Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 4: Property Types <strong>in</strong> Perspective<br />

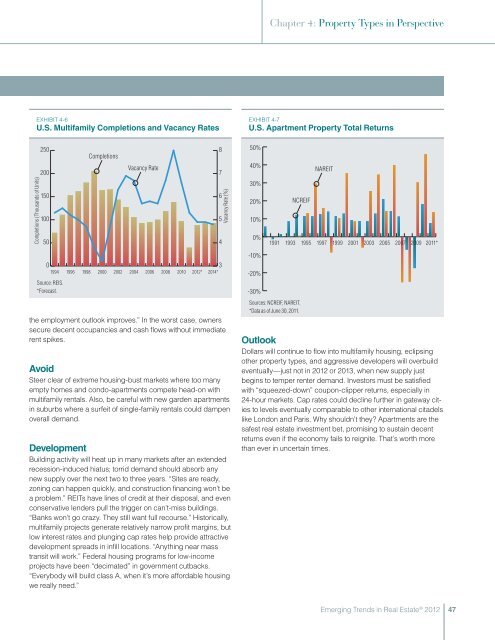

Exhibit 4-6<br />

U.S. Multifamily Completions and Vacancy Rates<br />

Exhibit 4-7<br />

U.S. Apartment Property Total Returns<br />

250<br />

200<br />

Completions<br />

Vacancy Rate<br />

8<br />

7<br />

50%<br />

40%<br />

NAREIT<br />

Completions (Thousands of Units)<br />

150<br />

100<br />

50<br />

6<br />

5<br />

4<br />

Vacancy Rate (%)<br />

30%<br />

20%<br />

10%<br />

0%<br />

1991<br />

1993<br />

NCREIF<br />

1995<br />

1997<br />

1999<br />

2001<br />

2003<br />

2005<br />

2007<br />

2009<br />

2011*<br />

0<br />

1994<br />

Source: REIS.<br />

*Forecast.<br />

1996<br />

1998<br />

2000<br />

2002<br />

3<br />

2014*<br />

the employment outlook improves.” In the worst case, owners<br />

secure decent occupancies and cash flows without immediate<br />

rent spikes.<br />

2004<br />

Avoid<br />

Steer clear of extreme hous<strong>in</strong>g-bust markets where too many<br />

empty homes and condo-apartments compete head-on with<br />

multifamily rentals. Also, be careful with new garden apartments<br />

<strong>in</strong> suburbs where a surfeit of s<strong>in</strong>gle-family rentals could dampen<br />

overall demand.<br />

Development<br />

Build<strong>in</strong>g activity will heat up <strong>in</strong> many markets after an extended<br />

recession-<strong>in</strong>duced hiatus; torrid demand should absorb any<br />

new supply over the next two to three years. “Sites are ready,<br />

zon<strong>in</strong>g can happen quickly, and construction f<strong>in</strong>anc<strong>in</strong>g won’t be<br />

a problem.” REITs have l<strong>in</strong>es of credit at their disposal, and even<br />

conservative lenders pull the trigger on can’t-miss build<strong>in</strong>gs.<br />

“Banks won’t go crazy. They still want full recourse.” Historically,<br />

multifamily projects generate relatively narrow profit marg<strong>in</strong>s, but<br />

low <strong>in</strong>terest rates and plung<strong>in</strong>g cap rates help provide attractive<br />

development spreads <strong>in</strong> <strong>in</strong>fill locations. “Anyth<strong>in</strong>g near mass<br />

transit will work.” Federal hous<strong>in</strong>g programs for low-<strong>in</strong>come<br />

projects have been “decimated” <strong>in</strong> government cutbacks.<br />

“Everybody will build class A, when it’s more affordable hous<strong>in</strong>g<br />

we really need.”<br />

2006<br />

2008<br />

2010<br />

<strong>2012</strong>*<br />

-10%<br />

-20%<br />

-30%<br />

Sources: NCREIF, NAREIT.<br />

*Data as of June 30, 2011.<br />

Outlook<br />

Dollars will cont<strong>in</strong>ue to flow <strong>in</strong>to multifamily hous<strong>in</strong>g, eclips<strong>in</strong>g<br />

other property types, and aggressive developers will overbuild<br />

eventually—just not <strong>in</strong> <strong>2012</strong> or 2013, when new supply just<br />

beg<strong>in</strong>s to temper renter demand. Investors must be satisfied<br />

with “squeezed-down” coupon-clipper returns, especially <strong>in</strong><br />

24-hour markets. Cap rates could decl<strong>in</strong>e further <strong>in</strong> gateway cities<br />

to levels eventually comparable to other <strong>in</strong>ternational citadels<br />

like London and Paris. Why shouldn’t they Apartments are the<br />

safest real estate <strong>in</strong>vestment bet, promis<strong>in</strong>g to susta<strong>in</strong> decent<br />

returns even if the economy fails to reignite. That’s worth more<br />

than ever <strong>in</strong> uncerta<strong>in</strong> times.<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong><br />

47