Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 2: Capital Flows<br />

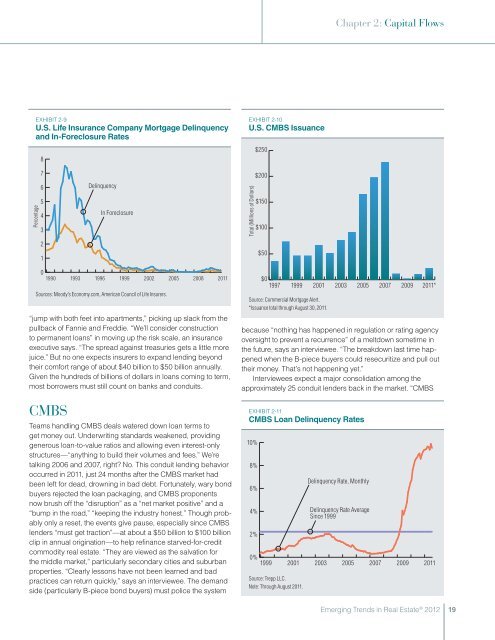

Exhibit 2-9<br />

U.S. Life Insurance Company Mortgage Del<strong>in</strong>quency<br />

and In-Foreclosure Rates<br />

8<br />

Exhibit 2-10<br />

U.S. CMBS Issuance<br />

$250<br />

Percentage<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

Del<strong>in</strong>quency<br />

In Foreclosure<br />

Total (Millions of Dollars)<br />

$200<br />

$150<br />

$100<br />

$50<br />

0<br />

1990<br />

1993<br />

1996<br />

1999<br />

2002<br />

Sources: Moody’s Economy.com, American Council of Life Insurers.<br />

2005<br />

2008<br />

“jump with both feet <strong>in</strong>to apartments,” pick<strong>in</strong>g up slack from the<br />

pullback of Fannie and Freddie. “We’ll consider construction<br />

to permanent loans” <strong>in</strong> mov<strong>in</strong>g up the risk scale, an <strong>in</strong>surance<br />

executive says. “The spread aga<strong>in</strong>st treasuries gets a little more<br />

juice.” But no one expects <strong>in</strong>surers to expand lend<strong>in</strong>g beyond<br />

their comfort range of about $40 billion to $50 billion annually.<br />

Given the hundreds of billions of dollars <strong>in</strong> loans com<strong>in</strong>g to term,<br />

most borrowers must still count on banks and conduits.<br />

2011<br />

$0<br />

1997<br />

1999<br />

2001<br />

Source: Commercial Mortgage Alert.<br />

*Issuance total through August 30, 2011.<br />

2003<br />

2005<br />

2007<br />

2009<br />

2011*<br />

because “noth<strong>in</strong>g has happened <strong>in</strong> regulation or rat<strong>in</strong>g agency<br />

oversight to prevent a recurrence” of a meltdown sometime <strong>in</strong><br />

the future, says an <strong>in</strong>terviewee. “The breakdown last time happened<br />

when the B-piece buyers could resecuritize and pull out<br />

their money. That’s not happen<strong>in</strong>g yet.”<br />

Interviewees expect a major consolidation among the<br />

approximately 25 conduit lenders back <strong>in</strong> the market. “CMBS<br />

CMBS<br />

Teams handl<strong>in</strong>g CMBS deals watered down loan terms to<br />

get money out. Underwrit<strong>in</strong>g standards weakened, provid<strong>in</strong>g<br />

generous loan-to-value ratios and allow<strong>in</strong>g even <strong>in</strong>terest-only<br />

structures—“anyth<strong>in</strong>g to build their volumes and fees.” We’re<br />

talk<strong>in</strong>g 2006 and 2007, right No. This conduit lend<strong>in</strong>g behavior<br />

occurred <strong>in</strong> 2011, just 24 months after the CMBS market had<br />

been left for dead, drown<strong>in</strong>g <strong>in</strong> bad debt. Fortunately, wary bond<br />

buyers rejected the loan packag<strong>in</strong>g, and CMBS proponents<br />

now brush off the “disruption” as a “net market positive” and a<br />

“bump <strong>in</strong> the road,” “keep<strong>in</strong>g the <strong>in</strong>dustry honest.” Though probably<br />

only a reset, the events give pause, especially s<strong>in</strong>ce CMBS<br />

lenders “must get traction”—at about a $50 billion to $100 billion<br />

clip <strong>in</strong> annual orig<strong>in</strong>ation—to help ref<strong>in</strong>ance starved-for-credit<br />

commodity real estate. “They are viewed as the salvation for<br />

the middle market,” particularly secondary cities and suburban<br />

properties. “Clearly lessons have not been learned and bad<br />

practices can return quickly,” says an <strong>in</strong>terviewee. The demand<br />

side (particularly B-piece bond buyers) must police the system<br />

Exhibit 2-11<br />

CMBS Loan Del<strong>in</strong>quency Rates<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

1999<br />

2001<br />

Source: Trepp LLC.<br />

Note: Through August 2011.<br />

Del<strong>in</strong>quency Rate, Monthly<br />

Del<strong>in</strong>quency Rate Average<br />

S<strong>in</strong>ce 1999<br />

2003<br />

2005<br />

2007<br />

2009<br />

2011<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong><br />

19