Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

esources bus<strong>in</strong>ess leads to new development. Room rates<br />

have rocketed at the limited number of exist<strong>in</strong>g hotels.<br />

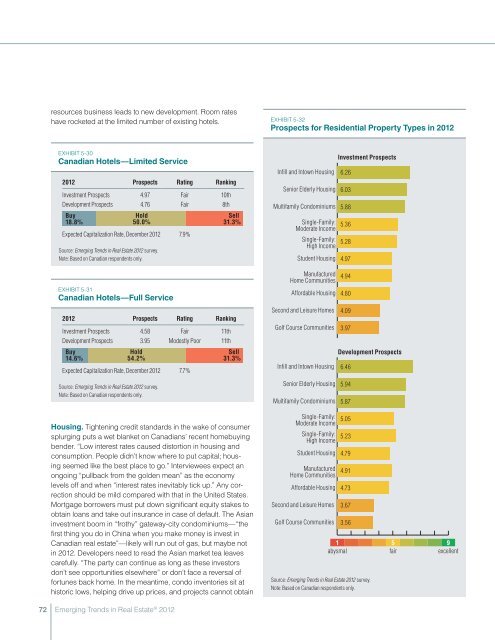

Exhibit 5-32<br />

Prospects for Residential Property Types <strong>in</strong> <strong>2012</strong><br />

Exhibit 5-30<br />

Canadian Hotels—Limited Service<br />

<strong>2012</strong> Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Investment Prospects 4.97 Fair 10th<br />

Development Prospects 4.76 Fair 8th<br />

Buy<br />

18.8%<br />

Hold<br />

50.0%<br />

Expected Capitalization Rate, December <strong>2012</strong> 7.9%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on Canadian respondents only.<br />

Sell<br />

31.3%<br />

Infill and Intown Hous<strong>in</strong>g<br />

Senior Elderly Hous<strong>in</strong>g<br />

Multifamily Condom<strong>in</strong>iums<br />

S<strong>in</strong>gle-Family:<br />

Moderate Income<br />

S<strong>in</strong>gle-Family:<br />

High Income<br />

5.28<br />

Student Hous<strong>in</strong>g 4.97<br />

Investment Prospects<br />

6.26<br />

6.03<br />

5.88<br />

5.36<br />

Exhibit 5-31<br />

Canadian Hotels—Full Service<br />

<strong>2012</strong> Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Investment Prospects 4.58 Fair 11th<br />

Development Prospects 3.95 Modestly Poor 11th<br />

Buy<br />

14.6%<br />

Hold<br />

54.2%<br />

Expected Capitalization Rate, December <strong>2012</strong> 7.7%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on Canadian respondents only.<br />

Sell<br />

31.3%<br />

Manufactured<br />

Home Communities<br />

Affordable Hous<strong>in</strong>g<br />

Second and Leisure Homes<br />

Golf Course Communities<br />

Infill and Intown Hous<strong>in</strong>g<br />

Senior Elderly Hous<strong>in</strong>g<br />

Multifamily Condom<strong>in</strong>iums<br />

4.94<br />

4.80<br />

4.09<br />

3.97<br />

Development Prospects<br />

6.46<br />

5.94<br />

5.87<br />

Hous<strong>in</strong>g. Tighten<strong>in</strong>g credit standards <strong>in</strong> the wake of consumer<br />

splurg<strong>in</strong>g puts a wet blanket on Canadians’ recent homebuy<strong>in</strong>g<br />

bender. “Low <strong>in</strong>terest rates caused distortion <strong>in</strong> hous<strong>in</strong>g and<br />

consumption. People didn’t know where to put capital; hous<strong>in</strong>g<br />

seemed like the best place to go.” Interviewees expect an<br />

ongo<strong>in</strong>g “pullback from the golden mean” as the economy<br />

levels off and when “<strong>in</strong>terest rates <strong>in</strong>evitably tick up.” Any correction<br />

should be mild compared with that <strong>in</strong> the United States.<br />

Mortgage borrowers must put down significant equity stakes to<br />

obta<strong>in</strong> loans and take out <strong>in</strong>surance <strong>in</strong> case of default. The Asian<br />

<strong>in</strong>vestment boom <strong>in</strong> “frothy” gateway-city condom<strong>in</strong>iums—“the<br />

first th<strong>in</strong>g you do <strong>in</strong> Ch<strong>in</strong>a when you make money is <strong>in</strong>vest <strong>in</strong><br />

Canadian real estate”—likely will run out of gas, but maybe not<br />

<strong>in</strong> <strong>2012</strong>. Developers need to read the Asian market tea leaves<br />

carefully. “The party can cont<strong>in</strong>ue as long as these <strong>in</strong>vestors<br />

don’t see opportunities elsewhere” or don’t face a reversal of<br />

fortunes back home. In the meantime, condo <strong>in</strong>ventories sit at<br />

historic lows, help<strong>in</strong>g drive up prices, and projects cannot obta<strong>in</strong><br />

S<strong>in</strong>gle-Family:<br />

Moderate Income<br />

S<strong>in</strong>gle-Family:<br />

High Income<br />

5.23<br />

Student Hous<strong>in</strong>g 4.79<br />

Manufactured<br />

Home Communities<br />

4.91<br />

Affordable Hous<strong>in</strong>g 4.73<br />

Second and Leisure Homes<br />

Golf Course Communities<br />

5.05<br />

3.67<br />

3.56<br />

1<br />

abysmal<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on Canadian respondents only.<br />

5<br />

fair<br />

9<br />

excellent<br />

72 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong>