Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Office<br />

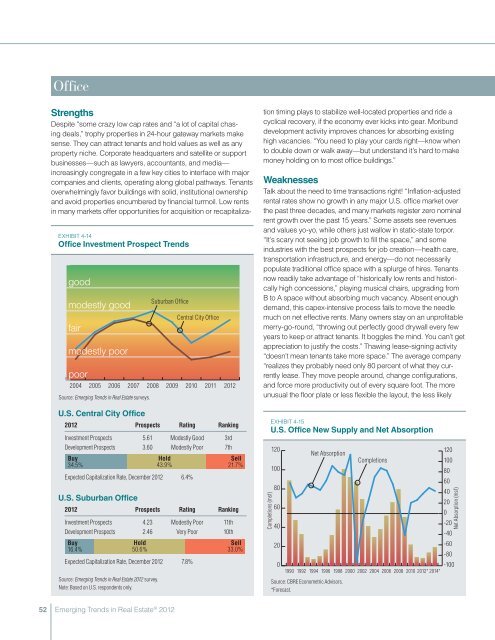

ExHIBIT 4-14<br />

Office Investment Prospect <strong>Trends</strong><br />

good<br />

modestly good<br />

fair<br />

modestly poor<br />

poor<br />

2004<br />

2005<br />

2006<br />

2007<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> surveys.<br />

Suburban Office<br />

2008<br />

2009<br />

Central City Office<br />

2010<br />

2011<br />

<strong>2012</strong><br />

Strengths<br />

Despite “some crazy low cap rates and “a lot of capital chas<strong>in</strong>g<br />

deals,” trophy properties <strong>in</strong> 24-hour gateway markets make<br />

sense. They can attract tenants and hold values as well as any<br />

property niche. Corporate headquarters and satellite or support<br />

bus<strong>in</strong>esses—such as lawyers, accountants, and media—<br />

<strong>in</strong>creas<strong>in</strong>gly congregate <strong>in</strong> a few key cities to <strong>in</strong>terface with major<br />

companies and clients, operat<strong>in</strong>g along global pathways. Tenants<br />

overwhelm<strong>in</strong>gly favor build<strong>in</strong>gs with solid, <strong>in</strong>stitutional ownership<br />

and avoid properties encumbered by f<strong>in</strong>ancial turmoil. Low rents<br />

<strong>in</strong> many markets offer opportunities for acquisition or recapitalization<br />

tim<strong>in</strong>g plays to stabilize well-located properties and ride a<br />

cyclical recovery, if the economy ever kicks <strong>in</strong>to gear. Moribund<br />

development activity improves chances for absorb<strong>in</strong>g exist<strong>in</strong>g<br />

high vacancies. “You need to play your cards right—know when<br />

to double down or walk away—but understand it’s hard to make<br />

money hold<strong>in</strong>g on to most office build<strong>in</strong>gs.”<br />

Weaknesses<br />

Talk about the need to time transactions right! “Inflation-adjusted<br />

rental rates show no growth <strong>in</strong> any major U.S. office market over<br />

the past three decades, and many markets register zero nom<strong>in</strong>al<br />

rent growth over the past 15 years.” Some assets see revenues<br />

and values yo-yo, while others just wallow <strong>in</strong> static-state torpor.<br />

“It’s scary not see<strong>in</strong>g job growth to fill the space,” and some<br />

<strong>in</strong>dustries with the best prospects for job creation—health care,<br />

transportation <strong>in</strong>frastructure, and energy—do not necessarily<br />

populate traditional office space with a splurge of hires. Tenants<br />

now readily take advantage of “historically low rents and historically<br />

high concessions,” play<strong>in</strong>g musical chairs, upgrad<strong>in</strong>g from<br />

B to A space without absorb<strong>in</strong>g much vacancy. Absent enough<br />

demand, this capex-<strong>in</strong>tensive process fails to move the needle<br />

much on net effective rents. Many owners stay on an unprofitable<br />

merry-go-round, “throw<strong>in</strong>g out perfectly good drywall every few<br />

years to keep or attract tenants. It boggles the m<strong>in</strong>d. You can’t get<br />

appreciation to justify the costs.” Thaw<strong>in</strong>g lease-sign<strong>in</strong>g activity<br />

“doesn’t mean tenants take more space.” The average company<br />

“realizes they probably need only 80 percent of what they currently<br />

lease. They move people around, change configurations,<br />

and force more productivity out of every square foot. The more<br />

unusual the floor plate or less flexible the layout, the less likely<br />

U.S. Central City Office<br />

<strong>2012</strong> Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Investment Prospects 5.61 Modestly Good 3rd<br />

Development Prospects 3.60 Modestly Poor 7th<br />

Buy<br />

34.5%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on U.S. respondents only.<br />

Hold<br />

43.9%<br />

Expected Capitalization Rate, December <strong>2012</strong> 6.4%<br />

U.S. Suburban Office<br />

Sell<br />

21.7%<br />

<strong>2012</strong> Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Investment Prospects 4.23 Modestly Poor 11th<br />

Development Prospects 2.46 Very Poor 10th<br />

Buy<br />

16.4%<br />

Hold<br />

50.6%<br />

Expected Capitalization Rate, December <strong>2012</strong> 7.8%<br />

Sell<br />

33.0%<br />

Completions (msf)<br />

ExHIBIT 4-15<br />

U.S. Office New Supply and Net Absorption<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Net Absorption<br />

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 <strong>2012</strong>* 2014*<br />

Source: CBRE Econometric Advisors.<br />

*Forecast.<br />

Completions<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

Net Absorption (msf)<br />

-60<br />

-80<br />

-100<br />

52 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong>