Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Hotels<br />

Strengths<br />

Occupancies recover to more normalized levels near ten-year<br />

averages for most lodg<strong>in</strong>g segments. “Demand is def<strong>in</strong>itely<br />

back.” Increased corporate travel—“the return of the weekday<br />

bus<strong>in</strong>ess warrior has had the most impact”—comb<strong>in</strong>ed with a<br />

weak dollar draw<strong>in</strong>g offshore tourists, helps boost revenues <strong>in</strong><br />

major gateway markets. New York City, Boston, San Francisco,<br />

Chicago, and Miami all do well. Overall, leisure travel holds fairly<br />

steady, but tourists stay price-conscious. Midscale segments<br />

without food and beverage show the best bottom-l<strong>in</strong>e results,<br />

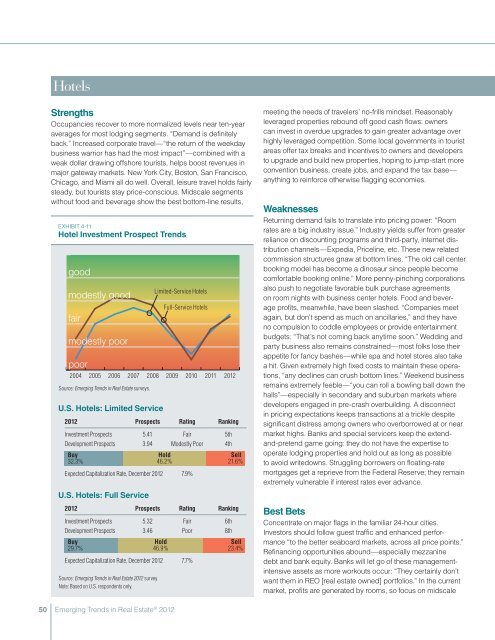

ExHIBIT 4-11<br />

Hotel Investment Prospect <strong>Trends</strong><br />

good<br />

modestly good<br />

fair<br />

modestly poor<br />

poor<br />

2004<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> surveys.<br />

<strong>2012</strong> Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Investment Prospects 5.41 Fair 5th<br />

Development Prospects 3.94 Modestly Poor 4th<br />

Buy<br />

32.3%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on U.S. respondents only.<br />

Hold<br />

46.2%<br />

Expected Capitalization Rate, December <strong>2012</strong> 7.9%<br />

Sell<br />

21.6%<br />

<strong>2012</strong> Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Investment Prospects 5.32 Fair 6th<br />

Development Prospects 3.46 Poor 8th<br />

Buy<br />

29.7%<br />

2005<br />

2006<br />

2007<br />

U.S. Hotels: Limited Service<br />

U.S. Hotels: Full Service<br />

2008<br />

Limited-Service Hotels<br />

Hold<br />

46.9%<br />

Full-Service Hotels<br />

2009<br />

2010<br />

Expected Capitalization Rate, December <strong>2012</strong> 7.7%<br />

2011<br />

<strong>2012</strong><br />

Sell<br />

23.4%<br />

meet<strong>in</strong>g the needs of travelers’ no-frills m<strong>in</strong>dset. Reasonably<br />

leveraged properties rebound off good cash flows: owners<br />

can <strong>in</strong>vest <strong>in</strong> overdue upgrades to ga<strong>in</strong> greater advantage over<br />

highly leveraged competition. Some local governments <strong>in</strong> tourist<br />

areas offer tax breaks and <strong>in</strong>centives to owners and developers<br />

to upgrade and build new properties, hop<strong>in</strong>g to jump-start more<br />

convention bus<strong>in</strong>ess, create jobs, and expand the tax base—<br />

anyth<strong>in</strong>g to re<strong>in</strong>force otherwise flagg<strong>in</strong>g economies.<br />

Weaknesses<br />

Return<strong>in</strong>g demand fails to translate <strong>in</strong>to pric<strong>in</strong>g power: “Room<br />

rates are a big <strong>in</strong>dustry issue.” Industry yields suffer from greater<br />

reliance on discount<strong>in</strong>g programs and third-party, <strong>in</strong>ternet distribution<br />

channels—Expedia, Pricel<strong>in</strong>e, etc. These new related<br />

commission structures gnaw at bottom l<strong>in</strong>es. “The old call center<br />

book<strong>in</strong>g model has become a d<strong>in</strong>osaur s<strong>in</strong>ce people become<br />

comfortable book<strong>in</strong>g onl<strong>in</strong>e.” More penny-p<strong>in</strong>ch<strong>in</strong>g corporations<br />

also push to negotiate favorable bulk purchase agreements<br />

on room nights with bus<strong>in</strong>ess center hotels. Food and beverage<br />

profits, meanwhile, have been slashed. “Companies meet<br />

aga<strong>in</strong>, but don’t spend as much on ancillaries,” and they have<br />

no compulsion to coddle employees or provide enterta<strong>in</strong>ment<br />

budgets: “That’s not com<strong>in</strong>g back anytime soon.” Wedd<strong>in</strong>g and<br />

party bus<strong>in</strong>ess also rema<strong>in</strong>s constra<strong>in</strong>ed—most folks lose their<br />

appetite for fancy bashes—while spa and hotel stores also take<br />

a hit. Given extremely high fixed costs to ma<strong>in</strong>ta<strong>in</strong> these operations,<br />

“any decl<strong>in</strong>es can crush bottom l<strong>in</strong>es.” Weekend bus<strong>in</strong>ess<br />

rema<strong>in</strong>s extremely feeble—“you can roll a bowl<strong>in</strong>g ball down the<br />

halls”—especially <strong>in</strong> secondary and suburban markets where<br />

developers engaged <strong>in</strong> pre-crash overbuild<strong>in</strong>g. A disconnect<br />

<strong>in</strong> pric<strong>in</strong>g expectations keeps transactions at a trickle despite<br />

significant distress among owners who overborrowed at or near<br />

market highs. Banks and special servicers keep the extendand-pretend<br />

game go<strong>in</strong>g: they do not have the expertise to<br />

operate lodg<strong>in</strong>g properties and hold out as long as possible<br />

to avoid writedowns. Struggl<strong>in</strong>g borrowers on float<strong>in</strong>g-rate<br />

mortgages get a reprieve from the Federal Reserve; they rema<strong>in</strong><br />

extremely vulnerable if <strong>in</strong>terest rates ever advance.<br />

Best Bets<br />

Concentrate on major flags <strong>in</strong> the familiar 24-hour cities.<br />

Investors should follow guest traffic and enhanced performance<br />

“to the better seaboard markets, across all price po<strong>in</strong>ts.”<br />

Ref<strong>in</strong>anc<strong>in</strong>g opportunities abound—especially mezzan<strong>in</strong>e<br />

debt and bank equity. Banks will let go of these management<strong>in</strong>tensive<br />

assets as more workouts occur: “They certa<strong>in</strong>ly don’t<br />

want them <strong>in</strong> REO [real estate owned] portfolios.” In the current<br />

market, profits are generated by rooms, so focus on midscale<br />

50 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong>