Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

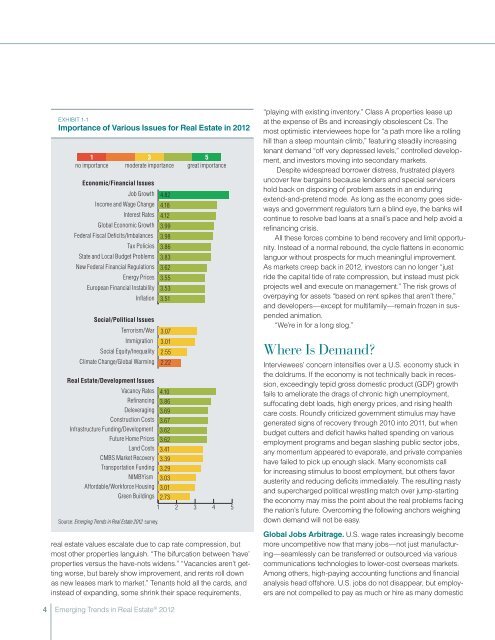

Exhibit 1-1<br />

Importance of Various Issues for <strong>Real</strong> <strong>Estate</strong> <strong>in</strong> <strong>2012</strong><br />

1<br />

no importance<br />

3<br />

moderate importance<br />

Economic/F<strong>in</strong>ancial Issues<br />

Job Growth<br />

Income and Wage Change<br />

Interest Rates<br />

Global Economic Growth<br />

Federal Fiscal Deficits/Imbalances<br />

Tax Policies<br />

State and Local Budget Problems<br />

New Federal F<strong>in</strong>ancial Regulations<br />

Energy Prices<br />

European F<strong>in</strong>ancial Instability<br />

Inflation<br />

Social/Political Issues<br />

Terrorism/War<br />

Immigration<br />

Social Equity/Inequality<br />

Climate Change/Global Warm<strong>in</strong>g<br />

<strong>Real</strong> <strong>Estate</strong>/Development Issues<br />

Vacancy Rates<br />

Ref<strong>in</strong>anc<strong>in</strong>g<br />

Deleverag<strong>in</strong>g<br />

Construction Costs<br />

Infrastructure Fund<strong>in</strong>g/Development<br />

Future Home Prices<br />

<strong>Land</strong> Costs<br />

CMBS Market Recovery<br />

Transportation Fund<strong>in</strong>g<br />

NIMBYism<br />

Affordable/Workforce Hous<strong>in</strong>g<br />

Green Build<strong>in</strong>gs<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

4.82<br />

4.18<br />

4.12<br />

3.99<br />

3.98<br />

3.86<br />

3.83<br />

3.62<br />

3.55<br />

3.53<br />

3.51<br />

3.07<br />

3.01<br />

2.55<br />

2.22<br />

4.10<br />

3.86<br />

3.69<br />

3.67<br />

3.62<br />

3.62<br />

3.41<br />

3.39<br />

3.29<br />

3.03<br />

3.01<br />

2.73<br />

5<br />

great importance<br />

1 2 3 4 5<br />

real estate values escalate due to cap rate compression, but<br />

most other properties languish. “The bifurcation between ‘have’<br />

properties versus the have-nots widens.” “Vacancies aren’t gett<strong>in</strong>g<br />

worse, but barely show improvement, and rents roll down<br />

as new leases mark to market.” Tenants hold all the cards, and<br />

<strong>in</strong>stead of expand<strong>in</strong>g, some shr<strong>in</strong>k their space requirements,<br />

“play<strong>in</strong>g with exist<strong>in</strong>g <strong>in</strong>ventory.” Class A properties lease up<br />

at the expense of Bs and <strong>in</strong>creas<strong>in</strong>gly obsolescent Cs. The<br />

most optimistic <strong>in</strong>terviewees hope for “a path more like a roll<strong>in</strong>g<br />

hill than a steep mounta<strong>in</strong> climb,” featur<strong>in</strong>g steadily <strong>in</strong>creas<strong>in</strong>g<br />

tenant demand “off very depressed levels,” controlled development,<br />

and <strong>in</strong>vestors mov<strong>in</strong>g <strong>in</strong>to secondary markets.<br />

Despite widespread borrower distress, frustrated players<br />

uncover few barga<strong>in</strong>s because lenders and special servicers<br />

hold back on dispos<strong>in</strong>g of problem assets <strong>in</strong> an endur<strong>in</strong>g<br />

extend-and-pretend mode. As long as the economy goes sideways<br />

and government regulators turn a bl<strong>in</strong>d eye, the banks will<br />

cont<strong>in</strong>ue to resolve bad loans at a snail’s pace and help avoid a<br />

ref<strong>in</strong>anc<strong>in</strong>g crisis.<br />

All these forces comb<strong>in</strong>e to bend recovery and limit opportunity.<br />

Instead of a normal rebound, the cycle flattens <strong>in</strong> economic<br />

languor without prospects for much mean<strong>in</strong>gful improvement.<br />

As markets creep back <strong>in</strong> <strong>2012</strong>, <strong>in</strong>vestors can no longer “just<br />

ride the capital tide of rate compression, but <strong>in</strong>stead must pick<br />

projects well and execute on management.” The risk grows of<br />

overpay<strong>in</strong>g for assets “based on rent spikes that aren’t there,”<br />

and developers—except for multifamily—rema<strong>in</strong> frozen <strong>in</strong> suspended<br />

animation.<br />

“We’re <strong>in</strong> for a long slog.”<br />

Where Is Demand<br />

Interviewees’ concern <strong>in</strong>tensifies over a U.S. economy stuck <strong>in</strong><br />

the doldrums. If the economy is not technically back <strong>in</strong> recession,<br />

exceed<strong>in</strong>gly tepid gross domestic product (GDP) growth<br />

fails to ameliorate the drags of chronic high unemployment,<br />

suffocat<strong>in</strong>g debt loads, high energy prices, and ris<strong>in</strong>g health<br />

care costs. Roundly criticized government stimulus may have<br />

generated signs of recovery through 2010 <strong>in</strong>to 2011, but when<br />

budget cutters and deficit hawks halted spend<strong>in</strong>g on various<br />

employment programs and began slash<strong>in</strong>g public sector jobs,<br />

any momentum appeared to evaporate, and private companies<br />

have failed to pick up enough slack. Many economists call<br />

for <strong>in</strong>creas<strong>in</strong>g stimulus to boost employment, but others favor<br />

austerity and reduc<strong>in</strong>g deficits immediately. The result<strong>in</strong>g nasty<br />

and supercharged political wrestl<strong>in</strong>g match over jump-start<strong>in</strong>g<br />

the economy may miss the po<strong>in</strong>t about the real problems fac<strong>in</strong>g<br />

the nation’s future. Overcom<strong>in</strong>g the follow<strong>in</strong>g anchors weigh<strong>in</strong>g<br />

down demand will not be easy.<br />

Global Jobs Arbitrage. U.S. wage rates <strong>in</strong>creas<strong>in</strong>gly become<br />

more uncompetitive now that many jobs—not just manufactur<strong>in</strong>g—seamlessly<br />

can be transferred or outsourced via various<br />

communications technologies to lower-cost overseas markets.<br />

Among others, high-pay<strong>in</strong>g account<strong>in</strong>g functions and f<strong>in</strong>ancial<br />

analysis head offshore. U.S. jobs do not disappear, but employers<br />

are not compelled to pay as much or hire as many domestic<br />

4 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong>