Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

Emerging Trends in Real Estate 2012 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Chapter 4: Property Types <strong>in</strong> Perspective<br />

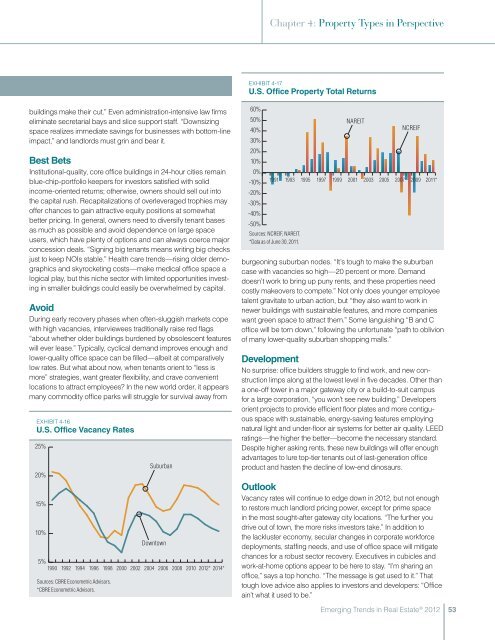

Exhibit 4-17<br />

U.S. Office Property Total Returns<br />

build<strong>in</strong>gs make their cut.” Even adm<strong>in</strong>istration-<strong>in</strong>tensive law firms<br />

elim<strong>in</strong>ate secretarial bays and slice support staff. “Downsiz<strong>in</strong>g<br />

space realizes immediate sav<strong>in</strong>gs for bus<strong>in</strong>esses with bottom-l<strong>in</strong>e<br />

impact,” and landlords must gr<strong>in</strong> and bear it.<br />

Best Bets<br />

Institutional-quality, core office build<strong>in</strong>gs <strong>in</strong> 24-hour cities rema<strong>in</strong><br />

blue-chip-portfolio keepers for <strong>in</strong>vestors satisfied with solid<br />

<strong>in</strong>come-oriented returns; otherwise, owners should sell out <strong>in</strong>to<br />

the capital rush. Recapitalizations of overleveraged trophies may<br />

offer chances to ga<strong>in</strong> attractive equity positions at somewhat<br />

better pric<strong>in</strong>g. In general, owners need to diversify tenant bases<br />

as much as possible and avoid dependence on large space<br />

users, which have plenty of options and can always coerce major<br />

concession deals. “Sign<strong>in</strong>g big tenants means writ<strong>in</strong>g big checks<br />

just to keep NOIs stable.” Health care trends—ris<strong>in</strong>g older demographics<br />

and skyrocket<strong>in</strong>g costs—make medical office space a<br />

logical play, but this niche sector with limited opportunities <strong>in</strong>vest<strong>in</strong>g<br />

<strong>in</strong> smaller build<strong>in</strong>gs could easily be overwhelmed by capital.<br />

Avoid<br />

Dur<strong>in</strong>g early recovery phases when often-sluggish markets cope<br />

with high vacancies, <strong>in</strong>terviewees traditionally raise red flags<br />

“about whether older build<strong>in</strong>gs burdened by obsolescent features<br />

will ever lease.” Typically, cyclical demand improves enough and<br />

lower-quality office space can be filled—albeit at comparatively<br />

low rates. But what about now, when tenants orient to “less is<br />

more” strategies, want greater flexibility, and crave convenient<br />

locations to attract employees In the new world order, it appears<br />

many commodity office parks will struggle for survival away from<br />

Exhibit 4-16<br />

U.S. Office Vacancy Rates<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

1990 1992<br />

Sources: CBRE Econometric Advisors.<br />

*CBRE Econometric Advisors.<br />

Suburban<br />

Downtown<br />

1994 1996 1998 2000 2002 2004 2006 2008 2010 <strong>2012</strong>* 2014*<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

1991<br />

1993<br />

Sources: NCREIF, NAREIT.<br />

*Data as of June 30, 2011.<br />

1995<br />

1997<br />

1999<br />

NAREIT<br />

NCREIF<br />

2011*<br />

burgeon<strong>in</strong>g suburban nodes. “It’s tough to make the suburban<br />

case with vacancies so high—20 percent or more. Demand<br />

doesn’t work to br<strong>in</strong>g up puny rents, and these properties need<br />

costly makeovers to compete.” Not only does younger employee<br />

talent gravitate to urban action, but “they also want to work <strong>in</strong><br />

newer build<strong>in</strong>gs with susta<strong>in</strong>able features, and more companies<br />

want green space to attract them.” Some languish<strong>in</strong>g “B and C<br />

office will be torn down,” follow<strong>in</strong>g the unfortunate “path to oblivion<br />

of many lower-quality suburban shopp<strong>in</strong>g malls.”<br />

Development<br />

No surprise: office builders struggle to f<strong>in</strong>d work, and new construction<br />

limps along at the lowest level <strong>in</strong> five decades. Other than<br />

a one-off tower <strong>in</strong> a major gateway city or a build-to-suit campus<br />

for a large corporation, “you won’t see new build<strong>in</strong>g.” Developers<br />

orient projects to provide efficient floor plates and more contiguous<br />

space with susta<strong>in</strong>able, energy-sav<strong>in</strong>g features employ<strong>in</strong>g<br />

natural light and under-floor air systems for better air quality. LEED<br />

rat<strong>in</strong>gs—the higher the better—become the necessary standard.<br />

Despite higher ask<strong>in</strong>g rents, these new build<strong>in</strong>gs will offer enough<br />

advantages to lure top-tier tenants out of last-generation office<br />

product and hasten the decl<strong>in</strong>e of low-end d<strong>in</strong>osaurs.<br />

Outlook<br />

Vacancy rates will cont<strong>in</strong>ue to edge down <strong>in</strong> <strong>2012</strong>, but not enough<br />

to restore much landlord pric<strong>in</strong>g power, except for prime space<br />

<strong>in</strong> the most sought-after gateway city locations. “The further you<br />

drive out of town, the more risks <strong>in</strong>vestors take.” In addition to<br />

the lackluster economy, secular changes <strong>in</strong> corporate workforce<br />

deployments, staff<strong>in</strong>g needs, and use of office space will mitigate<br />

chances for a robust sector recovery. Executives <strong>in</strong> cubicles and<br />

work-at-home options appear to be here to stay. “I’m shar<strong>in</strong>g an<br />

office,” says a top honcho. “The message is get used to it.” That<br />

tough love advice also applies to <strong>in</strong>vestors and developers: “Office<br />

a<strong>in</strong>’t what it used to be.”<br />

2001<br />

2003<br />

2005<br />

2007<br />

2009<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> <strong>Estate</strong> ® <strong>2012</strong><br />

53