Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 2: Capital Flows<br />

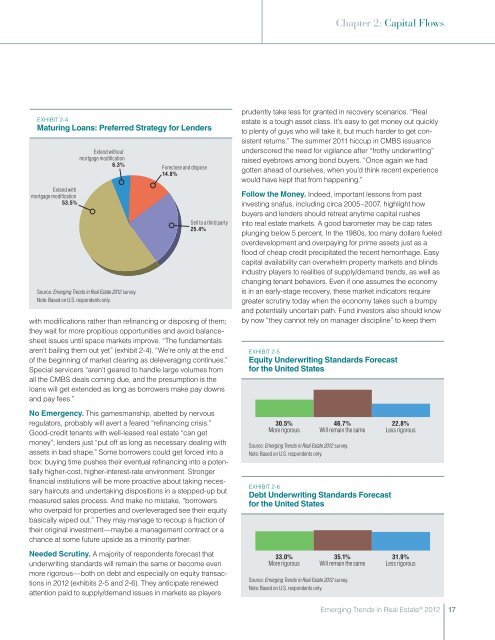

Exhibit 2-4<br />

Matur<strong>in</strong>g Loans: Preferred Strategy for Lenders<br />

Extend with<br />

mortgage modification<br />

53.5%<br />

Extend without<br />

mortgage modification<br />

6.3%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on U.S. respondents only.<br />

Foreclose and dispose<br />

14.8%<br />

Sell to a third party<br />

25.4%<br />

with modifications rather than ref<strong>in</strong>anc<strong>in</strong>g or dispos<strong>in</strong>g of them;<br />

they wait for more propitious opportunities and avoid balancesheet<br />

issues until space markets improve. “The fundamentals<br />

aren’t bail<strong>in</strong>g them out yet” (exhibit 2-4). “We’re only at the end<br />

of the beg<strong>in</strong>n<strong>in</strong>g of market clear<strong>in</strong>g as deleverag<strong>in</strong>g cont<strong>in</strong>ues.”<br />

Special servicers “aren’t geared to handle large volumes from<br />

all the CMBS deals com<strong>in</strong>g due, and the presumption is the<br />

loans will get extended as long as borrowers make pay downs<br />

and pay fees.”<br />

No Emergency. This gamesmanship, abetted by nervous<br />

regulators, probably will avert a feared “ref<strong>in</strong>anc<strong>in</strong>g crisis.”<br />

Good-credit tenants with well-leased real estate “can get<br />

money”; lenders just “put off as long as necessary deal<strong>in</strong>g with<br />

assets <strong>in</strong> bad shape.” Some borrowers could get forced <strong>in</strong>to a<br />

box: buy<strong>in</strong>g time pushes their eventual ref<strong>in</strong>anc<strong>in</strong>g <strong>in</strong>to a potentially<br />

higher-cost, higher-<strong>in</strong>terest-rate environment. Stronger<br />

f<strong>in</strong>ancial <strong>in</strong>stitutions will be more proactive about tak<strong>in</strong>g necessary<br />

haircuts and undertak<strong>in</strong>g dispositions <strong>in</strong> a stepped-up but<br />

measured sales process. And make no mistake, “borrowers<br />

who overpaid for properties and overleveraged see their equity<br />

basically wiped out.” They may manage to recoup a fraction of<br />

their orig<strong>in</strong>al <strong>in</strong>vestment—maybe a management contract or a<br />

chance at some future upside as a m<strong>in</strong>ority partner.<br />

Needed Scrut<strong>in</strong>y. A majority of respondents forecast that<br />

underwrit<strong>in</strong>g standards will rema<strong>in</strong> the same or become even<br />

more rigorous—both on debt and especially on equity transactions<br />

<strong>in</strong> <strong>2012</strong> (exhibits 2-5 and 2-6). They anticipate renewed<br />

attention paid to supply/demand issues <strong>in</strong> markets as players<br />

prudently take less for granted <strong>in</strong> recovery scenarios. “<strong>Real</strong><br />

estate is a tough asset class. It’s easy to get money out quickly<br />

to plenty of guys who will take it, but much harder to get consistent<br />

returns.” The summer 2011 hiccup <strong>in</strong> CMBS issuance<br />

underscored the need for vigilance after “frothy underwrit<strong>in</strong>g”<br />

raised eyebrows among bond buyers. “Once aga<strong>in</strong> we had<br />

gotten ahead of ourselves, when you’d th<strong>in</strong>k recent experience<br />

would have kept that from happen<strong>in</strong>g.”<br />

Follow the Money. Indeed, important lessons from past<br />

<strong>in</strong>vest<strong>in</strong>g snafus, <strong>in</strong>clud<strong>in</strong>g circa 2005–2007, highlight how<br />

buyers and lenders should retreat anytime capital rushes<br />

<strong>in</strong>to real estate markets. A good barometer may be cap rates<br />

plung<strong>in</strong>g below 5 percent. In the 1980s, too many dollars fueled<br />

overdevelopment and overpay<strong>in</strong>g for prime assets just as a<br />

flood of cheap credit precipitated the recent hemorrhage. Easy<br />

capital availability can overwhelm property markets and bl<strong>in</strong>ds<br />

<strong>in</strong>dustry players to realities of supply/demand trends, as well as<br />

chang<strong>in</strong>g tenant behaviors. Even if one assumes the economy<br />

is <strong>in</strong> an early-stage recovery, these market <strong>in</strong>dicators require<br />

greater scrut<strong>in</strong>y today when the economy takes such a bumpy<br />

and potentially uncerta<strong>in</strong> path. Fund <strong>in</strong>vestors also should know<br />

by now “they cannot rely on manager discipl<strong>in</strong>e” to keep them<br />

Exhibit 2-5<br />

Equity Underwrit<strong>in</strong>g Standards Forecast<br />

for the United States<br />

+30+47+23<br />

30.5%<br />

46.7%<br />

22.8%<br />

More rigorous Will rema<strong>in</strong> the same Less rigorous<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on U.S. respondents only.<br />

Exhibit 2-6<br />

Debt Underwrit<strong>in</strong>g Standards Forecast<br />

for the United States<br />

+33+35+32<br />

33.0%<br />

35.1%<br />

31.9%<br />

More rigorous Will rema<strong>in</strong> the same Less rigorous<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on U.S. respondents only.<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong><br />

17