Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

and environmental regulations will complicate development<br />

<strong>in</strong>itiatives and <strong>in</strong>crease costs. For now, “<strong>in</strong>stitutions have noth<strong>in</strong>g<br />

to buy.” . . . In New Brunswick, Fredericton and Moncton could<br />

also be development plays. Local families make very strong<br />

returns. . . . The prairie outpost of Saskatoon (6) benefits from<br />

oil patch spillover and a favorable commodity cycle, <strong>in</strong>clud<strong>in</strong>g<br />

flush potash prices. Investors cannot f<strong>in</strong>d much to buy because<br />

there is not much to trade. “Local owners are holders.” The<br />

market “could be a development play. It’s a place to watch for<br />

the future.” . . . W<strong>in</strong>nipeg (9) boasts some of the nation’s lowest<br />

office, retail, and <strong>in</strong>dustrial vacancy rates, but offers limited<br />

<strong>in</strong>vestment opportunities.<br />

Property Types <strong>in</strong> Perspective<br />

In <strong>2012</strong>, Canada’s property sectors, except hotels, should<br />

bathe <strong>in</strong> a comfortable equilibrium of high occupancies, steady<br />

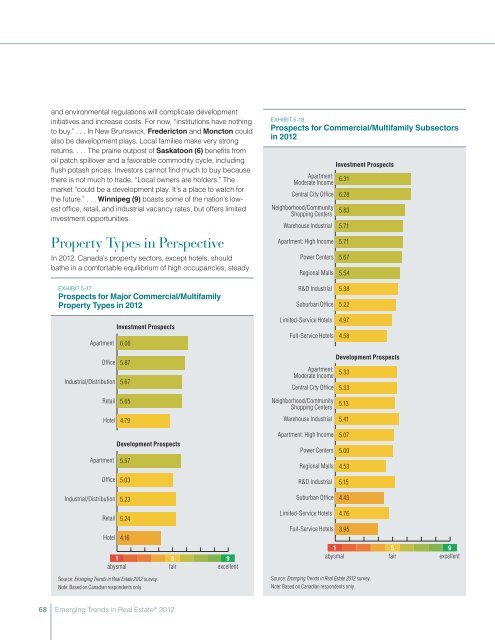

Exhibit 5-18<br />

Prospects for Commercial/Multifamily Subsectors<br />

<strong>in</strong> <strong>2012</strong><br />

Apartment:<br />

Moderate Income<br />

Central City Office<br />

Neighborhood/Community<br />

Shopp<strong>in</strong>g Centers<br />

Warehouse Industrial<br />

Apartment: High Income<br />

Power Centers<br />

Regional Malls<br />

Investment Prospects<br />

6.31<br />

6.28<br />

5.83<br />

5.71<br />

5.71<br />

5.67<br />

5.54<br />

Exhibit 5-17<br />

Prospects for Major Commercial/Multifamily<br />

Property Types <strong>in</strong> <strong>2012</strong><br />

Apartment<br />

Investment Prospects<br />

6.06<br />

R&D Industrial<br />

Suburban Office<br />

Limited-Service Hotels<br />

Full-Service Hotels<br />

5.38<br />

5.22<br />

4.97<br />

4.58<br />

Office<br />

Industrial/Distribution<br />

5.87<br />

5.67<br />

Apartment:<br />

Moderate Income<br />

Central City Office<br />

Development Prospects<br />

5.33<br />

5.33<br />

Retail<br />

5.65<br />

Neighborhood/Community<br />

Shopp<strong>in</strong>g Centers<br />

5.13<br />

Hotel<br />

4.79<br />

Warehouse Industrial<br />

5.41<br />

Apartment<br />

Development Prospects<br />

5.57<br />

Apartment: High Income<br />

Power Centers<br />

Regional Malls<br />

5.07<br />

5.00<br />

4.53<br />

Office<br />

5.03<br />

R&D Industrial<br />

5.15<br />

Industrial/Distribution<br />

5.23<br />

Suburban Office<br />

4.43<br />

Retail<br />

5.24<br />

Hotel 4.16<br />

1<br />

abysmal<br />

5<br />

fair<br />

9<br />

excellent<br />

Limited-Service Hotels<br />

Full-Service Hotels<br />

4.76<br />

3.95<br />

1<br />

abysmal<br />

5<br />

fair<br />

9<br />

excellent<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on Canadian respondents only.<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on Canadian respondents only.<br />

68 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong>