> <strong>Estate</strong> vs. Stocks/Bonds<br />

40% FTSE NAREIT Composite<br />

30%<br />

20%<br />

10%<br />

0%<br />

1997<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

1999<br />

S&P 500<br />

2001<br />

2003<br />

Sources: NCREIF, NAREIT, S&P, Barclays Group.<br />

*2011 data annualized from second-quarter 2010.<br />

Barclays Capital<br />

Government Bond Index<br />

NCREIF<br />

Construction Slowdown. Slipp<strong>in</strong>g demand for space across<br />

all sectors means developers and build<strong>in</strong>g companies will have<br />

less to do, slow<strong>in</strong>g any rebound <strong>in</strong> construction jobs, a oncereliable<br />

employment bulwark. Population growth—forecast at 3<br />

million–plus annually—will fuel the need for more hous<strong>in</strong>g, but<br />

not necessarily create as many construction-related jobs as<br />

homeowners and renters economize. The construction <strong>in</strong>dustry<br />

could have plenty of work rebuild<strong>in</strong>g the nation’s <strong>in</strong>creas<strong>in</strong>gly<br />

deficient <strong>in</strong>frastructure, but government deficits and political<br />

wrangl<strong>in</strong>g could cont<strong>in</strong>ue to short-circuit a ramp-up <strong>in</strong> public<br />

sector projects and result<strong>in</strong>g jobs.<br />

Global F<strong>in</strong>ancial Morass. Massive deleverag<strong>in</strong>g extends<br />

well beyond U.S. borders. “America is merely wounded; Europe<br />

risks death,” and Ch<strong>in</strong>a depends on sell<strong>in</strong>g goods <strong>in</strong>to Western<br />

economies, which lose at least some buy<strong>in</strong>g power. “The global<br />

economy really slows down” as the complexities of <strong>in</strong>terconnected<br />

economies and bank<strong>in</strong>g systems complicate f<strong>in</strong>d<strong>in</strong>g<br />

national or regional solutions. When Greece, let alone Italy or<br />

Spa<strong>in</strong>, “sp<strong>in</strong>s toward economic Armageddon,” the entire global<br />

bank<strong>in</strong>g system shudders <strong>in</strong>to a crisis state, and fragile stock<br />

and bond markets crater, wip<strong>in</strong>g out more wealth, says an<br />

<strong>in</strong>terviewee.<br />

F<strong>in</strong>ancial Industry Recalibration. America’s once highly<br />

profitable and jobs-creat<strong>in</strong>g f<strong>in</strong>ancial services <strong>in</strong>dustry struggles<br />

to rega<strong>in</strong> its foot<strong>in</strong>g <strong>in</strong> these compromised markets. Most banks<br />

make money, just a lot less. Without escalat<strong>in</strong>g values and easy<br />

credit to boost returns, the transaction arcade quiets down,<br />

fee volumes dim<strong>in</strong>ish, and bottom l<strong>in</strong>es erode. Deal-maker<br />

2005<br />

2007<br />

2009<br />

2011<br />

facilitators—lawyers, appraisers, brokers, and accountants—<br />

also feel the chill. <strong>Real</strong>ity takes hold: the economy, <strong>in</strong>clud<strong>in</strong>g the<br />

real estate world, cannot susta<strong>in</strong> so many highly paid middlemen<br />

engaged <strong>in</strong> tak<strong>in</strong>g real profits out of deals without provid<strong>in</strong>g<br />

long-term economic benefits.<br />

“Too Many Jobs Headw<strong>in</strong>ds”<br />

“All these structural economic changes can’t be good for real<br />

estate”; they augur “a long period of adjustment and ratchet<strong>in</strong>g<br />

down,” featur<strong>in</strong>g “a weak hir<strong>in</strong>g environment” until decl<strong>in</strong><strong>in</strong>g<br />

labor and bus<strong>in</strong>ess costs reach a po<strong>in</strong>t where the United States<br />

can compete aga<strong>in</strong>. Interviewees lament this “slow crawl” of<br />

dismal jobs growth, which barely keeps pace with young people<br />

enter<strong>in</strong>g the workforce (4.5 million Americans turn 21 annually)<br />

and struggles to make up the nearly 9 million jobs lost dur<strong>in</strong>g the<br />

recession (only a fraction have been recovered). “<strong>Real</strong> estate<br />

health simply depends on jobs, but there’s no significant uptick.”<br />

Pockets of hir<strong>in</strong>g occur <strong>in</strong> certa<strong>in</strong> <strong>in</strong>dustries and parts of<br />

the country:<br />

■■ The strong energy sector, driven by current high oil prices,<br />

helps Texas cities and some out-of-the-way places like North<br />

Dakota (“not exactly a happen<strong>in</strong>g real estate market,” says<br />

an <strong>in</strong>terviewee).<br />

■■ Technology boosts northern California, the Seattle area,<br />

Boston, and smaller high-tech markets like Aust<strong>in</strong> and Raleigh-<br />

Durham.<br />

■■ Health care expands everywhere. The steadily gray<strong>in</strong>g<br />

population needs more medical attention, but work skews<br />

to lower-paid aides or highly skilled doctors, nurses, and<br />

technicians.<br />

The country also experiences a shortage of eng<strong>in</strong>eers and<br />

specialized manufactur<strong>in</strong>g artisans. “The economy produces<br />

service jobs at the low end and very high-skilled jobs at the<br />

other extreme.” People either don’t make as much money as<br />

they used to <strong>in</strong> manufactur<strong>in</strong>g and services or need special skill<br />

sets and talent to make more, and many f<strong>in</strong>d themselves cast<br />

aside. Unfortunately, the nation’s education system, particularly<br />

its public schools, lags <strong>in</strong> produc<strong>in</strong>g enough tra<strong>in</strong>ed and<br />

accomplished workers despite still boast<strong>in</strong>g the world’s premier<br />

colleges and universities. Some attention-gett<strong>in</strong>g, new-age<br />

<strong>in</strong>dustries like social media and digital communications “either<br />

aren’t mass employers or reduce more jobs than they produce<br />

through automation and tech efficiencies.” Under these<br />

circumstances, how can office build<strong>in</strong>g absorption accelerate<br />

or consumers ramp up spend<strong>in</strong>g <strong>in</strong> malls It likely won’t happen<br />

<strong>in</strong> <strong>2012</strong>.<br />

6 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong>