Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 4: Property Types <strong>in</strong> Perspective<br />

and recent stock market losses leave many ag<strong>in</strong>g Americans,<br />

and particularly baby boomers, <strong>in</strong> problematic f<strong>in</strong>ancial straits.<br />

Larger percentages may not be able to afford seniors’ hous<strong>in</strong>g<br />

product, liv<strong>in</strong>g <strong>in</strong>stead with children and grandchildren to pool<br />

resources, or stay<strong>in</strong>g <strong>in</strong> exist<strong>in</strong>g homes as long as possible.<br />

Student hous<strong>in</strong>g still has legs. The bulg<strong>in</strong>g generation-Y tail has<br />

about six or seven years to run, “but after that, the pig will have<br />

moved.” Investors need to monitor impacts of reduced student<br />

aid on admission trends.<br />

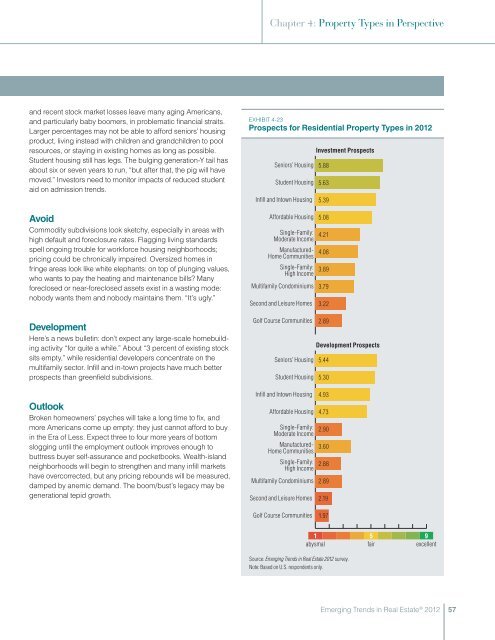

Exhibit 4-23<br />

Prospects for Residential Property Types <strong>in</strong> <strong>2012</strong><br />

Seniors’ Hous<strong>in</strong>g 5.88<br />

Student Hous<strong>in</strong>g<br />

Infill and Intown Hous<strong>in</strong>g<br />

Investment Prospects<br />

5.63<br />

5.39<br />

Avoid<br />

Commodity subdivisions look sketchy, especially <strong>in</strong> areas with<br />

high default and foreclosure rates. Flagg<strong>in</strong>g liv<strong>in</strong>g standards<br />

spell ongo<strong>in</strong>g trouble for workforce hous<strong>in</strong>g neighborhoods;<br />

pric<strong>in</strong>g could be chronically impaired. Oversized homes <strong>in</strong><br />

fr<strong>in</strong>ge areas look like white elephants: on top of plung<strong>in</strong>g values,<br />

who wants to pay the heat<strong>in</strong>g and ma<strong>in</strong>tenance bills Many<br />

foreclosed or near-foreclosed assets exist <strong>in</strong> a wast<strong>in</strong>g mode:<br />

nobody wants them and nobody ma<strong>in</strong>ta<strong>in</strong>s them. “It’s ugly.”<br />

Affordable Hous<strong>in</strong>g<br />

S<strong>in</strong>gle-Family:<br />

Moderate Income<br />

Manufactured-<br />

Home Communities<br />

S<strong>in</strong>gle-Family:<br />

High Income<br />

Multifamily Condom<strong>in</strong>iums<br />

Second and Leisure Homes<br />

5.08<br />

4.21<br />

4.08<br />

3.89<br />

3.79<br />

3.22<br />

Development<br />

Here’s a news bullet<strong>in</strong>: don’t expect any large-scale homebuild<strong>in</strong>g<br />

activity “for quite a while.” About “3 percent of exist<strong>in</strong>g stock<br />

sits empty,” while residential developers concentrate on the<br />

multifamily sector. Infill and <strong>in</strong>-town projects have much better<br />

prospects than greenfield subdivisions.<br />

Golf Course Communities 2.89<br />

Development Prospects<br />

Seniors’ Hous<strong>in</strong>g 5.44<br />

Student Hous<strong>in</strong>g 5.30<br />

Outlook<br />

Broken homeowners’ psyches will take a long time to fix, and<br />

more Americans come up empty: they just cannot afford to buy<br />

<strong>in</strong> the Era of Less. Expect three to four more years of bottom<br />

slogg<strong>in</strong>g until the employment outlook improves enough to<br />

buttress buyer self-assurance and pocketbooks. Wealth-island<br />

neighborhoods will beg<strong>in</strong> to strengthen and many <strong>in</strong>fill markets<br />

have overcorrected, but any pric<strong>in</strong>g rebounds will be measured,<br />

damped by anemic demand. The boom/bust’s legacy may be<br />

generational tepid growth.<br />

Infill and Intown Hous<strong>in</strong>g<br />

Affordable Hous<strong>in</strong>g<br />

S<strong>in</strong>gle-Family:<br />

Moderate Income<br />

Manufactured-<br />

Home Communities<br />

S<strong>in</strong>gle-Family:<br />

High Income<br />

Multifamily Condom<strong>in</strong>iums<br />

Second and Leisure Homes<br />

Golf Course Communities<br />

4.93<br />

4.73<br />

2.90<br />

3.60<br />

2.88<br />

2.89<br />

2.19<br />

1.97<br />

1<br />

abysmal<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on U.S. respondents only.<br />

5<br />

fair<br />

9<br />

excellent<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong><br />

57