Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Chapter 4: Property Types <strong>in</strong> Perspective<br />

driv<strong>in</strong>g traffic and sales. The mass distribution centers would<br />

provide greater convenience for shoppers who order onl<strong>in</strong>e.<br />

“They can pick items up for more <strong>in</strong>stant gratification or return<br />

them easily without the hassle of wait<strong>in</strong>g <strong>in</strong> l<strong>in</strong>es.” Many tired<br />

malls sell<strong>in</strong>g commodity merchandise should be adapted to<br />

serve as multifaceted town centers with education, community,<br />

or medical facilities, tak<strong>in</strong>g advantage of their often pivotal community<br />

locations.<br />

For <strong>2012</strong>, the fortress centers and well-situated groceryanchored<br />

retail—“like buy<strong>in</strong>g a bond”—will do well. “Neighbor hood<br />

center buyers must be extremely selective about locations,<br />

target<strong>in</strong>g assets with the top local supermarket cha<strong>in</strong>s and highest<br />

sales-per-square-foot numbers.” Major opportunities exist <strong>in</strong><br />

burgeon<strong>in</strong>g underserved or unserved Hispanic markets, especially<br />

<strong>in</strong> the Southwest and on the West Coast. “Population and<br />

<strong>in</strong>come <strong>in</strong> these communities grow ahead of national trends. The<br />

opportunity exists to stake out centers <strong>in</strong> neighborhoods, which<br />

can evolve with their demographics.”<br />

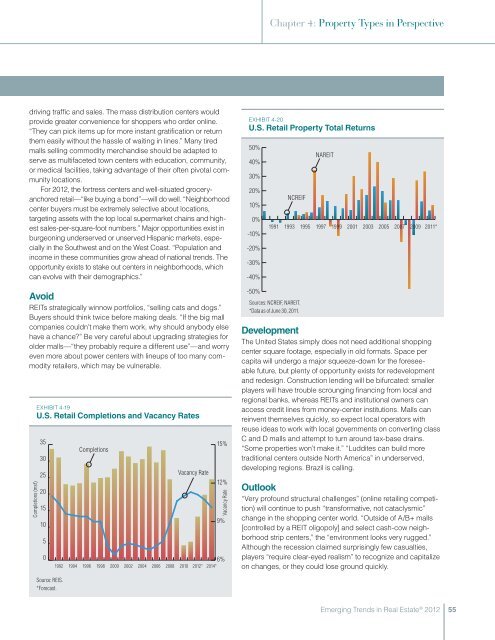

Exhibit 4-20<br />

U.S. Retail Property Total Returns<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

1991<br />

NCREIF<br />

1993<br />

1995<br />

NAREIT<br />

1997<br />

1999<br />

2001<br />

2003<br />

2005<br />

2007<br />

2009<br />

2011*<br />

Avoid<br />

REITs strategically w<strong>in</strong>now portfolios, “sell<strong>in</strong>g cats and dogs.”<br />

Buyers should th<strong>in</strong>k twice before mak<strong>in</strong>g deals. “If the big mall<br />

companies couldn’t make them work, why should anybody else<br />

have a chance” Be very careful about upgrad<strong>in</strong>g strategies for<br />

older malls—“they probably require a different use”—and worry<br />

even more about power centers with l<strong>in</strong>eups of too many commodity<br />

retailers, which may be vulnerable.<br />

Completions (msf)<br />

Exhibit 4-19<br />

U.S. Retail Completions and Vacancy Rates<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

1992<br />

1994<br />

Completions<br />

1996<br />

1998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

Vacancy Rate<br />

15%<br />

12%<br />

Vacancy Rate<br />

9%<br />

6%<br />

2010 <strong>2012</strong>* 2014*<br />

-50%<br />

Sources: NCREIF, NAREIT.<br />

*Data as of June 30, 2011.<br />

Development<br />

The United States simply does not need additional shopp<strong>in</strong>g<br />

center square footage, especially <strong>in</strong> old formats. Space per<br />

capita will undergo a major squeeze-down for the foreseeable<br />

future, but plenty of opportunity exists for redevelopment<br />

and redesign. Construction lend<strong>in</strong>g will be bifurcated: smaller<br />

players will have trouble scroung<strong>in</strong>g f<strong>in</strong>anc<strong>in</strong>g from local and<br />

regional banks, whereas REITs and <strong>in</strong>stitutional owners can<br />

access credit l<strong>in</strong>es from money-center <strong>in</strong>stitutions. Malls can<br />

re<strong>in</strong>vent themselves quickly, so expect local operators with<br />

reuse ideas to work with local governments on convert<strong>in</strong>g class<br />

C and D malls and attempt to turn around tax-base dra<strong>in</strong>s.<br />

“Some properties won’t make it.” “Luddites can build more<br />

traditional centers outside North America” <strong>in</strong> underserved,<br />

develop<strong>in</strong>g regions. Brazil is call<strong>in</strong>g.<br />

Outlook<br />

“Very profound structural challenges” (onl<strong>in</strong>e retail<strong>in</strong>g competition)<br />

will cont<strong>in</strong>ue to push “transformative, not cataclysmic”<br />

change <strong>in</strong> the shopp<strong>in</strong>g center world. “Outside of A/B+ malls<br />

[controlled by a REIT oligopoly] and select cash-cow neighborhood<br />

strip centers,” the “environment looks very rugged.”<br />

Although the recession claimed surpris<strong>in</strong>gly few casualties,<br />

players “require clear-eyed realism” to recognize and capitalize<br />

on changes, or they could lose ground quickly.<br />

Source: REIS.<br />

*Forecast.<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong><br />

55