Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 5: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> Canada<br />

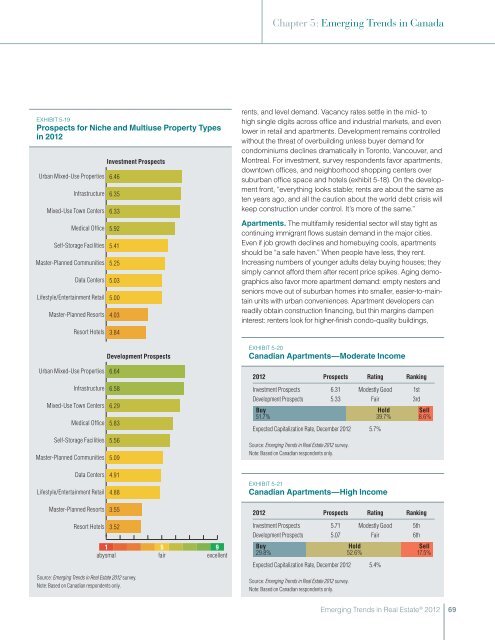

Exhibit 5-19<br />

Prospects for Niche and Multiuse Property Types<br />

<strong>in</strong> <strong>2012</strong><br />

<strong>Urban</strong> Mixed-Use Properties<br />

Infrastructure<br />

Mixed-Use Town Centers<br />

Medical Office<br />

Self-Storage Facilities<br />

Master-Planned Communities<br />

Data Centers<br />

Lifestyle/Enterta<strong>in</strong>ment Retail<br />

Master-Planned Resorts<br />

Resort Hotels<br />

Investment Prospects<br />

6.46<br />

6.35<br />

6.33<br />

5.92<br />

5.41<br />

5.25<br />

5.03<br />

5.00<br />

4.03<br />

3.84<br />

Development Prospects<br />

rents, and level demand. Vacancy rates settle <strong>in</strong> the mid- to<br />

high s<strong>in</strong>gle digits across office and <strong>in</strong>dustrial markets, and even<br />

lower <strong>in</strong> retail and apartments. Development rema<strong>in</strong>s controlled<br />

without the threat of overbuild<strong>in</strong>g unless buyer demand for<br />

condom<strong>in</strong>iums decl<strong>in</strong>es dramatically <strong>in</strong> Toronto, Vancouver, and<br />

Montreal. For <strong>in</strong>vestment, survey respondents favor apartments,<br />

downtown offices, and neighborhood shopp<strong>in</strong>g centers over<br />

suburban office space and hotels (exhibit 5-18). On the development<br />

front, “everyth<strong>in</strong>g looks stable; rents are about the same as<br />

ten years ago, and all the caution about the world debt crisis will<br />

keep construction under control. It’s more of the same.”<br />

Apartments. The multifamily residential sector will stay tight as<br />

cont<strong>in</strong>u<strong>in</strong>g immigrant flows susta<strong>in</strong> demand <strong>in</strong> the major cities.<br />

Even if job growth decl<strong>in</strong>es and homebuy<strong>in</strong>g cools, apartments<br />

should be “a safe haven.” When people have less, they rent.<br />

Increas<strong>in</strong>g numbers of younger adults delay buy<strong>in</strong>g houses; they<br />

simply cannot afford them after recent price spikes. Ag<strong>in</strong>g demographics<br />

also favor more apartment demand: empty nesters and<br />

seniors move out of suburban homes <strong>in</strong>to smaller, easier-to-ma<strong>in</strong>ta<strong>in</strong><br />

units with urban conveniences. Apartment developers can<br />

readily obta<strong>in</strong> construction f<strong>in</strong>anc<strong>in</strong>g, but th<strong>in</strong> marg<strong>in</strong>s dampen<br />

<strong>in</strong>terest: renters look for higher-f<strong>in</strong>ish condo-quality build<strong>in</strong>gs,<br />

Exhibit 5-20<br />

Canadian Apartments—Moderate Income<br />

<strong>Urban</strong> Mixed-Use Properties<br />

Infrastructure<br />

Mixed-Use Town Centers<br />

Medical Office<br />

Self-Storage Facilities<br />

Master-Planned Communities<br />

6.64<br />

6.58<br />

6.29<br />

5.83<br />

5.56<br />

5.09<br />

<strong>2012</strong> Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Investment Prospects 6.31 Modestly Good 1st<br />

Development Prospects 5.33 Fair 3rd<br />

Buy<br />

51.7%<br />

Expected Capitalization Rate, December <strong>2012</strong> 5.7%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on Canadian respondents only.<br />

Hold<br />

39.7%<br />

Sell<br />

8.6%<br />

Data Centers<br />

Lifestyle/Enterta<strong>in</strong>ment Retail<br />

Master-Planned Resorts<br />

4.91<br />

4.88<br />

3.55<br />

Exhibit 5-21<br />

Canadian Apartments—High Income<br />

<strong>2012</strong> Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Resort Hotels<br />

3.52<br />

Investment Prospects 5.71 Modestly Good 5th<br />

Development Prospects 5.07 Fair 6th<br />

1<br />

abysmal<br />

5<br />

fair<br />

9<br />

excellent<br />

Buy<br />

29.8%<br />

Hold<br />

52.6%<br />

Sell<br />

17.5%<br />

Expected Capitalization Rate, December <strong>2012</strong> 5.4%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on Canadian respondents only.<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> <strong>2012</strong> survey.<br />

Note: Based on Canadian respondents only.<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong><br />

69